I may never understand the fascination with gold. I honestly do not even like it as jewelry. But I do not have to understand it. The same way that I do not have to understand what it costs to build a F35 and how much profit is involved to trade Boeing stock. Gold exists, people buy it and it has a volatile price. And that price action is tradeable.

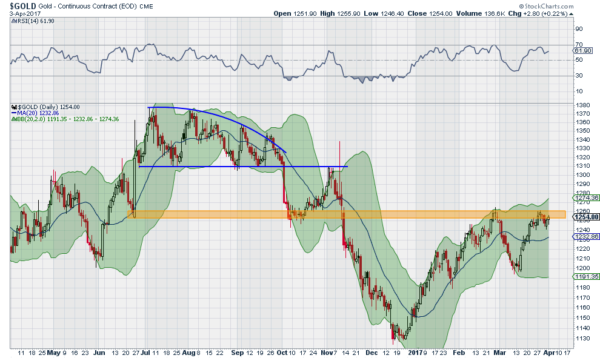

The chart below shows the price of gold over the last year. It rounded out of a top near 1380 in June breaking support at 1315 in October and falling hard. It found support at 1250, a launching point in June and bounced. But it could only retest the 1315 level before falling back. This time the 1250 level acted like a sieve as it passed through, eventually bottoming in December.

The bottom at 1125 established support for about a week and then the price started higher again. It rose in two legs to the 1250 area, and pushed slightly above to 1260 before pulling back. The pullback ended at a higher low near 1200 in March, ad reversed quickly. That led to a push back to the 1250-1260 range where it has held.

With a little push up Monday and then follow through in the pre-market hours Tuesday, gold is at the top of that range. The Bollinger Bands® are opening to the upside. And momentum remains strong and climbing. These support a push higher. Separation form the 1260 area likely has a free run higher to 1300-1315. Keep an eye here for a trade.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.