"The appeal of gold as a safe haven investment has faded after its rise following the decision of the Turkish Central Bank to raise interest rates to support the currency," – said the Masterforex-V World Academy experts. According to a group of analysts, the FED's two-day meeting will reduce the amount of monthly bond purchases.

As Ronald Leung, the chief dealer of the Lee Cheong Gold Dealers in Hong Kong notes, many analysts expect a reduction of $10 billion, so if the FED does not do anything, then prices may go up. If a reduction occurs, it is unlikely for gold to fall much as it has a strong support at the 1,200 level.

Forex Brokers: Gold futures will retreat.

“Gold futures retreated on Tuesday for a second day in a row amid the improved consumer sentiment in the U.S.A. that supports the stock market, while the meeting of the FOMC is in the focus now", - said the analyst of the Masterforex-V World Academy. “February gold futures fell by 11.60 dollars, or 0.9% to 1,251.80 dollars per ounce," –informed the analysts of Forex Broker HY Markets.

Gold prices rose slightly after the published statistics showed a decline of the orders for durable goods in December, but prices rolled back after the Conference Board informed that its index of consumer confidence in January rose up to 80.7 points, exceeding the analysts' forecasts and the December value which was in 77.2 points, specified the Masterforex-V World Academy analysts.

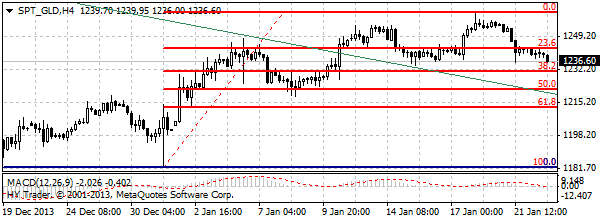

According to the experts of Forex Broker HY Markets, gold is consolidating in the area of 1,250 dollars after testing the area of 1,278 dollars. The nearest support is around 1,235.50 dollars.

The lower support is at 1,210.35 dollars (61.8% Fibo of 1,182.10 dollars). "Above 1,278 USD the resistance is at 1,293.80 dollars (high of Nov14)", specified the Masterforex-V World Academy analysts.