Gold price sales offer opportunity but patience is required. I like to see a market swoon of at least $50/ounce before buying any fresh medium-term gold or related positions.

Most amateur gold investors should wait for $100/ounce declines before buying or use very tight stop-losses to protect their capital.

When buying, it’s important that investors have strong hands accompanying them, and the smaller dips don’t attract Chindian dealer or COMEX commercial trader buying in much size.

Gold has rallied about $130 since the August lows of about $1175.

A consolidation or correction becomes more likely as a rally extends in both price and time. That doesn’t mean a correction has to happen now, but it does mean investors need to get emotionally prepared for it to happen.

A 50% correction would see gold trade near the $1250 area and that would represent about an $80 price sale from the $1330 area highs. That’s not likely enough of a pullback to guarantee significant Chindian dealer and COMEX commercial buying of size.

If gold’s rally continued to $1350 before the correction began, a pullback to $1250 would become an important buying area for long-term investors.

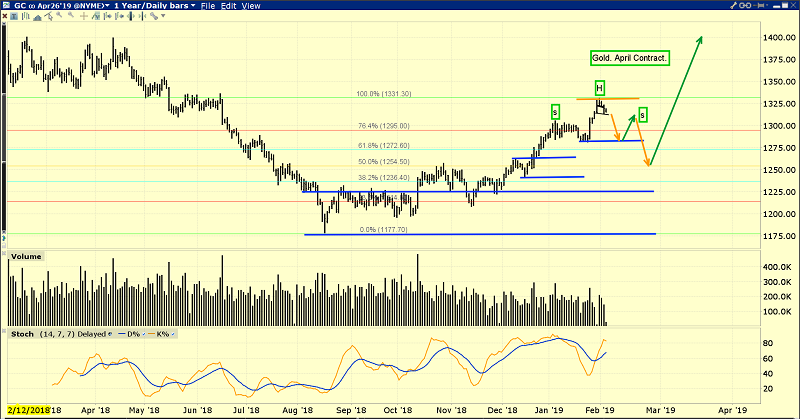

This is the short-term gold chart. Some “head-and-shoulder topping” action is beginning to present itself. Charts are created by fundamentals, and while the big picture for gold is truly spectacular, the short-term picture is somewhat negative.

That’s because the Chinese New Year holiday is in play. China’s gold market is closed this week, and it’s an important cog in the gold demand wheel.

While it’s true that Chinese demand tends to swoon at this time of year, this year I believe it’s unlikely to produce anything more than a modest and healthy correction. I’m already quite impressed with the orderly nature of the sell-off.

In America, top bank economists predict GDP growth will slip to 2% or lower by the third quarter, which is also stock market “crash season”. Republicans lost the House because they refused to eliminate income taxes for the poor, and now powerful politicians in the House want to reduce stock buybacks that have been supporting the stock market.

Jay Powell has warned investors that the US stock market is at risk of a crash. Wall Street money managers predict he won’t raise rates at all this year, but I’ve called that wishful thinking.

I don’t think the money managers need to be worried about rate hikes because of strong growth, but I do think they need to be very concerned about the possible emergence of US stagflation in the second half of the year. That could send money managers into gold stocks in quite a major way. The bottom line:

In the short term, gold faces modest seasonal headwinds. In the medium and long term, gold has mighty tailwinds!

This is the Direxion Daily Gold Miners Bull 3X Shares (NYSE:NUGT) chart. For short-term action, I suggest traders use my guswinger.com trade service to trade NUGT, Direxion Daily Gold Miners Bear 3X Shares (NYSE:DUST), ProShares UltraPro Dow30 (NYSE:UDOW), and ProShares UltraPro Short Dow 30 (NYSE:SDOW). I’ve highlighted my latest mechanical system trades on this chart.

Short-term trading in the gold market should be just one part of an overall investment program. The ability to take quick action can help reduce investor tension. In contrast, my sole focus for the US stock market is short term trading. The market is too dangerous now to engage in long term positioning with large amounts of risk capital.

US stocks should stagger somewhat higher because the business cycle still has some life left in it, but risk now dramatically overwhelms potential reward. Powell’s change in tone could be related to the money managers and the US government begging him to give them a break.

Unfortunately, it’s more likely that he has the same outlook the bank economists and I have for the US economy; a meltdown in US GDP growth and corporate earnings is imminent.

With the US government operating on massive debt growth autopilot, a slowdown in GDP is almost certain to be accompanied by a loss of confidence in the ability of the government to finance itself.

From a gold investor’s standpoint, what’s particularly interesting is that it appears that foreign central banks are slowly but surely replacing their US Treasury bond holdings with gold bullion! This is likely putting pressure on the Fed to dial back its QT program and that could create an even bigger loss of confidence event.

Long-term positions in the US stock market need to be accumulated at the business cycle trough, and that trough is likely to bring vastly lower stock market prices than investors see in front of them now.

This is the VanEck Vectors Gold Miners (NYSE:GDX) chart. Over the past twenty years, gold stocks have generally had severe price corrections when gold has staged modest swoons. That’s because a deflationary theme was in play.

Now, an inflationary theme is beginning. Some individual gold stocks are holding their gains when gold declines, and the GDX and SIL indexes are not staging any crash-like sell-offs when gold declines.

While profit booking is always a good thing (especially with oscillators overbought after a sharp run higher in the price), GDX is technically very healthy, and a possible bull flag pattern is in play. Will that pattern continue to form as the Chinese gold market stays closed this week? I think so. Will the price then burst out of the flag pattern and surge past $23 and reach my new $25 target? I think so, too!

Thanks!!

Cheers

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?