The price of gold soared once again yesterday, but there are important signs suggesting that this rally is close to being over.

The current action in the precious metal sector continues to be determined by the increasing concern/interest in war, so that’s what I’m going to start today’s chart analysis with.

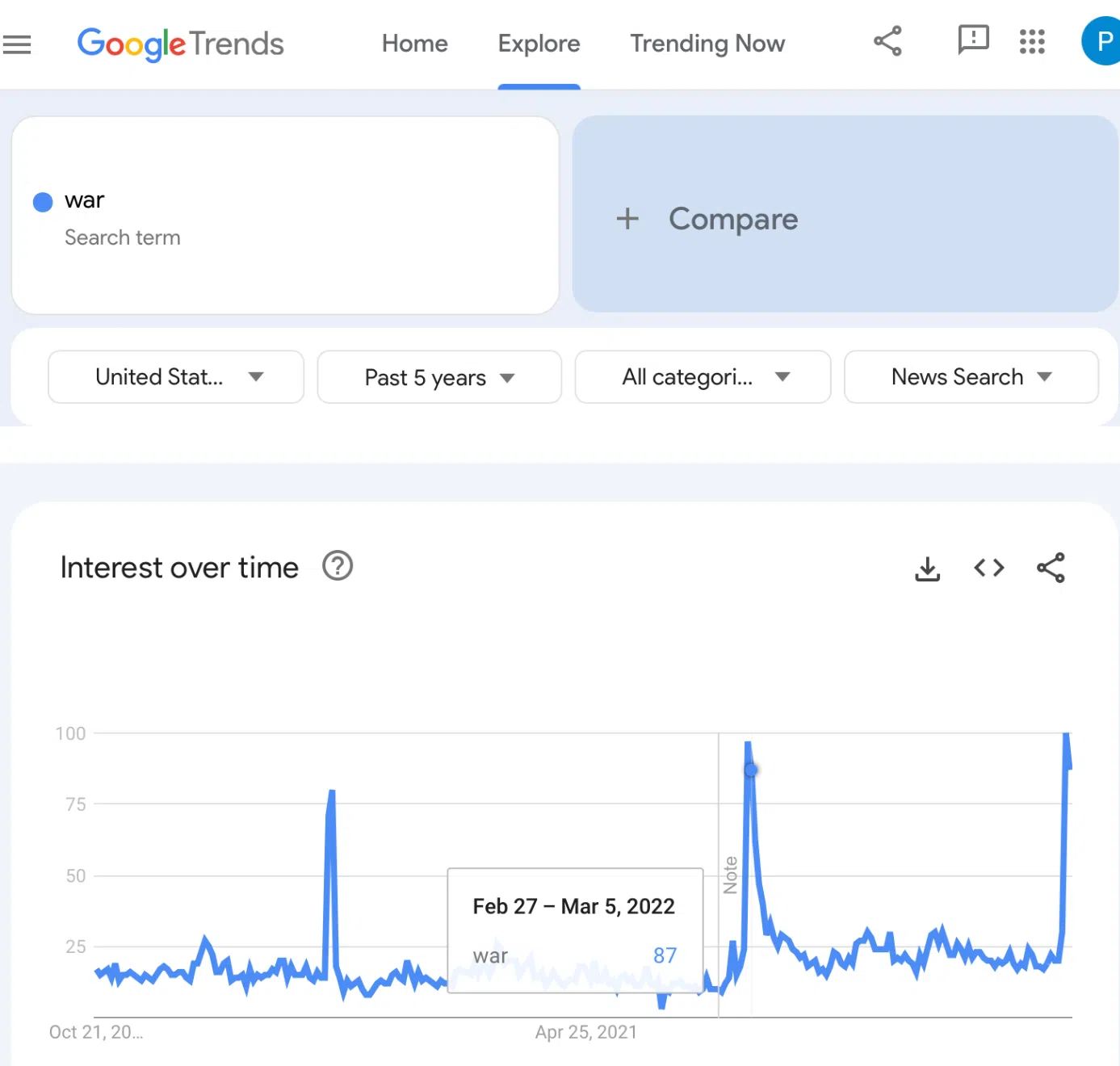

The below chart features the interest in war in Google (NASDAQ:GOOGL) News in the U.S.

The current situation is analogous to what we saw right before and right after the Russian invasion in 2022.

Now, since the market generally “buys the rumor and sells the fact”, gold is rallying primarily based on increasing fear or uncertainty, which is connected to, but no the same thing as actual events.

This concern can be measured by how frequently the term “war” is being searched in Google (in particular, in Google News – this part of Google’s service is used to get… well, news, which helps to isolate the concern with the current conflict).

The key thing that is happening this week is that after last week’s peak, it seems that this week’s interest is about to decline a bit. We still have just partial data as the week is not over yet, but it’s enough to see how analogous the situation is to the Feb 27 – Mar 5, 2022 week.

And guess what happened in gold at that time?

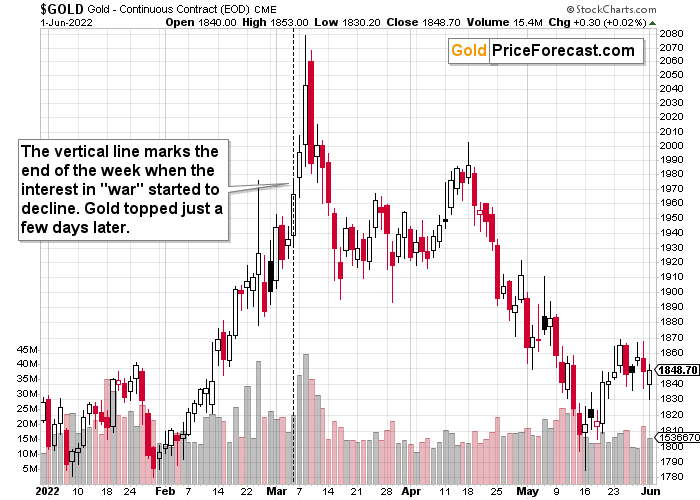

Just a brief gold price analysis reveals that it peaked but not exactly when the concerns did. Gold price continued to move higher after that lower-interest week for a few more days, and then it topped.

This is in tune with what I’ve been expecting the precious metals market to do right now – to move higher in the short run but then top and resume its medium-term downtrend.

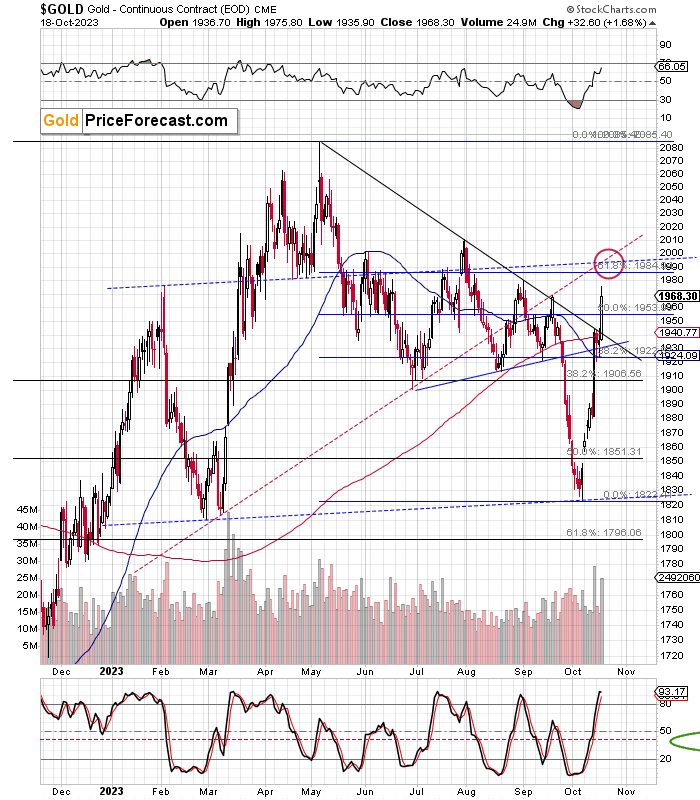

As you can see on the above chart, gold is currently soaring – just like it’s been soaring back in early 2022. If it is to continue to rally for a couple of days, it could move close to the $2,000 level before topping, providing a great shorting opportunity (we took profits from the previous short position before this rally picked up pace).

This would make the current rally symmetrical to the early 2023 decline, and it would make the entire 2023 (so far) one big head-and-shoulders pattern. Of course, that pattern would need to be confirmed by gold’s decline, but we already know that this is likely to happen based on the current sentiment analysis.

The triangle-vertex-based reversal is due in several days, so gold might indeed have some room to rally.

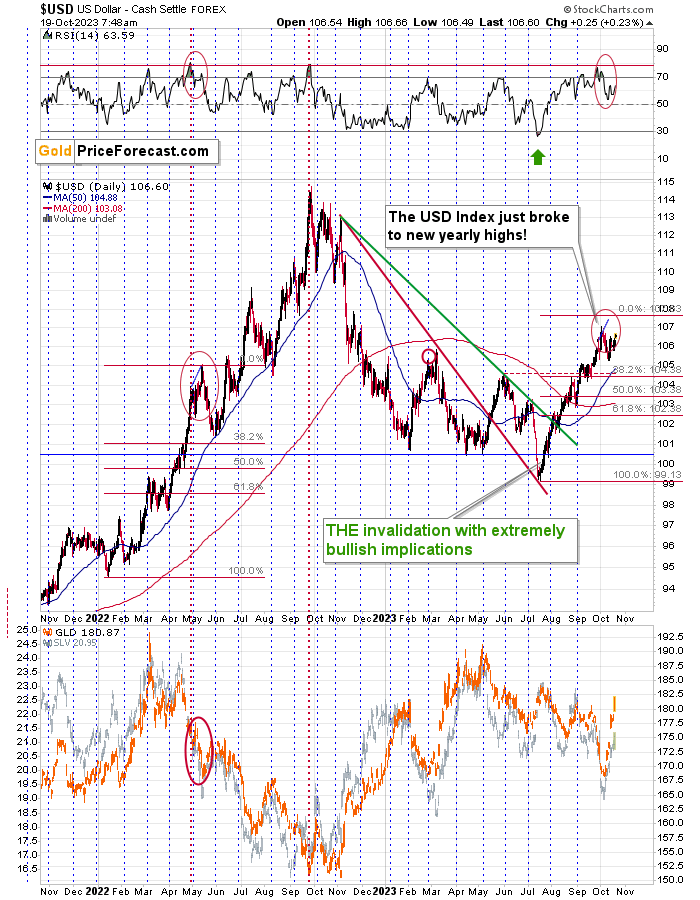

Interestingly, gold moved higher despite the fact that the USD Index moved higher, too.

Why did this take place? Because both gold and the U.S. dollar are viewed as safe-haven assets, and given the concerns regarding war in the Middle East, both are bought.

Whether the USD Index moves lower from here or higher doesn’t necessarily matter, as investors’ focus is on something else. Once the “war concern” peaks and then declines, in all likelihood, the USD Index will once again become an important driver of gold prices.

For now, the outlook for gold remains bullish, but it’s likely to change soon.