-

Gold prices reach a new record high of $2465/oz, driven by post-CPI and rate cut optimism.

-

Despite a resurgent US Dollar, gold’s upward momentum remains strong, briefly dipping before rallying to new highs.

-

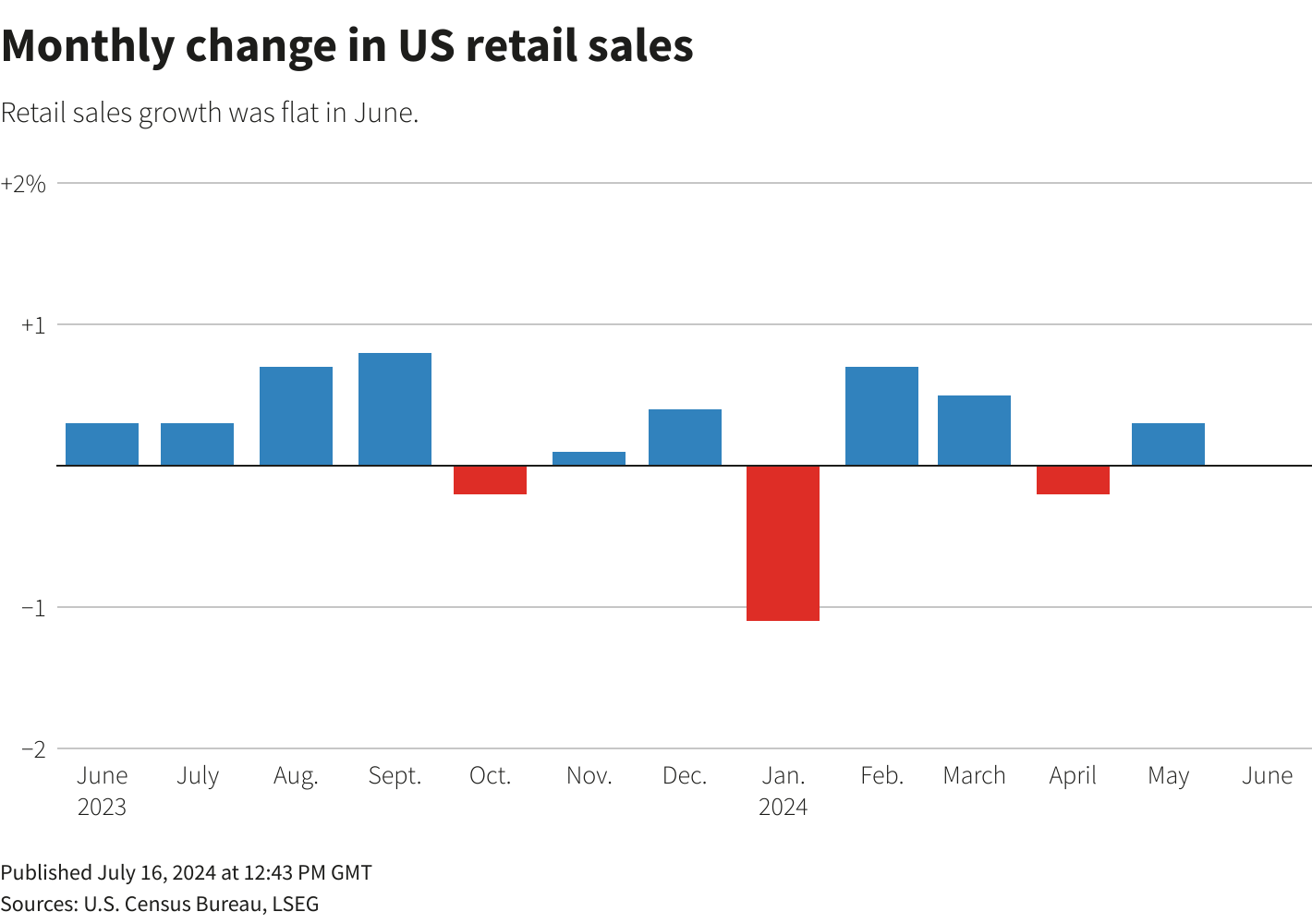

June’s US retail sales figures and an upward revision of May’s data had minimal impact on gold’s rally and market expectations for Fed rate cuts.

Gold prices continue to ride the wave of post-CPI and rate cut optimism as the precious metal nears its previous all-time high around the $2450/oz mark.

This surge comes despite a resurgent US Dollar Index, bolstered by recent events and positive US retail sales data.

Initially, the strength in the US Dollar index seemed poised to cap gold prices, but this pressure failed to materialize. Gold briefly dipped to a low of $2429.45 before rallying to fresh daily highs at $2458.05.

June’s US retail sales numbers remained unchanged, but an upward revision of May’s figure to 0.3% temporarily paused gold’s rally. Nonetheless, the report did little to alter market expectations regarding Fed rate cuts, even as the US Dollar gained some strength.

Source: Refinitiv

The overall probability of a September rate cut has seen a slight increase, rising from 91.9% to 93.3%. Meanwhile, the DXY has rebounded from support at the 104.00 level but is currently facing resistance at the 200-day moving average, which stands at 104.42.

Source: TradingView (click to enlarge)

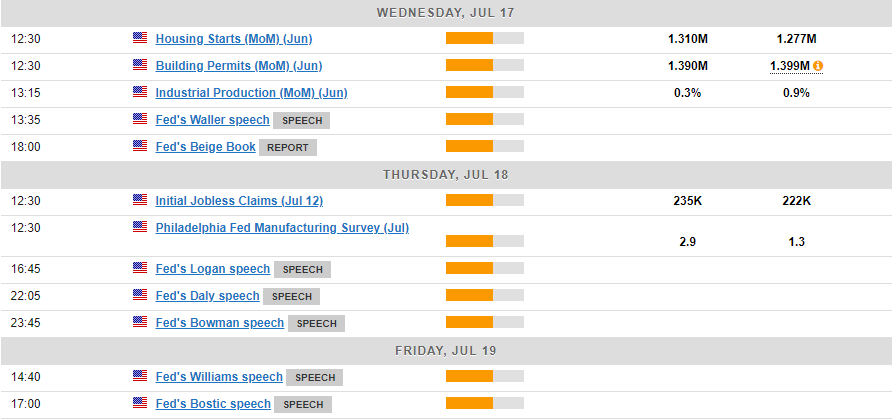

The Week Ahead: Fed Policymakers to Push Back on Rate Cut Bets?

The economic calendar for the upcoming week is light on high-impact US economic data. The main focus will be on Federal Reserve speakers, with several policymakers scheduled to address the public in the coming days.

For the US dollar to sustain its recovery following last week’s selloff, Fed policymakers will need to adopt a distinctly hawkish tone.

In contrast, gold appears to be on an unstoppable upward trajectory. With minimal price action to analyze, it is challenging to predict where this rally might encounter resistance.

Technical Analysis

From a technical standpoint, gold is now in uncharted territory. The break above previous all-time highs at $2450/oz makes that a key level of support.

If $2450/oz continues to hold, further gains are the most likely outcome. Psychological and round numbers are always key for gold, so keep a watch on $2475, and of course, the psychological $2500/oz handles.

Alternatively, a break below $2450 brings $2432 support into focus before the psychological $2400 may be revisited once more.

Support

-

2450

-

2432

-

2400

Resistance

-

2475

-

2500