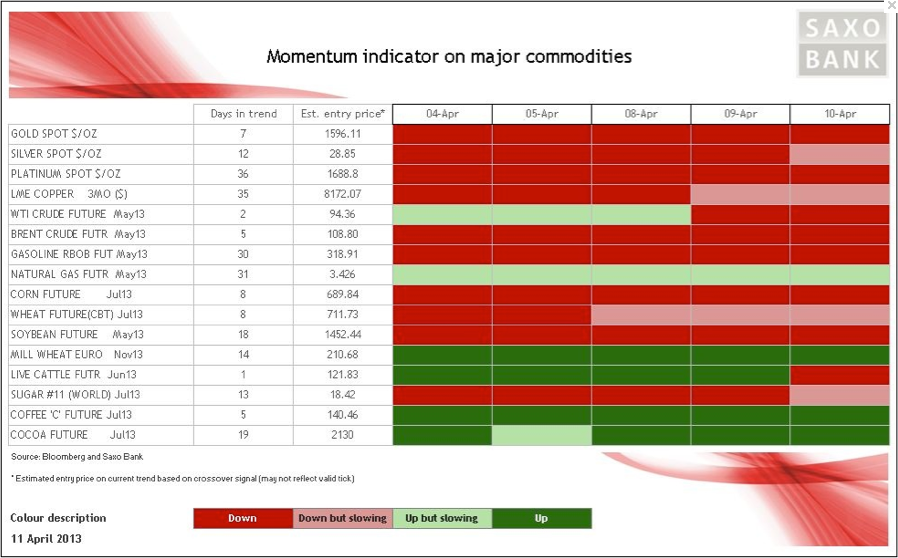

The metal sector remains stuck with negative momentum although industrial metals and silver have witnessed a small recovery up until yesterday. Silver's ratio to gold has fallen from 57.9 last week back down to 56.5 primarily due to the confidence in gold receiving another knock yesterday. News that Cyprus as part of its effort to fund its bailout would consider selling a large share of its gold reserves together with relative hawkish minutes from the recent meeting of the U.S. Federal Reserve knocked over whatever confidence had been build since last Friday's weak U.S. employment report leading to the biggest daily fall in five months.

Why Cyprus?

The reason why the Cyprus news, which was later denied, made such an impact was primarily due to the timing. The news came at a time when investor sentiment towards gold's prospect has become increasingly frail. As such the amount of EUR 400 million worth of gold is a tiny amount and equates to less than two percent of the average daily volume traded on the futures exchange in New York. But the concern it may raise is that this could create a precedent and be copied by other and much bigger nations in their efforts to shore up their finances. Such a move could undermine one of the few pillars of support for gold at the moment: central bank buying.

Elsewhere we saw no major changes with both crude oils (Brent and WTI) holding onto negative momentum while Live Cattle turned negative and sugar saw its negative momentum slow and a break back above 18 cents/lb could create some further positive vibes around the sweetener.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Knocked Over By Cyprus And FOMC

Published 04/11/2013, 11:07 AM

Updated 03/19/2019, 04:00 AM

Gold Knocked Over By Cyprus And FOMC

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.