"What's going on in the short-run certainly isn't positive, but for me it isn't sufficient yet – yet – to materially change my outlook," Dallas Fed President Robert Kaplan told Reuters in an interview on Friday. Still, he said, he would need to downgrade his outlook if tensions between the U.S. and its trade partners escalate. Even though the Fed's job is not to set trade policy, it must react to it, he said. Trade war between China and the U.S. is claiming commodity markets as one of its first victims. China, the biggest consumer of everything from copper to coal, has warned the proliferation of tariffs could cause a global recession. On Friday, reports showed weaker-than-expected growth in imports, and indicators of investment, factory output and retail sales growth all slowed in May.

Despite the fact that the U.S. import prices fell the most in more than two years in June as prices for petroleum products fell and a strong dollar weighed on the costs of other goods, U.S. President Donald Trump has been consistently maintaining trade disputes, and ensuing losses in commodities, which are likely to remain until after the U.S. midterm elections in November to keep the crude prices at the lowest levels.

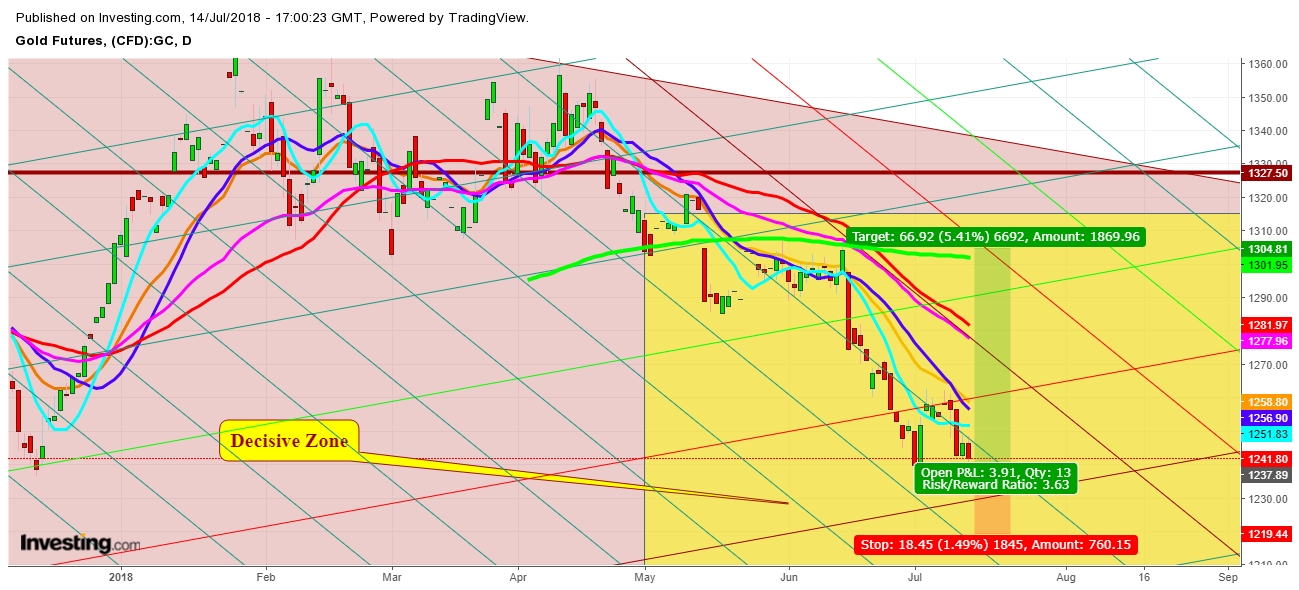

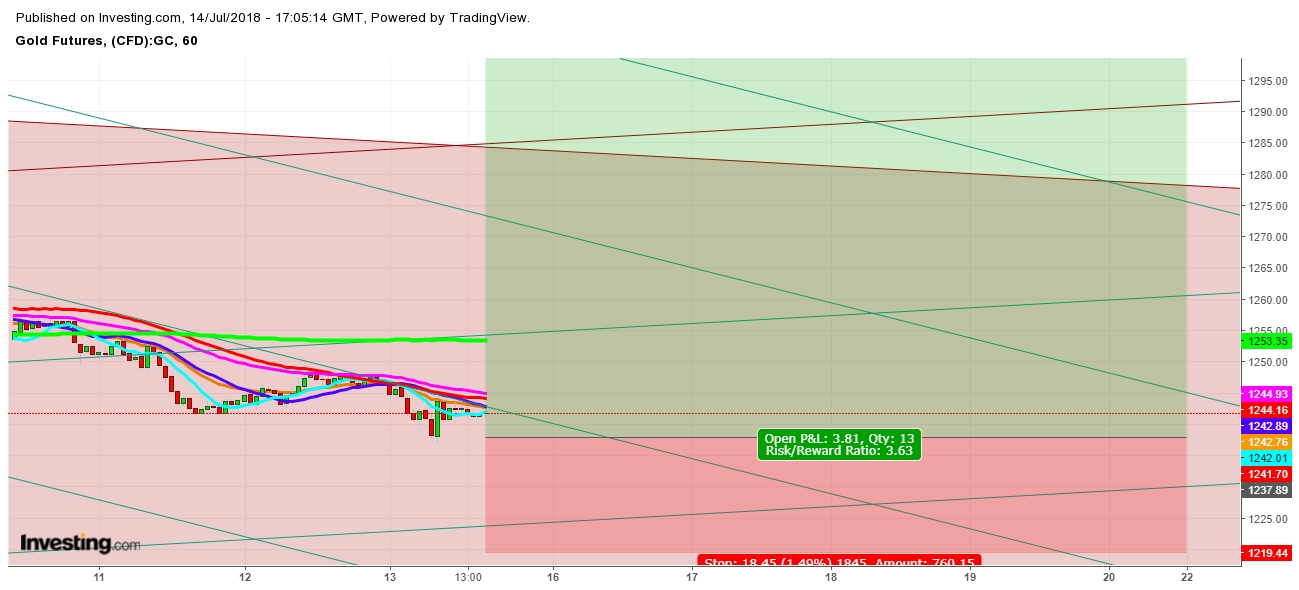

On analysis of the movement of Gold futures amid currently prevailing recessionary scenario, I find that Gold Futures are ready for a rally which is likely to continue during the upcoming week. No doubt that the quantum of volatility will be too high due to sudden tilt in geopolitical moves after the US President Donald Trump and Russian President Vladimir Putin will hold a summit on July 16 in Helsinki where they are likely to discuss issues on relations between the United States and Russia and other national security issues. I’ve found the following expected trading zones for Gold futures for the Week of July 15th, 2017.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.