Gold makes people crazy. I will never understand why this shiny yellow rock has garnered so much excitement through the ages. It's not about scarcity, at least not anymore. We have plenty of mines and can dig up more. And you see what we use it for. Not really an industrial metal.

Yet people get manically excited about it. Including the prospect of investing in Gold. This makes even less sense to me. It does not have earnings, or pay a dividend. And again, remember what it is used for. But despite that it has a deep and liquid market. What makes Gold even more interesting right now is that with all the traders and investors excited about events and geo-political goings on the shiny yellow metal is doing nothing. Absolutely nothing.

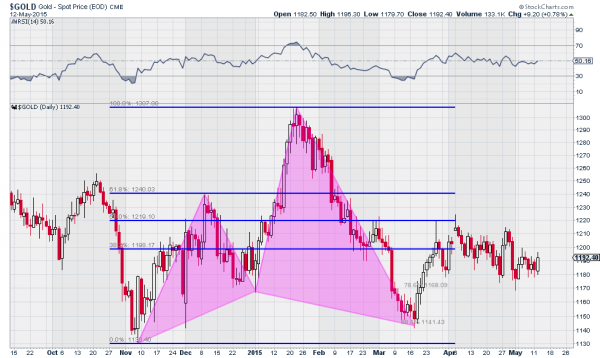

The chart above shows the price action in Gold since the beginning of October. It did have some spunk into the end of 2014 and through the first quarter of this year. The price action traced out a bullish Shark harmonic, and reversed higher right at the Potential Reversal Zone. It took all of 7 days to retrace 50% of the pattern and then...nothing. It has traded like the 38.2% retracement level at 1200 is a magnet. Even the momentum indicator RSI is showing no bias one way or the other as it runs along the mid line.

If there was ever a time for even the most diehard goldbugs to give up on the metal and just watch, it would be right now. Until Gold makes a definitive statement, by moving either above 1225 or below 1170, it is truly both useless and boring.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.