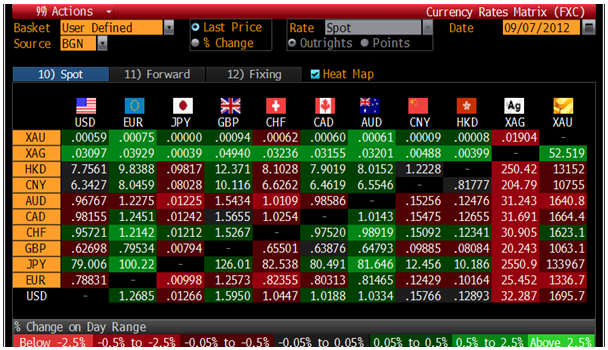

Today’s AM fix was USD 1,696.00, EUR 1,337.75, and GBP 1,062.06 per ounce.

Yesterday’s AM fix was USD 1,708.50, EUR 1,355.09and GBP 1,074.53 per ounce.

Gold climbed $6.70 or 0.4% in New York yesterday and closed at $1,700.30. Gold in euro’s also rose to near record highs prior to falls soon after the ECB interest rate and bond buying announcement.

Silver outperformed once again and surged to $32.987 and then dropped to $32.346 in early New York trade but then it recovered and finished up 1.24%.

Gold is lower in all major currencies today except the Swiss franc which has come under pressure on speculation the SNB will lift their completely unsustainable peg to the euro.

Gold rose in anticipation of the ECB embarking on another money printing exercise with a potentially unlimited bond-buying programme. There was then an element of "buy on the rumour and sell on the news" as gold then saw slight falls on the well flagged announcement.

Markets rallied around Mario Draghi’s "bazooka" that was able to silence the Bundesbank's Jens Weidmann and force his latest money printing exercise through. The can has been kicked down the road and the euro will survive a bit longer.

At least until the next sovereign debt crisis develops – possibly as soon as next week, on September 12th, when the German Constitutional Court delivers their verdict regarding the 500 billion euro European Stability Mechanism (ESM). The court is reported to be divided in its opinion.

Banker "Super Mario" won this battle but the Bundesbank and the will of the German people may ultimately win the war.

Investors will watch the US nonfarm payrolls (1230 GMT) number as a clue as to whether the US Fed will launch QE3 at their policy meeting in September.

South Africa's platinum sector is still in discord as the AMCU union refused to sign a "peace deal" with Lonmin, stifling government-backed efforts to open pay talks and end a 4-week work stoppage that resulted in multiple deaths.

Gold ETF’s hit a record for the third straight day. The amount increased 1.3 metric tons, or 0.1 percent, to 2,471.97 tons, data tracked by Bloomberg showed.

Gold imports by China from Hong Kong rose in July as Chinese people renewed their buying of gold to hedge against financial market’s turmoil and weaker currencies with increasing concerns about the Chinese economy and stock and property markets.

Mainland China bought 75,842 kilograms (75.84 metric tons) of gold in July, including scrap and coins, almost double the 38,143 kilograms a year earlier, according to export data from the Census and Statistics Department of the Hong Kong government which was reported by Bloomberg.

It was the first rise in imports after three months of slightly lower imports. Shipments were a record 103,644.5 kilograms in April, according to the department. China doesn’t publish such data.

Gold shipments from Hong Kong to China surged to 458,628 kilograms (458.628 metric tonnes) in the first seven months of 2012 from 103,090 kilograms (103.09 metric tonnes) in 2011.

Exports of gold to Hong Kong from China were 30,038 kilograms in July, according to a separate Statistics Department statement, up from 27,507.5 kilograms in June.

For the week, the precious metals look set to again outperform fiat currencies with all four precious metals higher against the dollar (see G10 and Precious Metals Weekly Returns).

Gold is flat in dollars, slightly lower in euro and pound terms and slightly higher in Japanese Yen, Norwegian Krone and Swiss franc terms for the week.

All in all it was a week of consolidation for gold and further gains for the other precious metals.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Imports To China From Hong Kong Double Again On Haven Demand

Published 09/09/2012, 07:36 AM

Updated 07/09/2023, 06:31 AM

Gold Imports To China From Hong Kong Double Again On Haven Demand

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.