We grow up in a world where gold is associated with wealth and status. From an early age, we hear the story of King Midas and everything he touches turning to gold. We remember all the gold he created, not the moment when his daughter turned to gold. Famous actresses dress in gold to stun the crowd, entertainers shock their audience with gold suits.

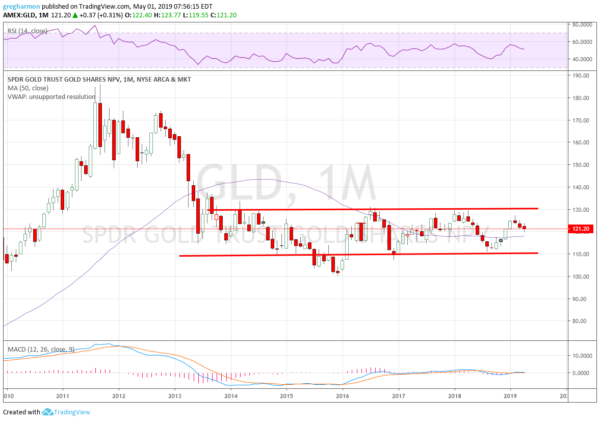

But back in the real world gold has been in a funk. A malaise that is going on for 6 years. Since dropping from its high plateau beginning in 2012, the price of gold has spent 90% of the time within a tight range. The chart of the Gold ETF (NYSE:GLD) below shows the 110-130 price range to contain all but a few candles from the end of 2015.

This is the very definition of a malaise. There is nothing flashy here. And with the current drift lower in the middle of the range it does not scream out that this is going to change anytime soon. Aside from price action, momentum is also not exciting. The RSI is oscillating between 40 and 60 around the midline, unable to commit to a direction. The MACD has been flat at zero for 2 and a half years. With this picture I suggest, it is gold malaise, not gold lame, that is winning out.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.