- Gold enters a new bull run; shifts spotlight to all-time high

- Technical signals point to more upside; close above 2,650 needed

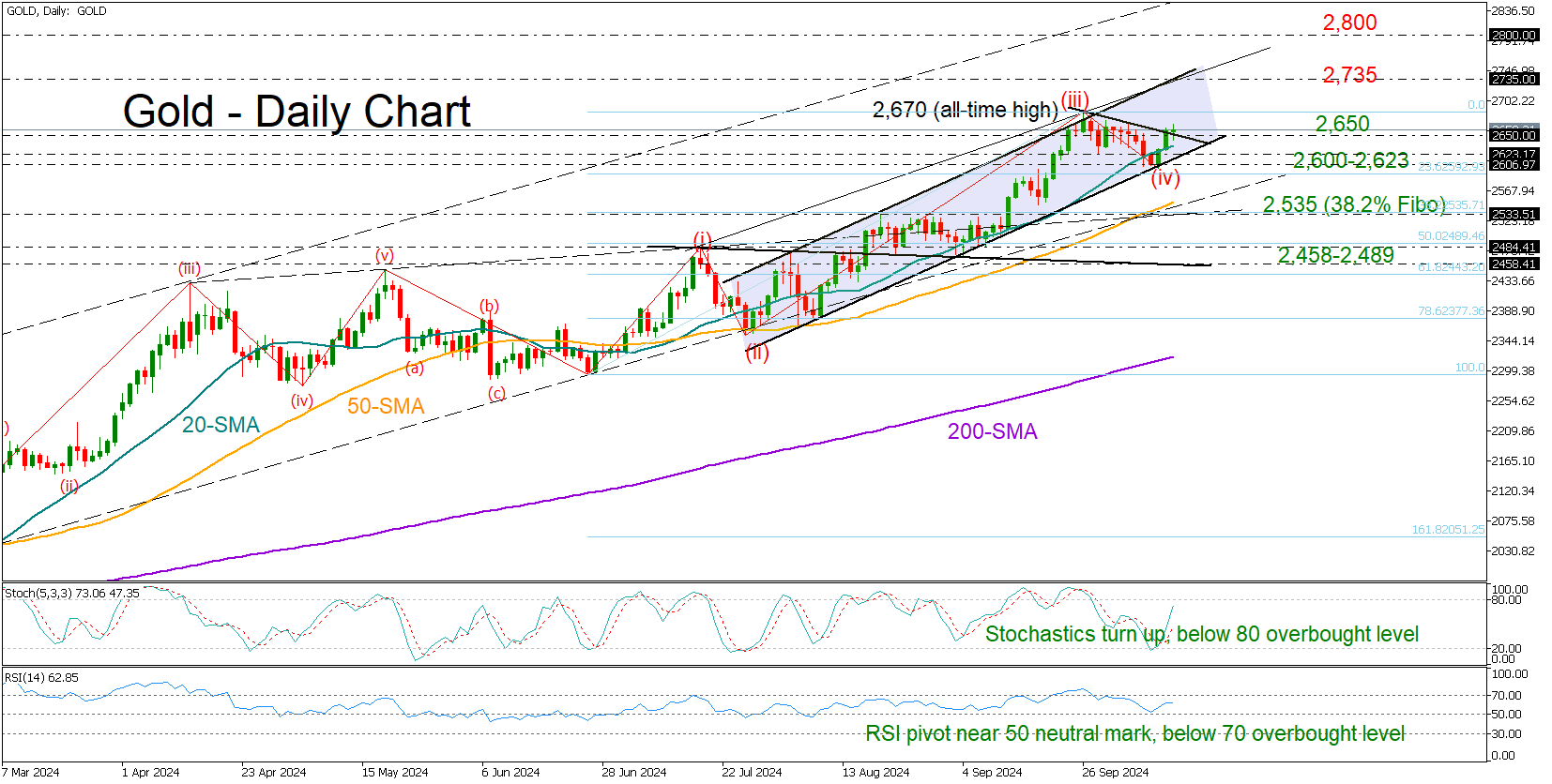

Gold started a new bullish corrective phase near the 2,600 level last week, adding extra credence to its upward trend that has been active for more than two months.

On Monday, the price climbed to 2,666, surpassing the short-term falling trendline from September’s peak that the bulls must break to reach the top of 2,670 or achieve a new record high near the upper band of the channel at 2,735. The latter coincides with the 161.8% Fibonacci extension of the previous downfall. If the rally continues above it, the next barrier could occur within the 2,800-2,850 region and near the resistance line of the broad upward-sloping channel.

Based on the RSI and stochastic oscillator, it appears that the current rebound is still at an early stage. Encouraging trend signals persist as well. If the Elliot pattern in the chart is correct, the precious metal might have one more upleg to complete before it shifts to the sidelines.

However, if the price doesn’t close above 2,650, it may drop and find support near the 20-day SMA and the channel’s support trendline at 2,623. The 2,600 area may also be scrutinized, and if the bears break through that level, the sell-off could accelerate towards the 50-day SMA and the 38.2% Fibonacci retracement of the June-September uptrend at 2,535. Failure to pivot there could cause another rapid fall towards the 50% Fibonacci mark of 2,489 and the flat constraining line at 2,458.

Summing up, gold is expected to continue its bull run in the short-term. In the meantime, a close above 2,650 might be necessary to bolster buying appetite towards the top of the bullish channel.