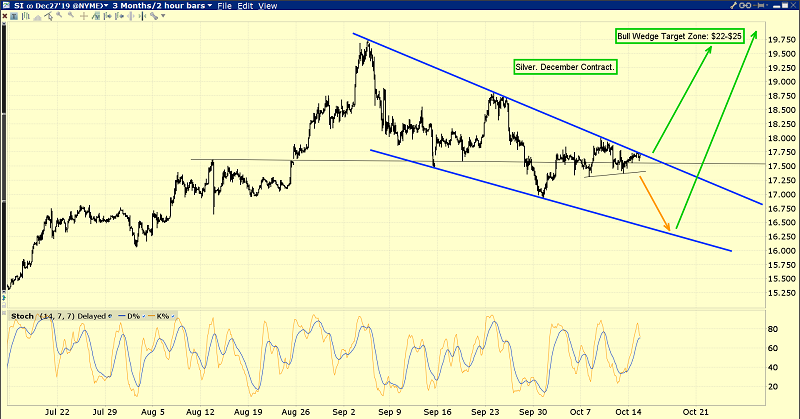

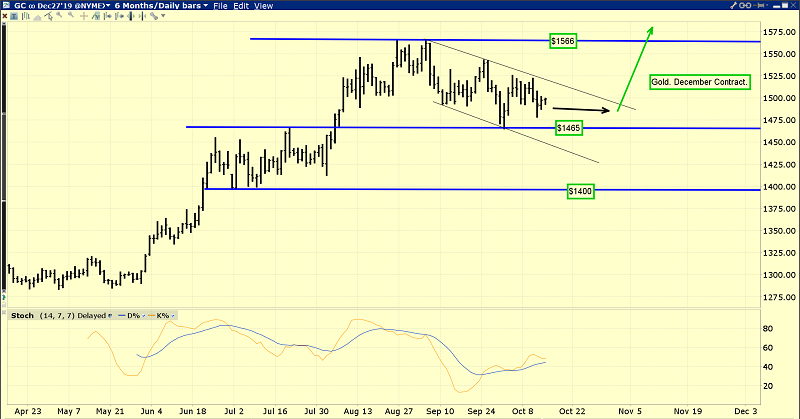

For silver, all roads probably lead to the $22-$25 area. For gold, all roads likely lead to $1600-$1800. There could be significant bumps in these roads, probably involving time more than price.

Silver looks stronger than gold, but gold is also looking very solid, from both a fundamental and technical perspective.

Whether silver breaks out from the bull wedge now or a bit later really doesn’t matter.

My recommendation to silver price enthusiasts is to get in on the action right now and buy more on any further price softness, which may or may not happen.

It’s been my firm contention that rather than roar higher or melt lower, gold is poised to consolidate with sideway action.

The $1465 support zone is acting like a sponge more than a trampoline or trap door, and that’s positive.

While the Western fear trade gets the most attention from gold market fundamentalists, it’s like the hare while the love trade is the turtle. In the long term, it could be the love trade that drives and sustains gold at prices that currently seem almost unimaginable.

One of my predictions has been that Dubai (the city of gold) will ultimately become the world’s main centre of price discovery.

Dubai jewellers estimate the world’s annual demand for gold jewellery at more than 2000 tons, and they project solid growth for the long-term.

Mine supply is stagnant and central banks don’t appear interested in selling gold. India’s RBI has recently joined the central bank “buy club” with modest accumulation.

On the demand side, Dubai’s new gold policy can help make the $1400-$1500 zone into a real floor.

The lower-for-longer approach to interest rates in the West is another floor-building theme.

Also, the US-China trade deal appears to be more of a tariff taxes lock than an actual trade deal, and I’ve predicted these tariff taxes will be here for at least the next decade.

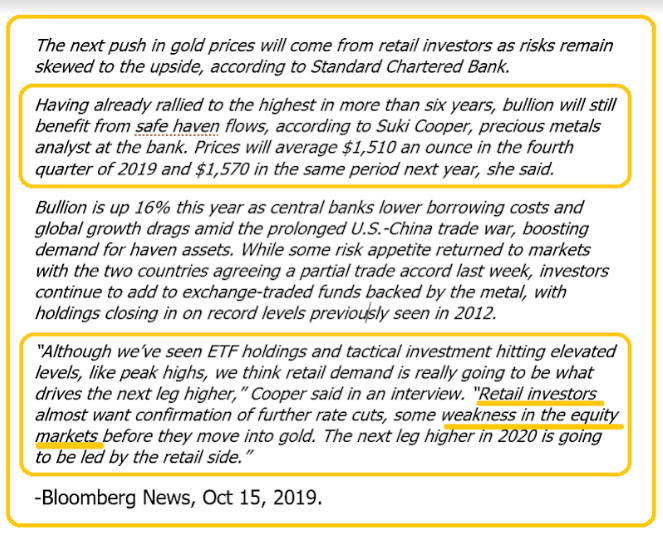

What about the retail investor? Standard Chartered (LON:STAN) Bank’s heavyweight analyst Suki Cooper is highly respected in the institutional investor community.

She predicts the stock market is likely to swoon in 2020, and retail investors will seek refuge in gold as that happens.

I’ve also been adamant that in any stock market sell-off, gold will be a better safe-haven that T-bonds.

Most money managers believe QE and rate cuts have waned as tools to boost economic growth, but they can still help to cushion a stock-market meltdown.

When the Fed rolled out QE and rate cuts in 2008, T-bonds still paid some interest. Money managers are concerned that the Treasury will join other central banks and begin offering negative rate bonds to investors.

Negative rate bonds issued by a US government that refuses to cut spending and debt are not a safe-haven… and they could be a time bomb! Institutional concern about negative rate bond issuance is clearly an important driver of gold demand that could be here to stay.

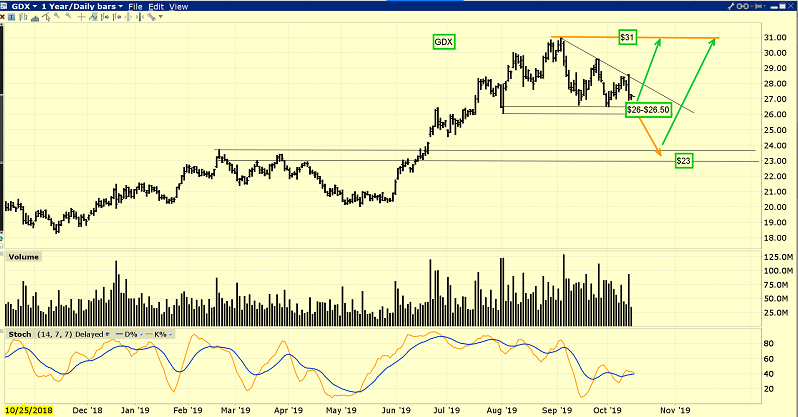

GDX (NYSE:GDX) doesn’t look as good as silver or gold bullion. The U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE:GOAU) ETF sports a beautiful bull wedge pattern.

Whether there’s a bit more bump-and-grind action within the wedge should not be a concern for investors. The focus should be on the bull wedge itself, because it suggests a move to and through the $18-area highs will be the next big event.