Financial markets are starting the week with somewhat uncertain dynamics. Friday's strong rally failed to develop into further buying in Asian trading on Monday while shying away from a sell-off. Judging by the indirect signs, investors paused buying but remain optimistic.

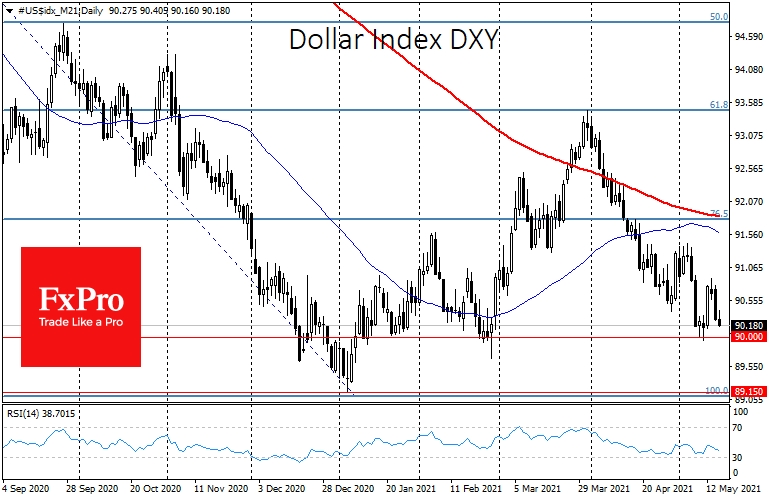

The dollar index returned to the psychologically important 90 level, waiting for new signals that will send the dollar higher or lower, as it has been doing for the last four months. A sharp pullback below 90 would signal to the broader market that the American currency is in a wide retreat and would begin a new anti-rally.

In terms of strength, it could be comparable to what we saw in 2020 when the index lost more than 11% between May and early January this year. The technical analysis suggests possible long-term targets for a new downward movement of the Dollar Index in the area between 80 and 82, the lows of 2014 and 161.8% of the amplitude of the move since last May, respectively.

The continuing pressure on the dollar is signalled by GBP/USD testing the 1.41 mark and a moderate downward movement in USD/CAD and USD/CNH. We often look at these pairs as an indicator of risk demand in Europe, America and Asia. They have recovered quickly from the local dollar pullback and returned to the recent extremes.

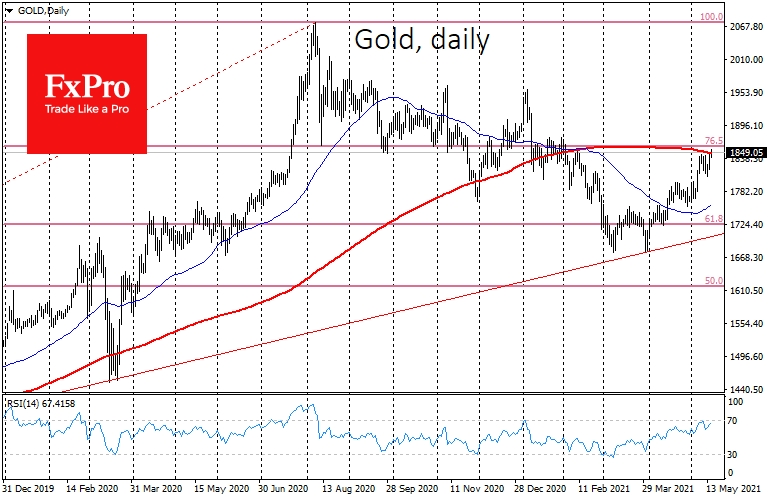

Gold gave an even more bullish signal, coming back above the 200 SMA on Monday morning and making new 4-month highs. Gold prices reached a local bottom in late March, which coincided with local peaks in the dollar index. However, gold investors are more concerned about preserving the value of fiat currencies with the major central banks' printing presses constantly running.

Not surprisingly, therefore, gold's recovery has been more robust. However, the rally above $1855 this morning has yet to be cemented by closing the day above the 200-day moving average (now at $1847).

A move higher would confirm the rebound from the two-year trendline support and allow the area above $2600 to be seen as the long-term target for a new upside momentum, well above last August's all-time highs of $2075.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Growth Confirms Restart Of Dollar Downtrend

Published 05/17/2021, 11:00 AM

Updated 03/21/2024, 07:45 AM

Gold Growth Confirms Restart Of Dollar Downtrend

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.