After a severe selloff, precious metals have enjoyed a bit of a respite. Corrections are a function of time and/or price. The correction to the recent selloff has been more in time than than price. Metals and miners have stabilized over the past nine trading days but have not rebounded much in price terms. Gold has barely rallied $20/oz while GDX and GDXJ have rebounded less than 4% and 5% respectively. In addition to the weakness of this rally, the gold stocks are sporting a negative divergence – and that does not bode well for an end-of-the-year rally.

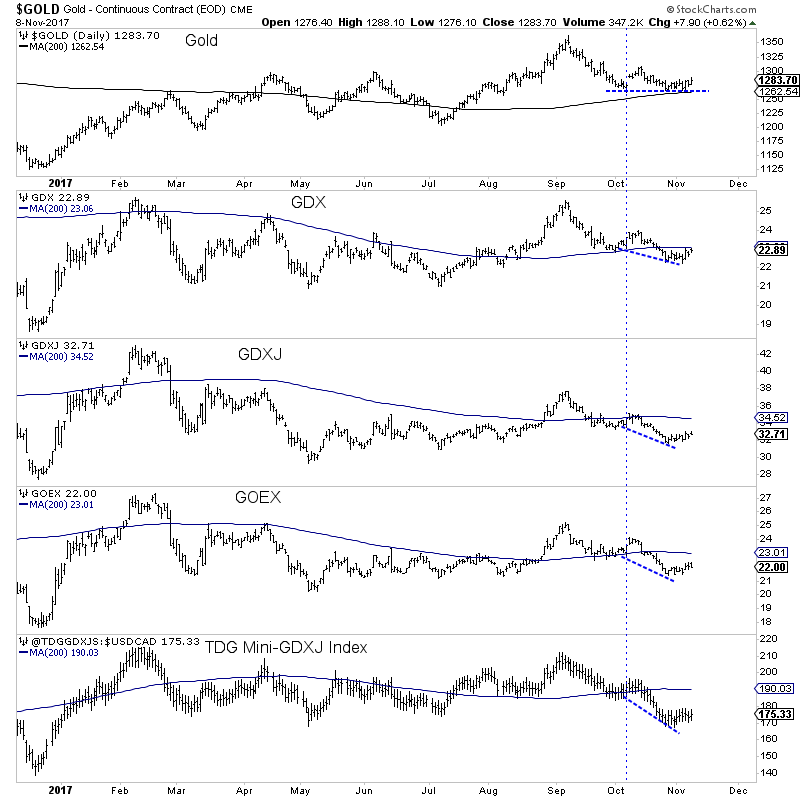

The negative divergence is visible in the daily bar charts below. We plot gold along with the gold-stock ETFs and our “mini” GDXJ index. Gold's price action since October looks constructive. The market has held its October low and the 200-day moving average. It could have a chance to reach $1300-$1310. However the miners are saying 'no' to that possibility. Everything from large miners to small juniors made a new low while gold itself did not. The second negative divergence has to do with the 200-day moving average.

Sentiment

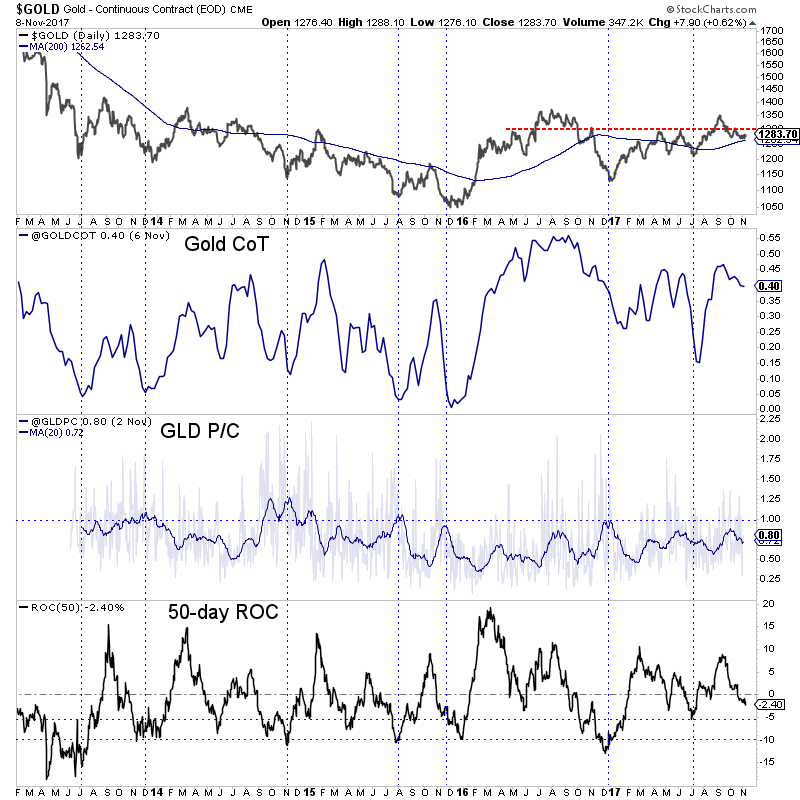

Gold has corrected by $100/oz over the past seven weeks but the relevant sentiment indicators do not indicate much of a shift in sentiment. In the chart below, we plot the net speculative position in gold as a percentage of open interest (gold CoT) and the GLD put-call ratio. The CoT remains elevated at 40%. The two important lows of the past 12 months occurred at 16% and 26%. The put-call ratio, which is smoothed by a 20-day moving average, has some work to do before it reaches a level associated with market lows. Finally, gold is not oversold based on a simple 50-day ROC.

Important Support

The relative weakness and negative divergence in the gold stocks have coupled and could portend lower gold prices by the end of 2017. Gold has important support at $1260 and if it loses that, it threatens a decline to $1200-$1220. The gold stocks are lagging the metal across the board with the worst performers being the smaller juniors. Given gold's weak technicals and questionable fundamentals, we will continue to wait for lower prices, worse sentiment and a low-risk buying opportunity in the coming months. The good news is that those who buy weakness in the months ahead can position themselves for strong profits in 2018. In the meantime, find the best companies and evaluate their potential value and catalysts that will drive buying.