On a monthly chart, the last resistance point for gold is the $1923 peak in 2011.

Why Gold?

Tensions of all sorts are on the rise in the US, EU, and globally: COVID, employment, fiscal stimulus China (military and economic), and massive increases in money supply by the central banks, especially the Fed.

Cup and Handle

The Cup and Handle is a technical formation. A handle is formed on a pullback before the pattern blasts higher.

Of course, there may be no handle. Gold may just blast higher (or collapse) but fundamentals suggest higher, perhaps after some consolidation.

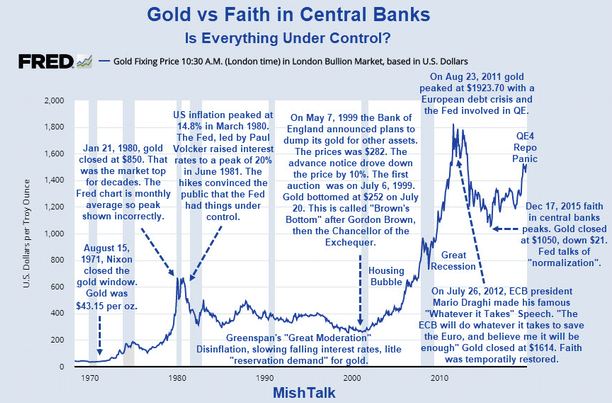

Gold vs Faith in Central Banks

Gold does worst when faith in central banks is the highest. Greenspan's great moderation is the best example. Greenspan was considered the great "Maestro" who could do no wrong.

That theory crashed to earth in the DotCom bust. We have now had 3 major economic bubbles in 20 years.

It should be obvious that the Fed is boosting financial assets but that is not going to create jobs or cure COVID.

I do not see a reversal in Fed policy. Do you?