Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Gold and silver prices have crept higher during Asian trading today, with the US Federal Reserve about to start a two-day Open Market Committee meeting that will provide important clues as to precious metals’ likely short and medium-term price trajectories. Gold has nudged above resistance at $1,630, while silver looks like challenging $29. We likely won’t see any big moves in the metals until the end of play tomorrow, when Ben Bernanke gives his post-FOMC press conference, and it becomes clear whether or not the Fed is in fact going to try to juice the US economy with more newly-printed money.

This “QE3” speculation has been rumbling on ever since the QE2 finished in June 2011, though clear signs in recent months that the US economy is slowing – with the horrific June 1 jobs report a particularly telling indicator – is raising dovish expectations. Goldman Sachs thinks it possible that the Fed could resort to regular open-market purchases of $50-$75 billion, perhaps as part of efforts to target nominal GDP increases.

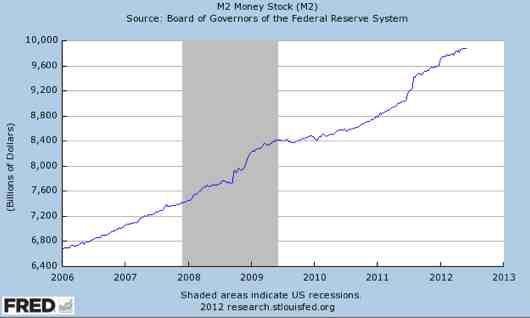

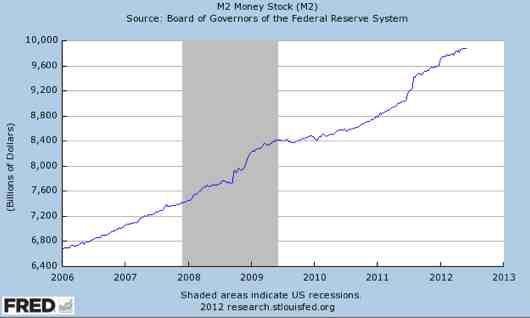

If so, this really is the type of “QE to infinity” programme that could have serious inflationary consequences. As economist Bob Wenzel reports at his blog: “$75 billion in added reserves would be huge. If it doesn't end up as excess reserves, $75 billion alone would mean annualized [sic] money supply (M2) growth of 10.5% – not including any multiplier effect as a result of fractional reserve banking.”

This “QE3” speculation has been rumbling on ever since the QE2 finished in June 2011, though clear signs in recent months that the US economy is slowing – with the horrific June 1 jobs report a particularly telling indicator – is raising dovish expectations. Goldman Sachs thinks it possible that the Fed could resort to regular open-market purchases of $50-$75 billion, perhaps as part of efforts to target nominal GDP increases.

If so, this really is the type of “QE to infinity” programme that could have serious inflationary consequences. As economist Bob Wenzel reports at his blog: “$75 billion in added reserves would be huge. If it doesn't end up as excess reserves, $75 billion alone would mean annualized [sic] money supply (M2) growth of 10.5% – not including any multiplier effect as a result of fractional reserve banking.”