The gold bull era what exactly is it?

Some insight into this exciting matter. While silly Westerners worship government fiat and debt-funded bully wars, billions of citizens in China and India focus on “going big” with saving…

And going big with gold!

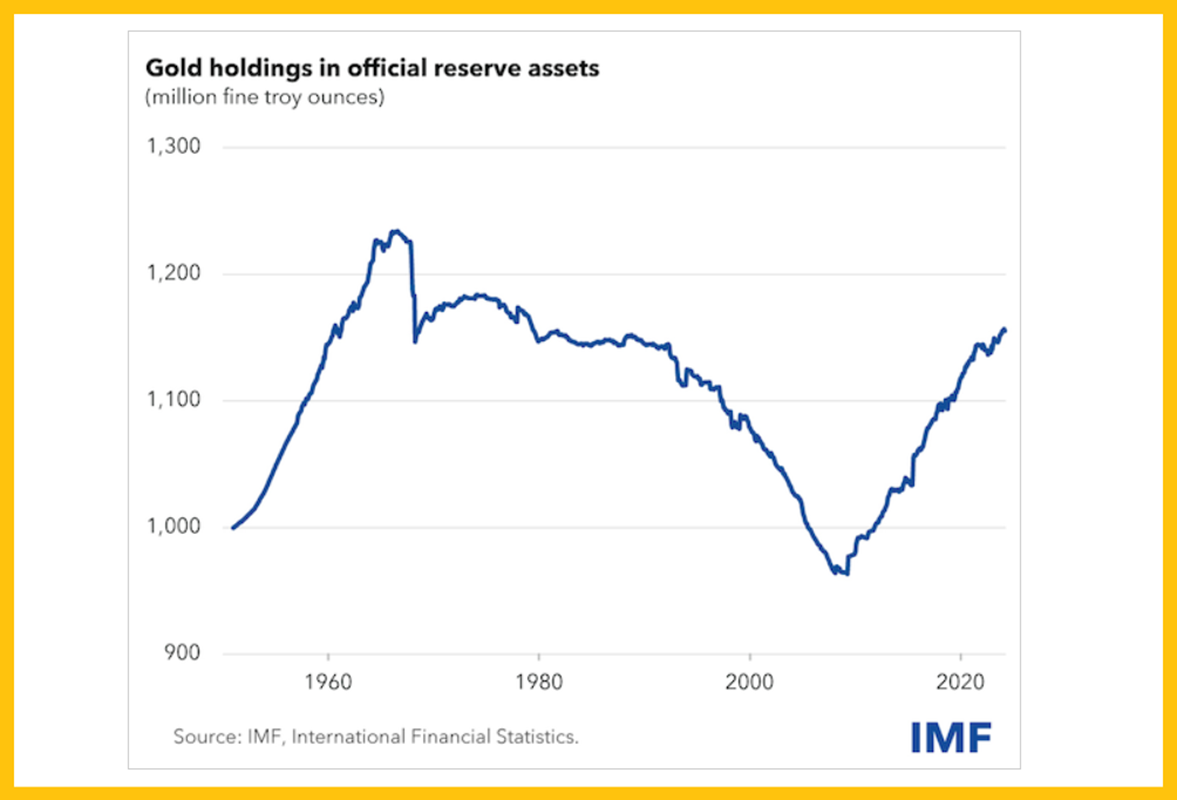

Whether it’s the citizens making enormous purchases of jewellery or central banks adding aggressively to their reserves, the gold-oriented action in the East is set to continue, and intensify, for the next 200 years.

As the East saves more and puts the proceeds into gold, citizens of the West will eventually catch that vibe.

It’s already happening! As their fiat collapses, many Western citizens are making weekly and monthly purchases of gold at retail giant Costco (NASDAQ:COST) (now estimated at $200million/month by Wells Fargo), and that’s fuelling interest in purchasing gold from the highest quality gold and silver dealers like Kitco.

In the short term, events like this Friday’s US jobs report will cause minor changes in the gold price (likely a dip), but that won’t stop the growing trend of citizens around the world becoming obsessed with getting more gold.

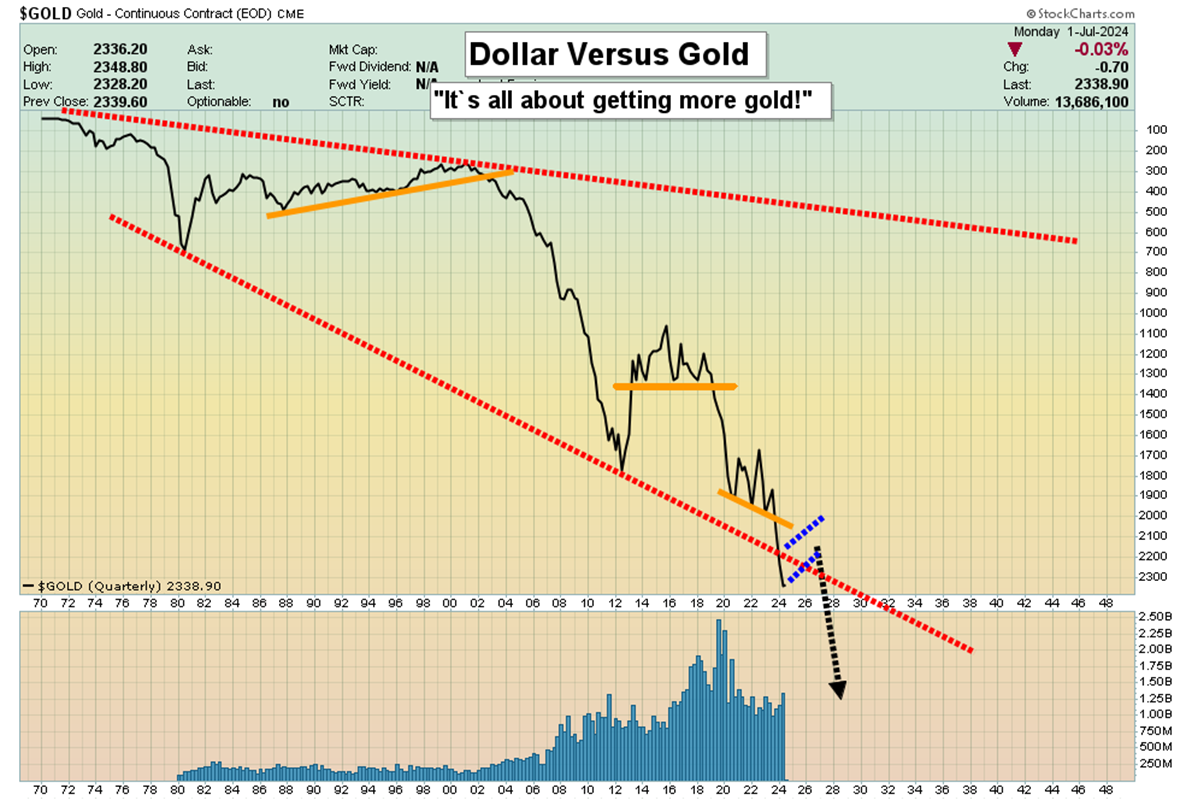

On this weekly gold chart, a bull flag scenario exists. Interestingly, gold could dip to $2200 or even lower and the flag would still be intact.

On the daily chart, gold is trading sideways in its traditional “summer doldrums” pattern.

The price is underpinned with several massive floors of support. I’ve outlined $2265 as a solid zone to buy silver/mining stocks and $2220-$2000 to buy more gold.

Without a ramp-up in Lebanon-Israel-Iran tensions, gold is likely to continue its ooze sideways with a slight downside bias until October.

That’s when the US election will take the short-term spotlight and a big move higher for gold should occur.

The Iranian presidential election is also underway, and the battle is between a professional soldier (hardliner) and a surgeon (reformist). The reformist has the edge so far, but barely.

If the hardliner wins and takes Iran into the Israel-Lebanon fray, the bull flag on the weekly chart could activate, sending gold to $2600-$2800 before this month ends. If the reformist wins, the sideways ooze into October is the most likely scenario for the price.

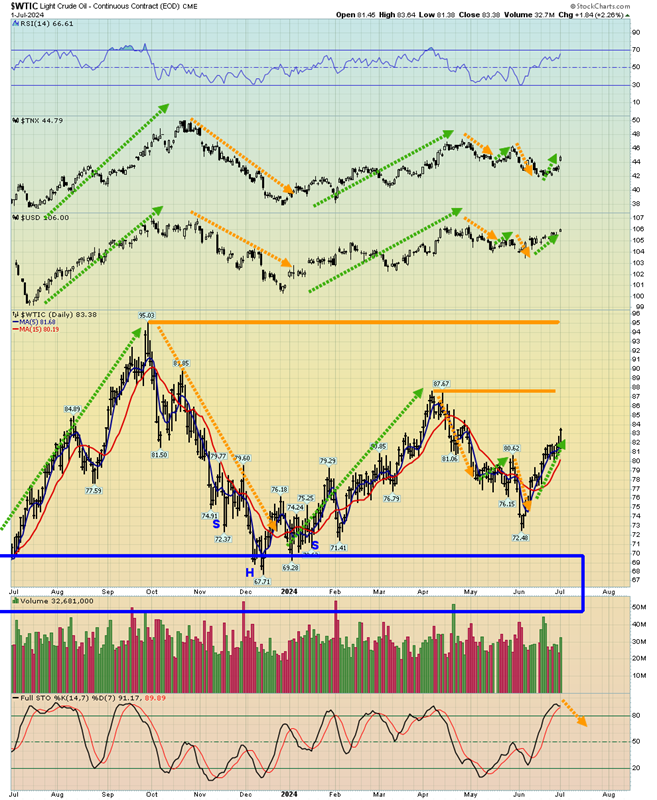

What about rates? Several months ago, I suggested an upward move was likely, to complete the right shoulder zone on this US rates chart.

That’s played out as suggested. With US rates significantly higher than Eurozone rates, money managers are buying the dollar but at the same time, Asian governments are curtailing their US government bond buy programs.

The money managers appear to be buying dollars but with a focus on bank deposits and the US stock market rather than government bonds.

The current dollar and rates situation is essentially neutral for gold, and in Asia, few investors care whether gold pays interest or not. All they care about is getting more of it on dips in the price.

The H&S top pattern on rates hints that there could be a big stock market swoon in the Aug-Oct time frame. Rates would fall and bond prices rise as panicked investors sell stocks and buy supposed safe-haven bonds.

Oil? Oil has been moving in sync with the dollar and rates, rather than with gold. A lot of traditional relationships have fallen apart as the “Get more gold and get it regardless of what else is happening!” theme intensifies globally.

Investors should own a modest amount of oil, but if there’s a stock market tumble, oil could fall too. Oil will become a sideshow as the gold bull era intensifies and copper could become as big a holding in the major commodity indexes as oil is now.

The miners? The GDX chart. Why buy miners at a gold price of $2265? Well, that’s almost a $200/oz drop in the price from the $2448 high. Significant sales in the price need to be bought. That drop would likely put technical oscillators into some interesting buy zones too.

Most importantly, many futures market gamblers will have their long position stop losses placed just below the $2280 low. They will likely go short there and be quickly overwhelmed by thunderous commercial trader short covering and some very golden long position buys!