Gold prices have been in focus lately, as investors flock to safe haven assets amid the latest Fed decision and escalating trade tensions with China, flirting with six-year highs in recent days. This is good timing for Barrick Gold Corp (NYSE:GOLD), with the gold miner set to report second-quarter earnings before the open Monday, Aug. 12.

However, recent earnings history favors the bears. GOLD shares moved lower the session after six of the last eight earnings reports, including a 4.1% drop back in February. Over the past two years, the shares have swung an average of 3.4% the day after earnings, regardless of direction. This time around, the options market is pricing in a larger-than-usual 4.6% swing for Tuesday's trading.

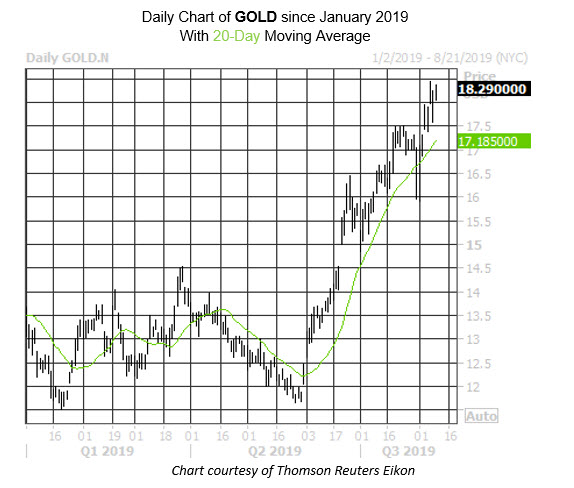

On the charts, GOLD is trading at $18.29, just below its Wednesday two-year high of $18.30. Since breaching the $12 level in late May, the shares have added 56%, with their ascending 20-day moving average providing support. If bears are looking for any solace, they could note that GOLD's 14-day Relative Strength Index (RSI) is running hot, coming in at 70, so the shares could be due for a short-term breather at the least.

A pullback would be a welcome sign to the bevy of short sellers surrounding Barrick Gold. Short interest increased by 17.3% in the two most recent reporting periods to 30.37 million shares, the most since mid-December. This takes up a hefty 32.3% of GOLD's total available float.

In the options pits, calls dominate the picture. In the last 10 days, 34,460 long calls crossed at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), compared to just 6,634 puts. The equity does have a history of making moves bigger than the options market was pricing in, based on the Schaeffer's Volatility Scorecard (SVS) of 88, out of a possible 100.