The allure of Gold is timeless, and the goal of every investor should of course be… to eagerly get more of it.

According to State Street (NYSE:STT) and Investopedia, investors in the West are doing so aggressively, and 54% of these investors prefer investing in physical gold bullion rather than ETFs, futures, etc.

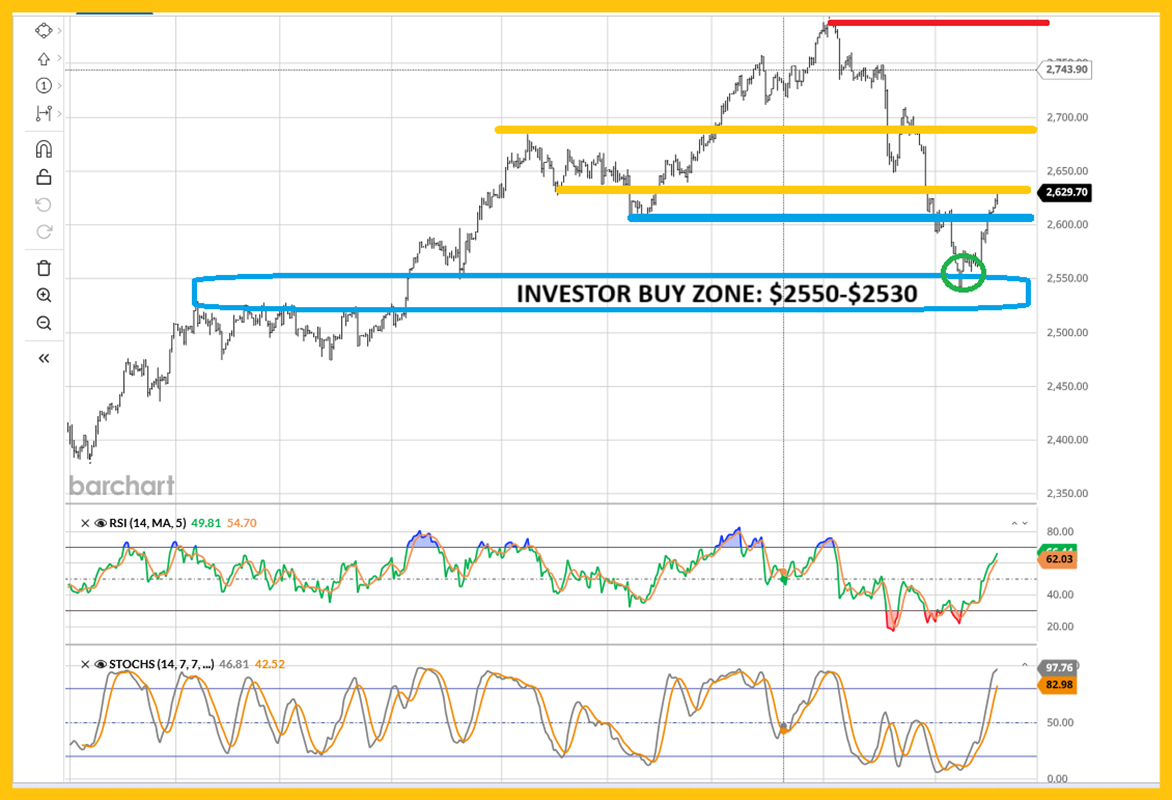

The short-term cash gold price chart. As gold traded near $2800, I urged both gamblers and investors to prepare to buy gold at $2550-$2530, and gold promptly dipped into that zone.

The price has bounced nicely. It’s already up almost $100/oz from our buy! On this short-term chart some congestion is apparent at $2630-$2690.

A look at the daily chart. Gamblers can book light profits now. Investors should be prepared for a double bottom “torture” scenario.

Investing in gold (and anything, really) is more about preparation than price prediction. Most of what happens in markets is a surprise to investors, so prep for surprise is the obvious first order of business… and of survival.

The weekly close price chart clearly illustrates the zones where gold bugs need to prepare to buy with the largest amount of fiat capital.

The $2550-$2530 area was (and still is) a buy zone, but the congestion zone at $2450-$2300 is much bigger, and “bigness” needs to be respected.

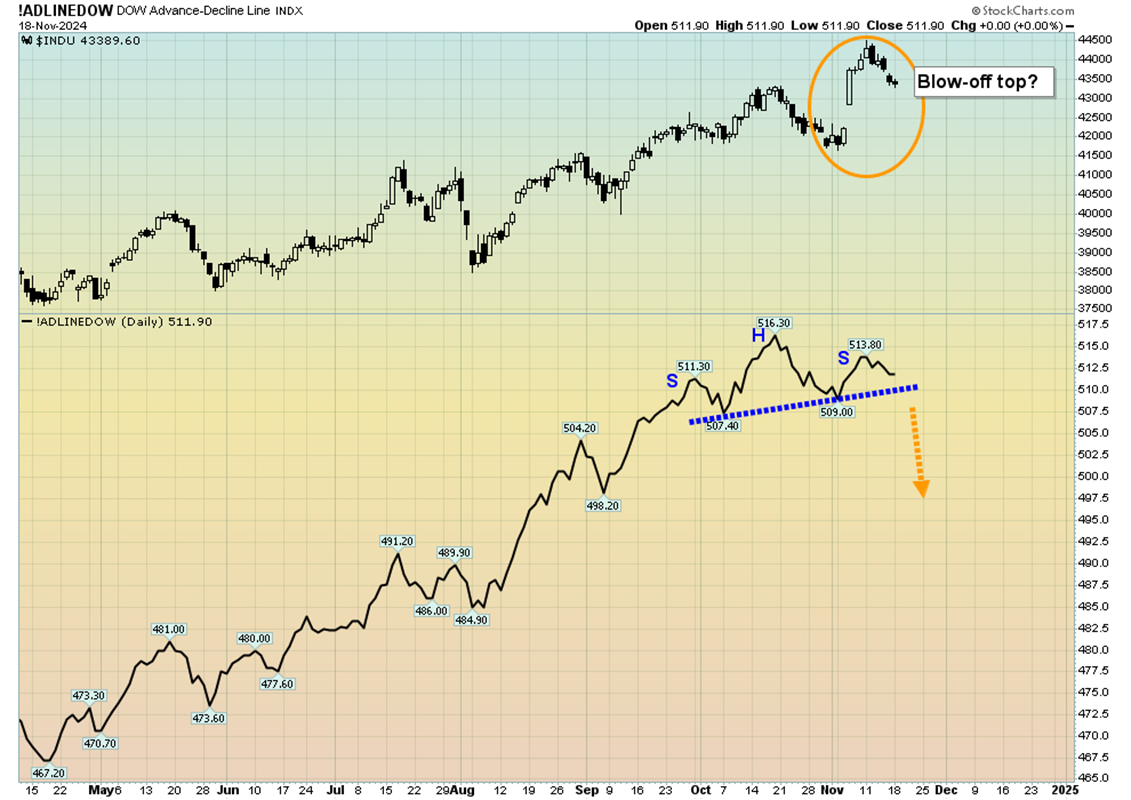

The concerning US stock market chart. An ominous head and shoulders top pattern has appeared on the advance/decline line for the Dow.

This is the first “crack in the armour” of the seemingly endless rally for the Dow and its risky SP500 and Nasdaq compatriots.

It’s possible that Team Trump makes America great… but it’s also possible (and arguably probable) that they make inflation “great” too.

The key US rates chart. While investors need to be prepared to buy more gold in the important $2450-$2300 zone, a near-imminent collapse in US interest rates could be related to a collapse in the stock market and a rush into gold.

Money has poured into America in anticipation of a Trump victory, and that’s created upwards pressure on the US Dollar, and on rates.

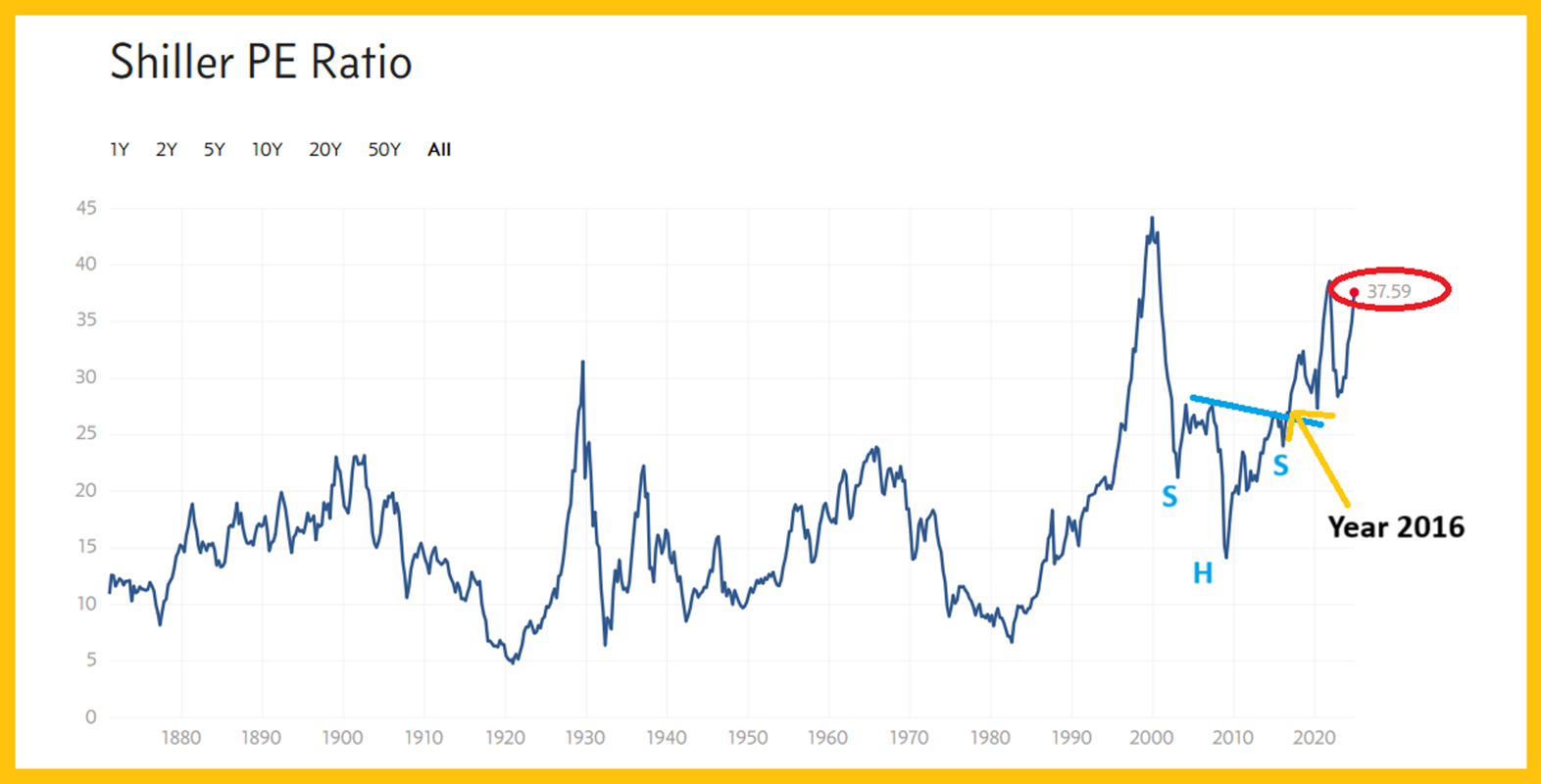

Basis the Shiller/Cape ratio, the stock market was only moderately overvalued when Trump got elected in 2016, and it was breaking out of a very bullish inverse H&S pattern.

Now? Now it looks like wax-winged Icarus, flying far too close to the sun! Ironically, Trump called the stock market overvalued in 2016… but says little to nothing about the situation now. This is a time for the government to prepare investors for a major crash, but instead all the US “Gmen” have their party hats on. It’s unlikely to end well.

All the good Trump-oriented news is in now, and the only dollar-positive news in the pipeline would be safe-haven buying in the event of a vicious Russian government attack, in response to Biden’s “launch long-range missiles into Russia” scheme…

But even that safe haven buying of US fiat would be dramatically overwhelmed by panic buying of gold!

A daily focus on the big picture is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis.

What about Silver? Silver bugs have a developing H&S top situation to contend with, but silver follows gold.

If rates and the dollar roll over in response to a tumbling stock market, it’s likely that gold surges to a fresh all-time high. Silver would follow the metals market leader and likely trade near or even above its own high in the $50 area.

This long-term chart reveals a much more bullish posture for silver than the daily does.

The $35 area was a congestion zone in the bull runs of both 2011 and in 1980. A pause was expected and it’s in play now.

The weekly chart for GDX (NYSE:GDX) targets a move to $60, and the current pullback is also expected and normal.

Investors need to brace for the potential double bottom emotional torture scenario, but the great news is that if it plays out, the weekly chart oscillators would likely become nicely oversold, almost guaranteeing the next move would be a beautiful upside breakout and fast surge to $60!