The gold and silver Commitments of Traders indicated a potential for a coming decline in gold, silver and the gold miners. A correction, not the end of the bull phase by this sentiment measure. CoT was overdone, but not extreme to a bull killer degree.

This as the macro fundamentals had been positive since late 2022 and gold miners’ technical situation bullish, but in doubt as to the ability to continue upward in the near term.

First, the macro fundamentals, such as the following:

- Up-trending gold/commodity ratios

- Up-trending gold/stock market ratios

- A potential top in ‘real’ (inflation-adjusted) Treasury yields

- Easing inflationary pressure, and thus…

- A potential end to the Fed’s hawk regime

- Deceleration in the economy and corporate earnings

They were either bullish and/or constructive heading into the correction in the precious metals complex and true to form, the fundamentals have bent quite a bit, but not yet broken. This amid a very noisy market backdrop that includes the Debt Ceiling Kabuki dance, which will be resolved soon, likely to the good cheer of broad market MOMOs and FOMOs.

Speaking of FOMOs, we’ve got a side order of “AI” hype to really propel the party atmosphere, which is not at all positive for gold or gold miners.

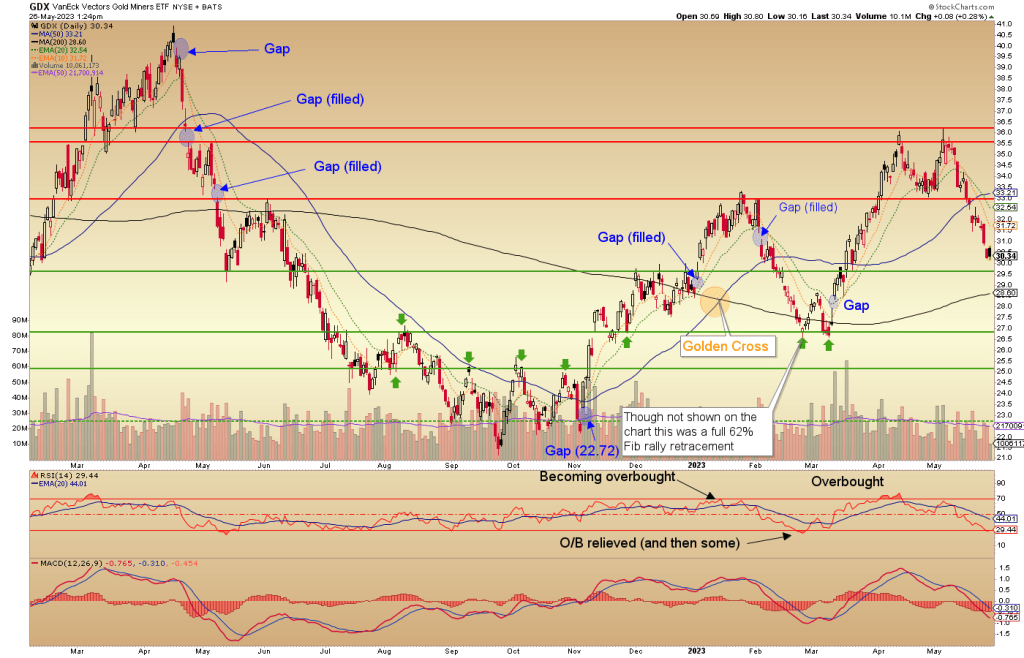

So the precious metals correction drags on. It is important to realize that its potential was very much in the cards anyway as this update first advised traders to consider taking some profits back on April 13, as GDX (NYSE:GDX) filled the second of three upside gaps we had on watch. The macro is playing ball, providing rationale for a correction in gold, silver and the miners.

This post will simply look at the GDX “daily management” chart that we have used since managing the March rally and then its potential for correction. Satisfied that anyone who would have taken action to prepare has long since done so (for my part, I did some selling but hedged key positions with the miner bear ETF, DUST), I’ll do a little public TA on GDX.

The update linked above was made on the first poke into resistance, which then saw a pullback, and another rise to resistance to form a double top. If we assume that the fundamentals are going to hold and/or recover, GDX must not make a lower low to the March low to avoid a daily chart breakdown. Conveniently, there is a gap down there that we’ve had our eye on for all too long now. So watch for a gap fill, a higher low to March, a test of the 200 day moving average (black) and RSI oversold to about the degree it was overbought in April.

Too much to ask? Nah… it’s the markets and it would be very normal for the counter-cyclical sector to get this work done while the MOMOs and FOMOs party in the broad market (said MOMO concentrated in Tech and Semi, as we originally expected and have tracked all along the way). The gold miners are getting hit with the inflation/commodity stick as a majority of inflation bugs do what they always do and wrongly sell the miners because “OMG… no inflation!” or “OMG the Fed is still hawking against inflation!”

But if the macro eases back to a beneficial backdrop for the gold mining sector and you see the technical parameters as noted above, you might think of being brave while the average bug is getting stomped. There is, after all, another gap up above winking at those who will be prepared. What’s more, if the macro continues to swing counter-cyclical and away from today’s party atmosphere, the bigger picture will resume positive for gold mining, a uniquely counter-cyclical stock sector.

But if the macro eases back to a beneficial backdrop for the gold mining sector and you see the technical parameters as noted above, you might think of being brave while the average bug is getting stomped. There is, after all, another gap up above winking at those who will be prepared. What’s more, if the macro continues to swing counter-cyclical and away from today’s party atmosphere, the bigger picture will resume positive for gold mining, a uniquely counter-cyclical stock sector.The bottom line is that there is nothing wrong so far in a sector that was bound to correct under today’s macro conditions, which are likely temporary (although this version of Goldilocks sure has been persistent). The correction is normal per the technicals. It should eventually provide opportunity for those who are prepared.