The gold futures contract gained 0.22% on Wednesday, as it slightly extended its small Tuesday's advance of 0.13%. The market remained relatively calm despite the FOMC Statement release. Recently gold retraced most of the decline from September 1 local high of $2,001.20. Yesterday it has reached new short-term local high of $1,983.80 before coming back closer to the opening price. Gold is still trading within a consolidation along $1,950-2,000, as we can see on the daily chart:

Gold is 0.8% lower this morning, as it is trading along yesterday's daily low. What about the other precious metals? Silver gained 0.04% on Wednesday and today it is 1.3% lower. Platinum lost 0.89% and today it is 2.4% lower. Palladium gained 0.13% yesterday and today it's 1.1% lower. So precious metals are generally lower this morning.

Yesterday's Retail Sales release has been worse than expected. And today we will get the Unemployment Claims along with the Philly Fed Manufacturing Index, Building Permits and Housing Starts releases at 8:30 a.m.

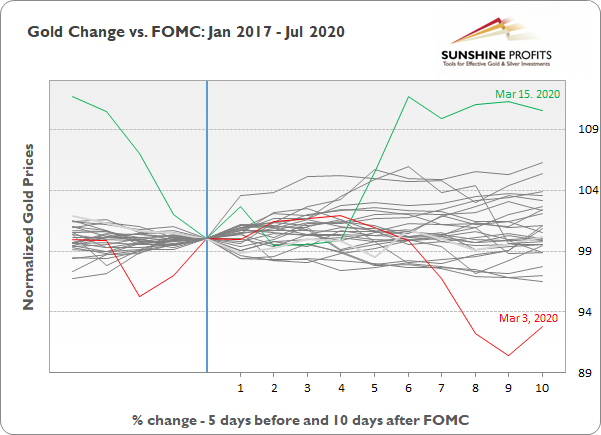

Where would the price of gold go following yesterday's Fed news release? We've compiled the data since January of 2017, a 43-month-long period of time that contains of thirty FOMC releases. The first chart shows price paths 5 days before and 10 days after the FOMC release. We can see that the biggest 10-day advance after the NFP day was +10.5% after March 15, 2020 release and the biggest decline was -7.2% after March 3, 2020 release. However, we've had an increased volatility following coronavirus fear then.

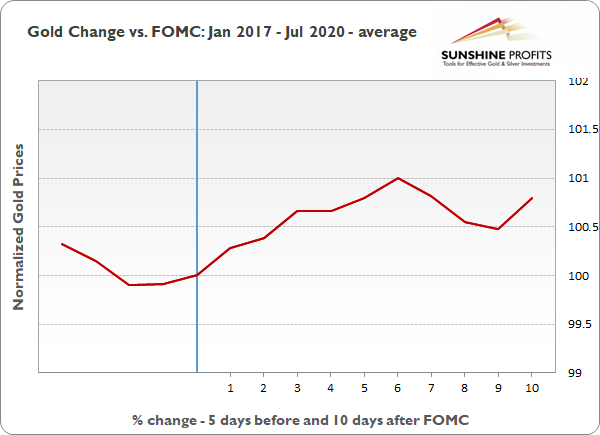

The following chart shows average gold price path before and after the FOMC releases for the past 43 months and 30 releases. The market was usually declining ahead of the FOMC day. Then it was going up for a week-long period. We can see that on average, gold price was 0.8% higher 10 days after the FOMC Statement announcement.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, September 17

- 8:30 a.m. U.S. - Philly Fed Manufacturing Index, Unemployment Claims, Building Permits, Housing Starts

Friday, September 18

- 8:30 a.m. U.S. - Current Account

- 10:00 a.m. U.S. - Preliminary UoM Consumer Sentiment, CB Leading Index m/m