Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The only theory I can think of to explain this is that the smart money in that the market is anticipating that the Fed will have to soon reverse itself and pump even more money into the banking system.

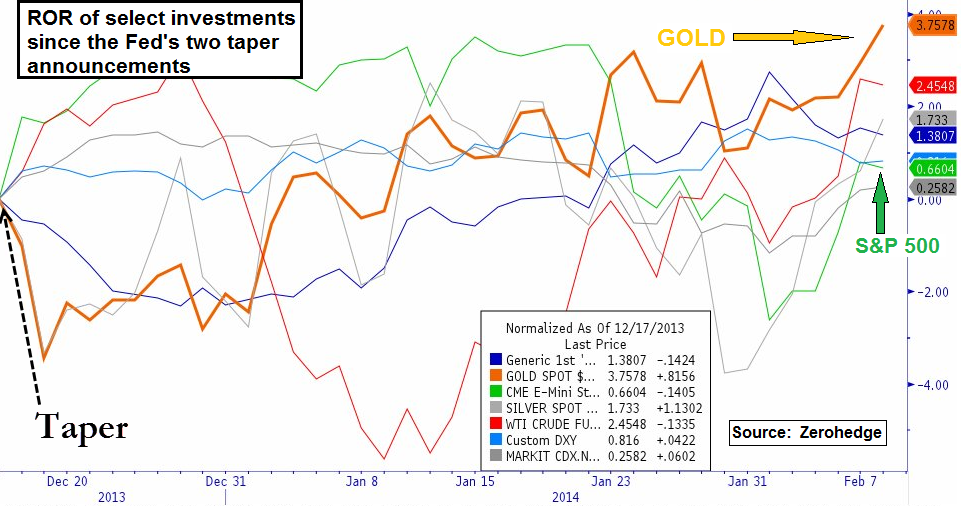

Although I was wrong that gold would fly when QE3 started - primarily due to the the Fed's price containment of gold (see today's earlier post) - I did say late last year that if the Fed did start to taper I would not be surprised to see gold start to chew threw the market obstacles being thrown at it by the Fed/bullion banks and move higher in anticipation of an eventual reversal of the taper. Janet Yellen is just person for that task given her stance on interest rates and "deflation fighting."

In fact, in the fund I manage, we had several holdings where were up double digits, with some of them outperforming the triple-leveraged mining stock ETFs: AAU +14.5%, Wildcat Silver up 17.9%, Exeter Resources (XRA) up 13% and ATAC Resources up 13.8%. Some of our holdings have more than doubled since early December.

I have suggested to a few colleagues that properly selected junior miners could end up returning 20-30x your investment at these levels. We've seen that occur in the past and now the big mining companies like Newmont and Goldcorp are starving to replace their reserves. A couple of the ones mentioned above have monster reserves and will eventually be swallowed up by the bigs.

There's no rush like a gold rush...