Key Points:

- Further gains could be realised moving ahead.

- Push above the 100 day EMA shows the metal’s underlying strength.

- Trump-based uncertainty also fuelling the rally.

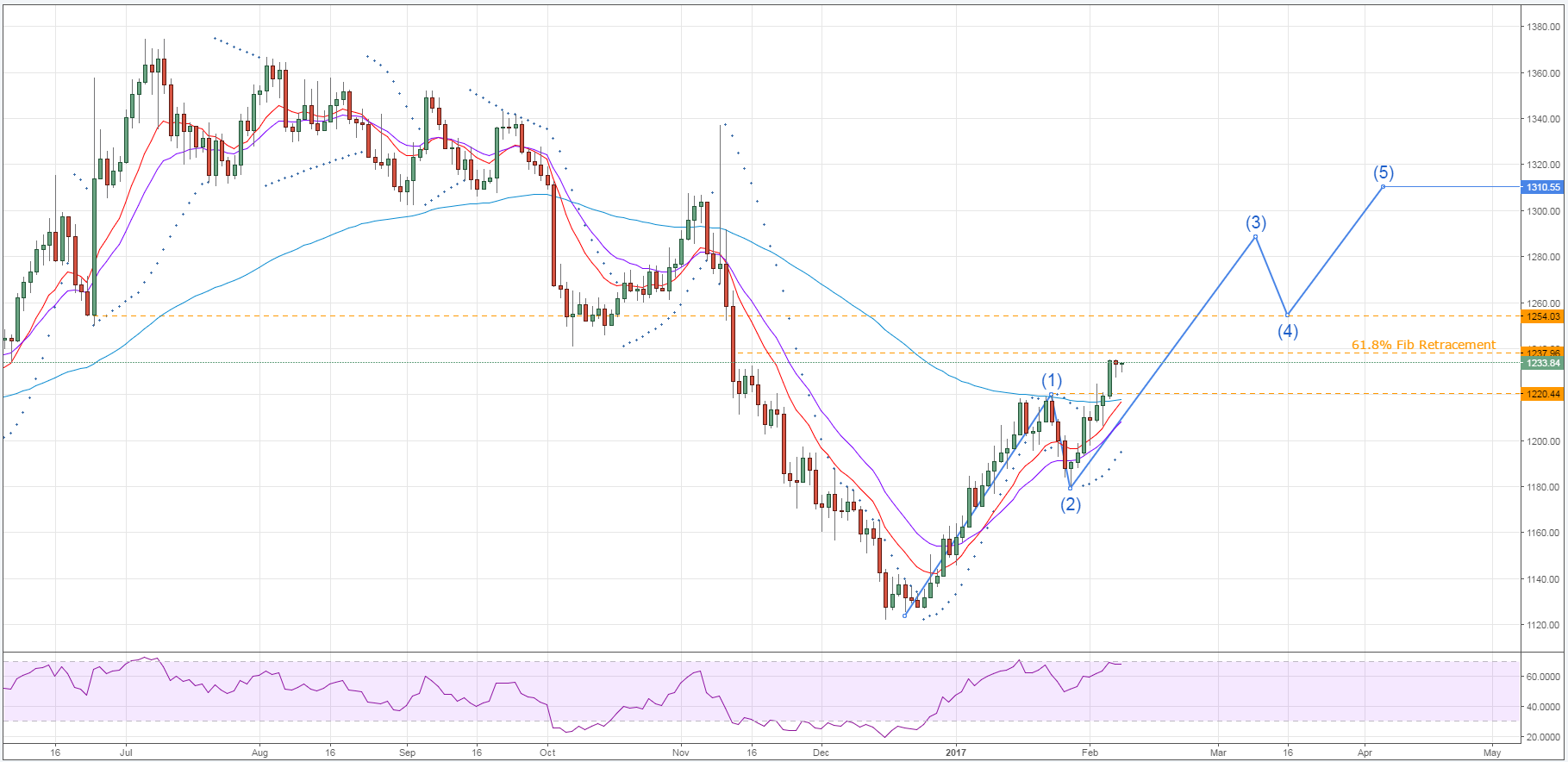

Gold has been one of the big winners of the past few weeks and, much to the enjoyment of the gold bulls out there, its resurgence could be only partially complete. Notably, a number of technical signals are now in agreement that the metal could be midway to completing a rather sizable rally which could see it touch the post-US-election highs.

Primarily, the EMA bias present on the daily chart provides the clearest indication that upside potential could still be rather substantial. I am speaking of course of gold’s recent push above the relentlessly bearish 100 day average which made the metal’s underlying strength plain. Furthermore, this push higher significantly caps downside risks as the 100 day EMA should now be a source of dynamic support for gold prices.

Aside from the EMA activity, there are at least two other technical readings suggestive of continued gains moving ahead. Firstly, there is the Parabolic SAR reading which is in little danger of switching its trend in the near to medium-term. Secondly, there is evidence that an Elliot wave is forming up which could carry gold significantly higher over the coming weeks.

However, this forecasted push higher is likely to run into a small snag which should mean we see a brief period of moderation this week. Specifically, the 61.8% Fibonacci level appears to be holding firm despite the swell in buying pressure over the past session. Moreover, the RSI reading is verging on overbought which might need to be relieved slightly prior to any further surges for the metal.

Ultimately, it is likely to come down to the fundamentals if we hope to see the 1300.00 handle challenged yet again. Market uncertainty will be the key force among these fundamentals but, as always, finding a measure that captures this sentiment in no small task. However, if you’re not already doing so, keep a close eye on the Trump administration as a little common sense goes a long way in forecasting how the market will react to any given announcement.