Gold has spent the best part of the year under heavy selling pressure, but several clues point towards its potential to break this trend.

We can see on the weekly chart that bears have had a field day since the 2018 high. Most notably its fall from 1365.01 to 1160.25 showed little in the way of pullbacks, and even the subsequent rebound has been modest as far as corrections are concerned.

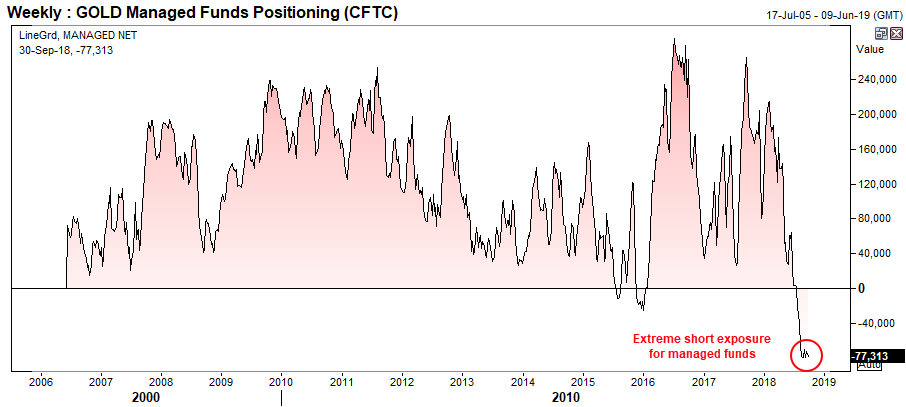

However, as managed funds are near their most bearish net exposure on record, the commodity is vulnerable to rapid short-covering if market sentiment changes abruptly. And with price action making its way off the lows already, this could be the market to watch if it breaks higher. Moreover, if we are to see a 38.2% correction from 1160.25 it leaves a potential $30 upside target near the December 2017 low.

Now trading back within range, we’re closely watching developments on the daily chart for a break higher. We note that the four most volatile sessions since the 1160.25 low have been bullish, and it crossed above its bearish trendline by yesterday’s close. That said, we’d prefer to see some follow-through as it remains very close the trendline, and we’d like to see it break above 1214.35 before assuming a change of trend. Either way, the 1183.20 – 1214.35 zone remains a key focus as a decisive break beyond it could mark its next major move.