Since the Fed Chair Powel announced a slow pace of interest rate hike this Wednesday, the sudden surge in gold was only a temporary breakout as the U.S. central bank looks to be more hawkish. However, the fight against inflation is far from over.

Equity markets are currently pricing in a 91% probability that the Fed will increase rates by 50 basis points on Dec. 14 and only a 9% chance of another 75 basis point hike.

Expectations have also grown worldwide that China, while still trying to contain infections, could look to re-open at some point next year once it achieves better vaccination rates among its elderly.

I believe that the current surge in gold prices only revolves around the expectations, which pushed the gold futures to a two-week high of $1,779.39 an ounce. Meanwhile, oil edged up, supported by signs that OPEC+ may cut supply further at a meeting on Sunday.

Persistent inflation, surging oil prices, and the decreasing pace of interest rate hikes do not favor the sudden surge in gold.

The Federal Reserve has increased uncertainty as the equity markets are currently pricing in a 91% probability that the Fed will raise rates by 50 basis points on Dec. 14 and only a 9% chance of another 75 basis point hike.

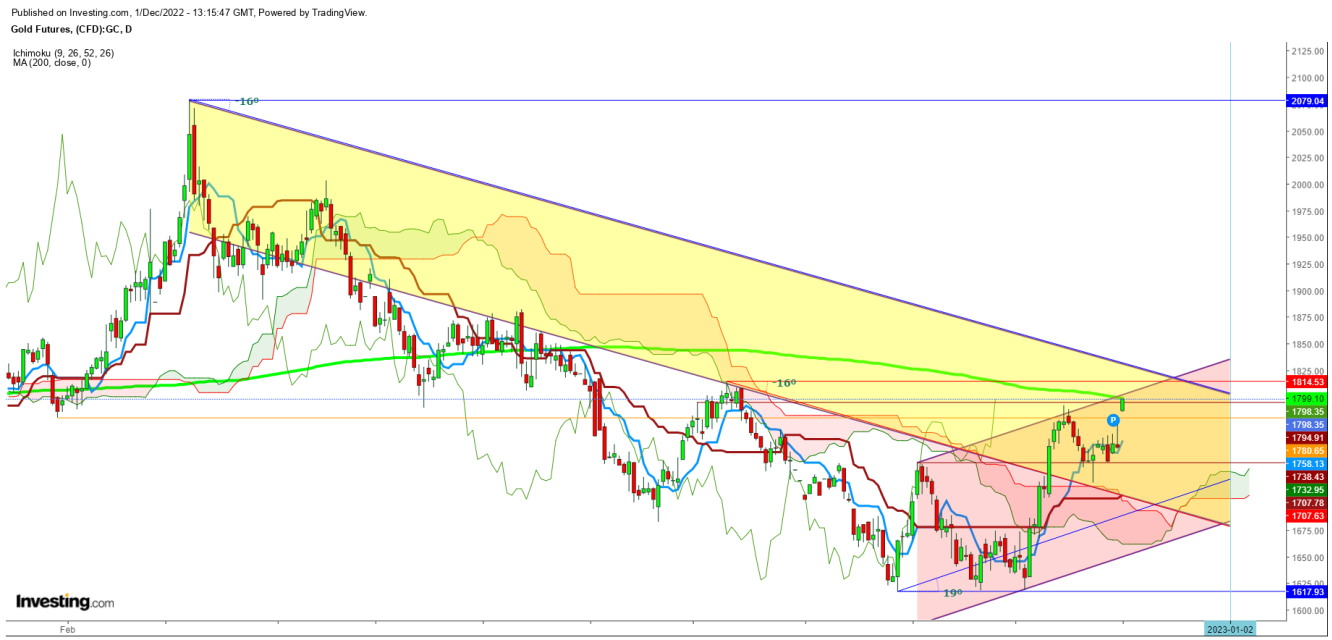

In the daily chart, gold looks ready to test the immediate resistance at 200 DMA, currently at $1999.

This could attract bears to open their shorts here, as the current move be a false breakout as the inflationary pressures are still intact.

A steep slide could follow the current move if the prices fail to sustain above 200 DMA in today’s trading session.

A breakdown below the immediate support at $1780.65 before this weekly closing will be the first confirmation of a steep slide that may continue during the upcoming week.

Disclaimer: The author of this analysis does not have any position in Gold futures. Readers are advised to take any position at their own risk.