- Gold soars to new record highs as Fed chief prepares to testify

- Bitcoin also hits all-time peaks, but retreats alongside tech stocks

- Bank of Canada rate decision and UK budget on the menu too

Gold shines, will Powell help?

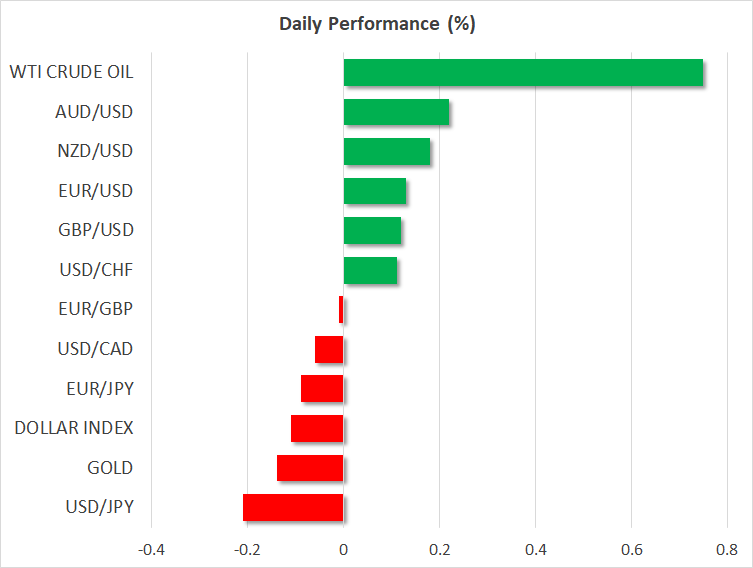

Gold prices cruised to new record highs on Tuesday, extending a blistering rally that has seen the precious metal gain over 4% already this month. A round of disappointing US data releases lately has reignited hopes of interest rate cuts, pushing down on real yields and the dollar, which has served as jet fuel for gold.

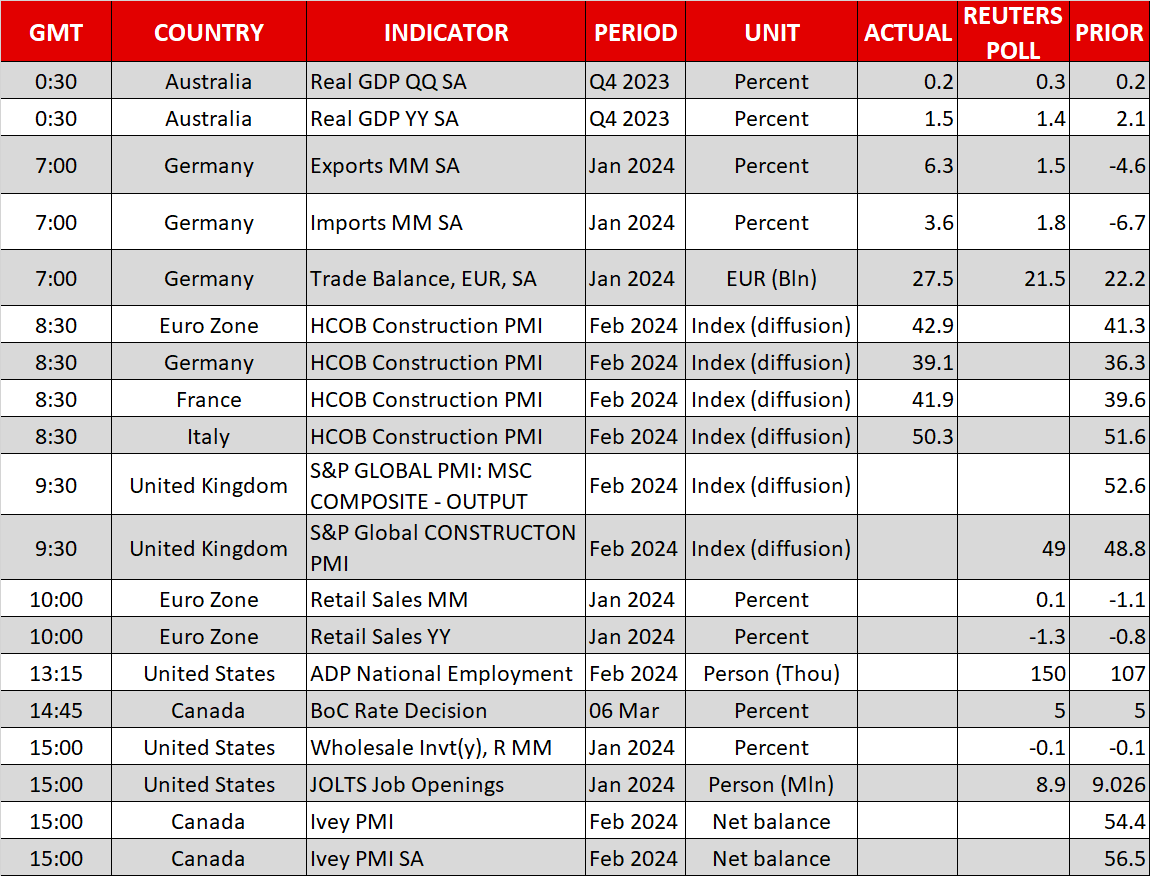

The US non-manufacturing sector lost steam in February, with the popular ISM survey signaling softer employment conditions and cooling inflationary pressures. Factory orders fell short of expectations as well, painting a picture of a US economy that is losing growth momentum, albeit from a strong starting point.

Aside from the pullback in the dollar and yields, another positive force behind bullion has been the record buying spree by central banks seeking to diversify their reserves, as well as purchases by Chinese consumers looking for protection from local property and stock market declines.

Whether gold stretches its rally even further will depend on what Fed Chairman Powell has to say before the House of Representatives today. Investors usually focus on the Q&A session with lawmakers, where the Fed chief will be grilled on the economic outlook.

The risk for gold is that Powell brushes aside the latest slowdown in economic surveys and reiterates that the Fed is not in any rush to cut rates as most of the ‘hard’ data remains solid. That might cool the rally in gold prices, although it is unlikely to change the broader positive trend.

Bitcoin and stocks retreat from all-time peaks

Crossing into the crypto arena, Bitcoin hit a record high of its own yesterday. The king of crypto has been boosted by speculation of lower interest rates, increasing interest from institutional investors, and the prospect of reduced supply growth ahead of next month’s halving event.

One indication that the Bitcoin rally is being driven by ‘smart money’ is that smaller coins are nowhere close to their own record highs, which indicates a preference for quality and less volatility among investors, rather than simply chasing gains. That said, Bitcoin retreated after it hit new records, dragged down by a decline in the stock market.

Shares on Wall Street encountered a rare selloff, with the S&P 500 losing 1% of its value as traders locked profits on high-flying tech stocks. Apple (NASDAQ:AAPL) has been the driving force behind the recent losses. Its shares have lost more than 11% this year, haunted by stagnant revenue growth and a lack of impressive initiatives in the artificial intelligence arms race, alongside a hefty antitrust fine by the EU.

Of course, the stock market remains very close to all-time highs, so investors are not panicking either.

UK budget and BoC meeting also in focus

Over in the United Kingdom, the Chancellor will unveil the government’s new budget today. With a general election on the horizon that will almost certainly be a disaster for the Conservative party, the Chancellor is expected to unveil tax cuts for workers, in a last-ditch attempt to win back voters.

That could spell good news for the pound as any cut to income taxes or national insurance would put more money in the hands of consumers, helping to fuel spending and inflation, which in turn would add pressure on the Bank of England to keep rates higher for longer.

Even in this case though, any boost might be relatively limited as there isn’t much scope for drastic tax changes.

Over in Canada, the central bank is set to keep rates unchanged today, although it might adopt a slightly more cautious tone following recent declines in inflation. On the data front, the latest ADP and JOLTS employment data from the US will also attract attention.