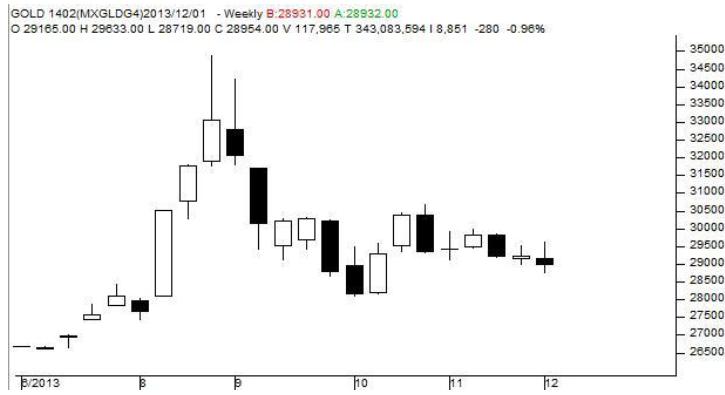

MCX Gold February as seen in the weekly chart above has opened the week at 29,165 levels initially moved sharply lower, but has found support at 28,719 levels. Later prices rallied sharply towards 29,633 levels, but could not sustain the gains corrected back towards 28,720 levels, and finally closed lower from the previous weeks closing levels, according to a weekly analysis by Angel Commodities.

For the next week we expect gold prices to find support in the range of 28,570 – 28,530 levels. Trading consistently below 28,500 levels would lead towards the strong support at 28,190 levels and then finally towards the major support at 27,420 levels.

Resistance is now observed in the range of 29,260-29,300 levels. Trading consistently above 29,400 levels would lead towards the strong resistance at 29,830 levels, and then finally towards the Major resistance at 30,320 levels.

MCX / Spot Gold Trading levels for the week

Trend: Sideways

S1-28,570/ $ 1215 R1-29,280 / $ 1250

S2-28,190 / $ 1190 R2-29,830/ $ 1272

Weekly Recommendation: Sell MCX Gold February between 29,260-29,300, SL-29,521, Target -28,600. Angel Commodities report added.

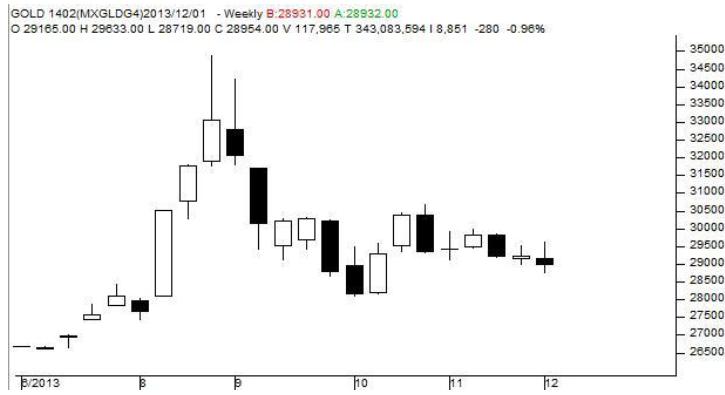

For the next week we expect gold prices to find support in the range of 28,570 – 28,530 levels. Trading consistently below 28,500 levels would lead towards the strong support at 28,190 levels and then finally towards the major support at 27,420 levels.

Resistance is now observed in the range of 29,260-29,300 levels. Trading consistently above 29,400 levels would lead towards the strong resistance at 29,830 levels, and then finally towards the Major resistance at 30,320 levels.

MCX / Spot Gold Trading levels for the week

Trend: Sideways

S1-28,570/ $ 1215 R1-29,280 / $ 1250

S2-28,190 / $ 1190 R2-29,830/ $ 1272

Weekly Recommendation: Sell MCX Gold February between 29,260-29,300, SL-29,521, Target -28,600. Angel Commodities report added.