Last week saw Gold fall sharply as market sentiment swung towards the US dollar. However, the precious metal might finally have discovered some support as the commodity managed to gap open on Monday.

Gold remained under significant pressure over the past week as the market continues to take a risk-off approach to the metal ahead of December’s FOMC meeting. Subsequently, Gold prices continued to fall throughout last week, despite the US PPI and Retail Sales providing a lack lustre result at -0.4% and 0.1% m/m respectively. The precious metal fell to as low at $1073.98 before it received a bid back up to $1083.70.

However, this week’s opening session actually saw the metal gap significantly higher as Gold’s price seems to be inexplicably linked to the moveable feast that is the US economy. As some of the negative economic data was distilled, it appears that a revaluation for the embattled commodity might be in order. This is an especially salient point given the metal’s current location at a strong level of support. However, the spectre of the Fed decision continues to loom and is likely to make its risk felt as we move closer to December.

Looking at the week ahead and despite the opening gap, Gold is likely to remain firmly under the grips of the bearish trend as speculation of a US rate hike in December continues. Subsequently, keep a close watch on the upcoming US Unemployment Claims figures as the market will be looking for a strong result to confirm a bias towards the Fed hiking rates. The US CPI is also due, however, the indicator is likely to match expectations of 0.2% and subsequently provide little direction.

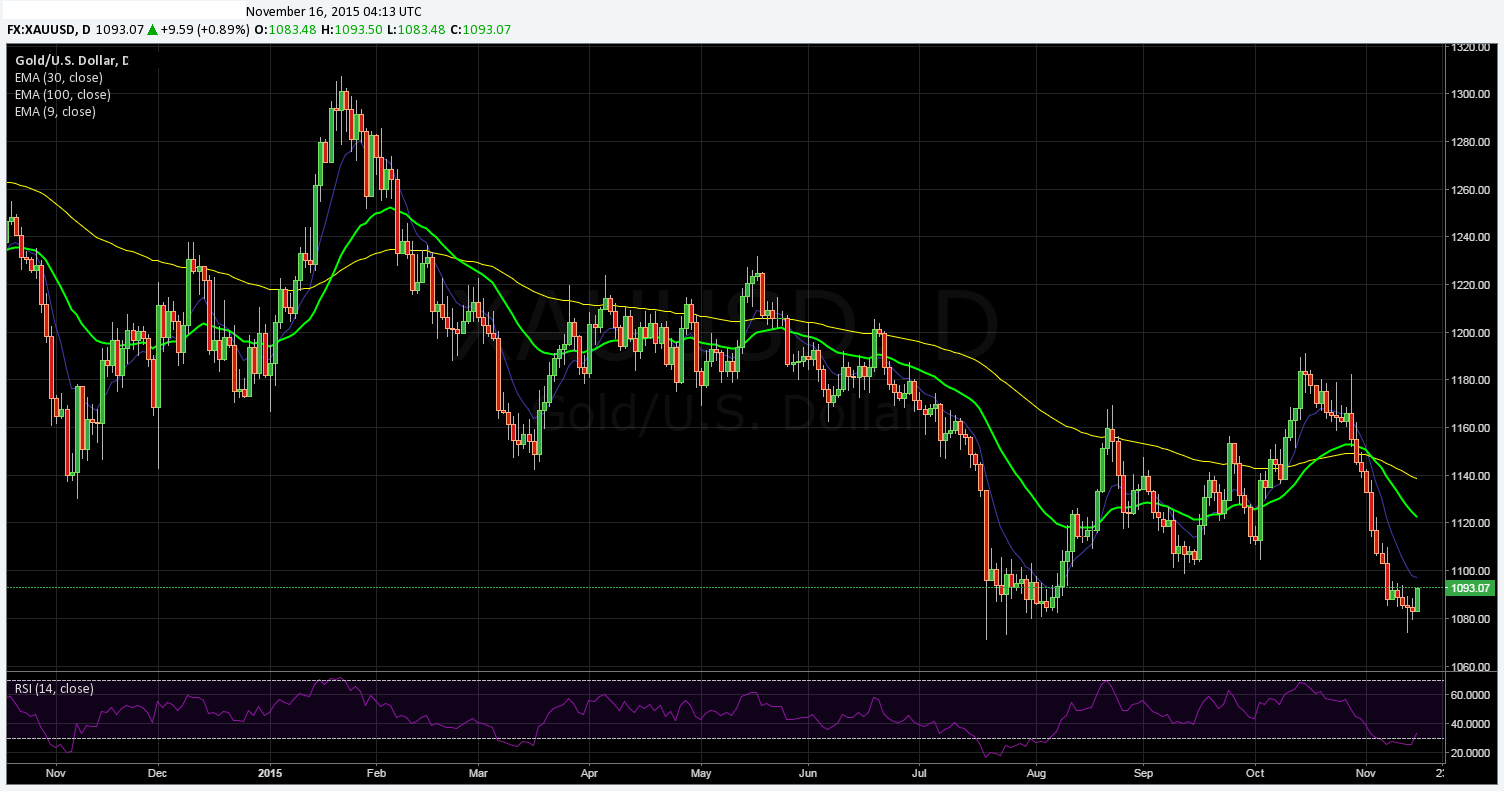

From a technical perspective, Gold has fallen strongly back below the short term bullish trend line. The 12 and 30 EMA’s have also subsequently turned negative as they decline below the 100-Day moving average whilst the RSI oscillator continues to flatten within over-sold territory.

Support is currently in place for the pair at $1182.17, and $1172.01. Resistance exists on the upside at $1114.00, $1156.83, and $1191.38.