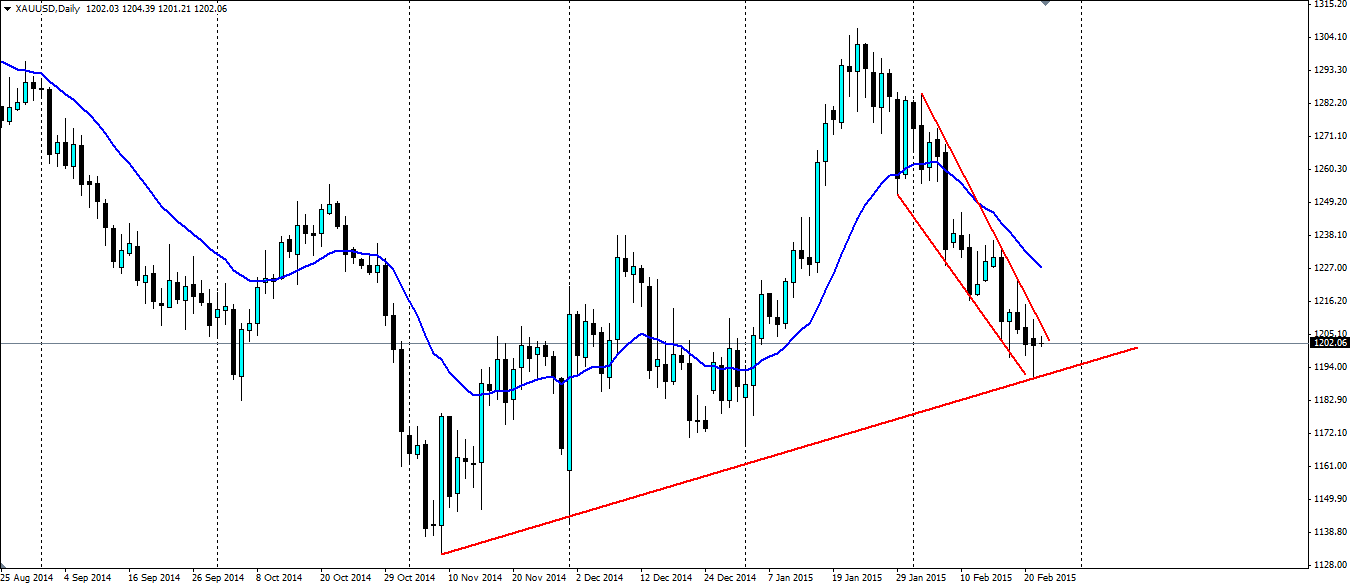

The Gold markets have been consolidating for a number of months with a bearish wedge heading towards a longer term bullish trend line. The speech by Janet Yellen is likely to provide the catalyst for action in the gold markets.

US Federal Reserve Chairwoman Janet Yellen is due to give testimony to the Senate Banking Committee later today for the first time this year. She has not really changed her tone too much in the face of falling inflation and we are likely to see her stick to her guns when it comes to the timing of the first interest rate rise since 2007.

Yellen has previously indicated this will come in mid-year and the current market consensus is for June.

The Gold markets are likely to view this rather bearishly as it would give plenty of support to the US dollar and make the yield on US Treasuries much more attractive relatively to gold. Yellen is also likely to point to the strong growth in the jobs market as seen by the last few nonfarm results remaining over 200k and Unemployment claims coming in under 300k more often than not. If Yellen remains slightly hawkish, gold prices are likely to crash through the longer term bullish trend.

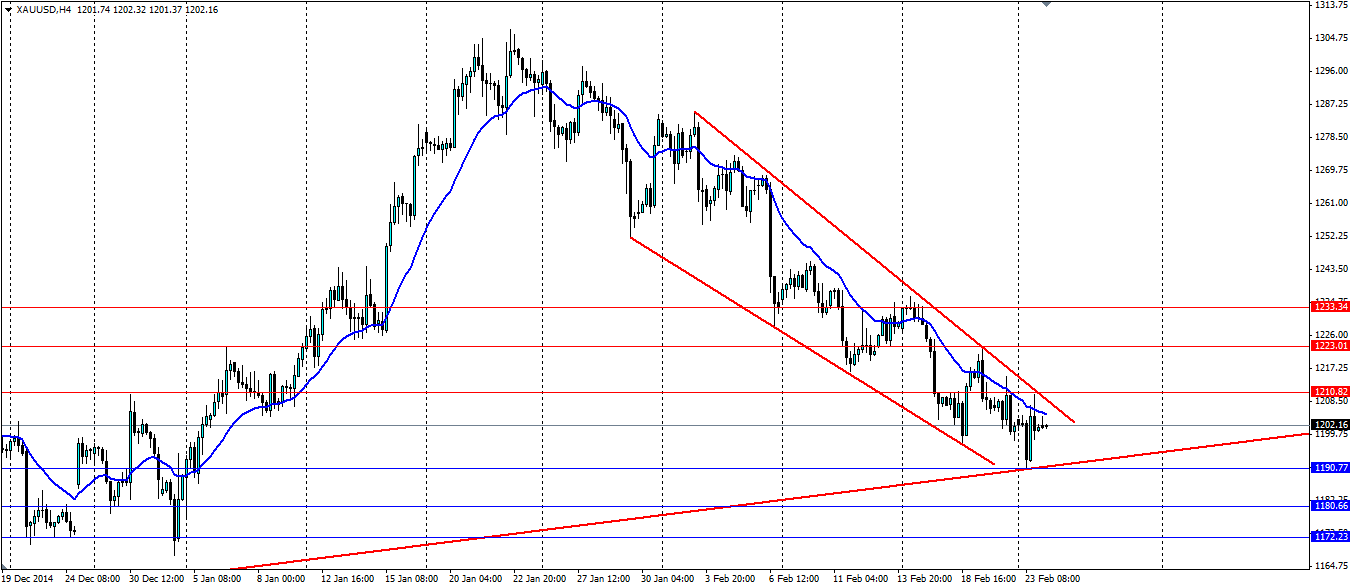

The shorter term descending wedge provides an interesting feature on the charts as generally this technical set up would provide a bullish breakout, especially given the dynamic support found along the bullish trend line. However, in this case, I feel the fundamental bearish breakout play is likely to be the winner on the day, given how much the central banks have been moving the markets recently.

Either way the gold markets are set to move. If we see a bullish push, look for resistance to be found at 1210.82, 1223.01 and 1233.34. If we see a bearish breakout through the trend line, look for support to be found at 1190.77, 1180.66 and 1172.23.

Gold markets are set for a movement given the convergence of two technical patterns and a speech from FED Chairwoman Janet Yellen. If Yellen remains hawkish, the breakout is likely to be bearish.