Price Of Gold Recovers From 10-Month Low Before Price Drops Back Again On Federal Reserve Announcement

The talks regarding a go signal from the U.S. Federal Reserve which has been in the talks since earlier this year has now been granted by the fed reserve chairwoman Janet Yellen. This is to be the first interest rate hike since the great recession back in 2008. Despite the prices of gold steadying before the meeting, the announcement of the interest rate hike sent gold back to lose its earlier gains.

A couple of hours before the fed meeting on the interest rate hike, Gold prices were steady showing signs of recovery. U.S. Gold futures rallied by around 0.4% at $1,163.70 while Spot gold rose up by 0.3% to $1,161.73. Other metals such as silver rose 1.1% a $17.02 per ounce.

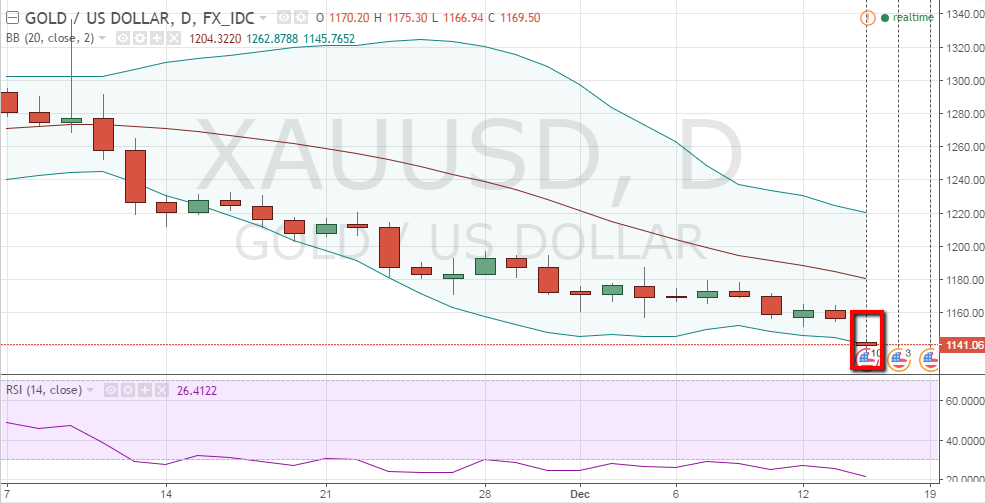

Over the past couple of months, the price of the precious metal have plunged to new lows given the recent economic events including the announcement of Donald Trump’s victory and in anticipation of the U.S. fed reserve decision. A recovery was recently seen in the price movement of the commodity after a weaker US dollar drove the price of gold from a downward trend.

Although gold prices showed earlier signs of recovery from its current ten-month slump, it has returned to lower prices on the rate increase which was highly anticipated by different markets.

According to the federal reserve, three more rate hikes are to be announced or planned next year. The two-day meeting ended with an announcement that the fed is raising the interest rate by 0.25% in the benchmark rate to 0.50% to 0.75% from only 0.25% to 0.50% along with a forecast that three more interest rate hike would be talked about next year.

Direction Of Gold Prices

As analysts have expected, an interest rate hike would badly hurt the prices of commodities particularly gold as Yellen announced an interest rate hike go signal.

At the moment, Gold prices are down by about 17% with analysts stating to a bearish outlook for gold prices due to the recent announcement from the US Federal Reserve as they also announced that three more interest rate hikes are to be planned by the organization next year.

Aside from the rising market confidence recently regarding the outlook of increasing market confidence on the fed raising the interest rate further next year, gold prices also slumped on other economic events recently such as the result of the U.S. elections and the market uncertainty on the Trump administration.

Gold prices now have now rebounded to its previous ten-month low. U.S. gold futures, meanwhile have slid down by 1.6% to $1,145.20 per ounce while Spot gold has declined by 0.1% to $1,143.05 per ounce. The RSI Indicator still shows that the commodity has not recovered from an oversold stock from around two to three weeks ago.