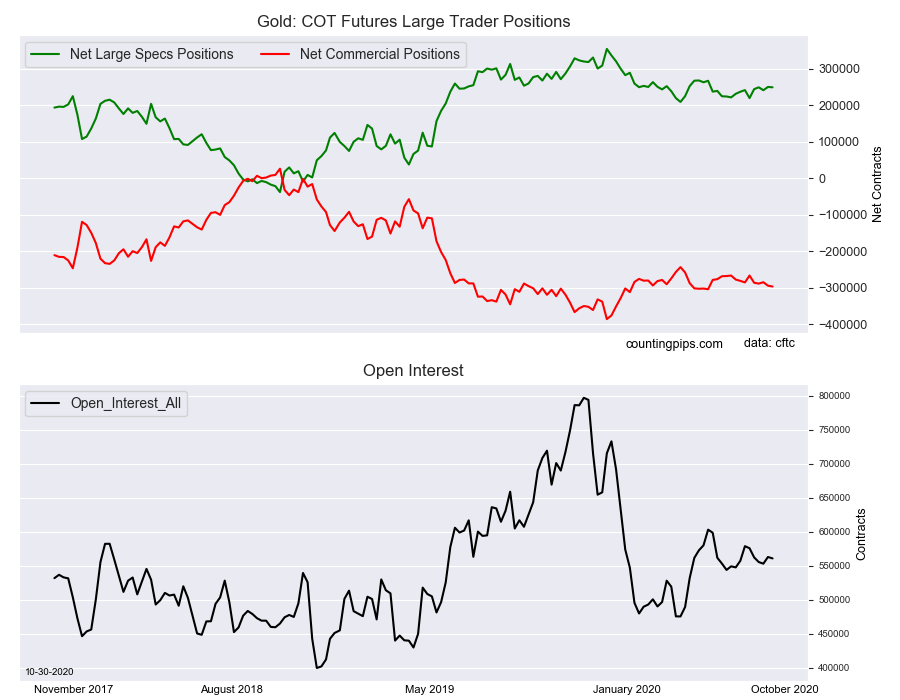

Gold Non-Commercial Speculator Positions:

Large precious metals speculators reduced their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 248,634 contracts in the data reported through Tuesday October 27th. This was a weekly decline of -970 net contracts from the previous week which had a total of 249,604 net contracts.

The week’s net position was the result of the gross bullish position (longs) decreasing by -14,143 contracts (to a weekly total of 326,063 contracts) while the gross bearish position (shorts) fell by -13,173 contracts for the week (to a total of 77,429 contracts).

The gold speculative positions dipped on Tuesday after a strong run-up that had seen bullish positions gaining in six out of the previous eight weeks. Despite this week’s slight decrease, the net positions have now added a total of +27,596 bullish bets to the overall speculator standing over the past nine weeks. The gold sentiment has continued to maintain a steady bullish standing with the net position remaining above the +200,000 net contract level for seventy-two consecutive weeks.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -296,462 contracts on the week. This was a weekly fall of -2,338 contracts from the total net of -294,124 contracts reported the previous week.

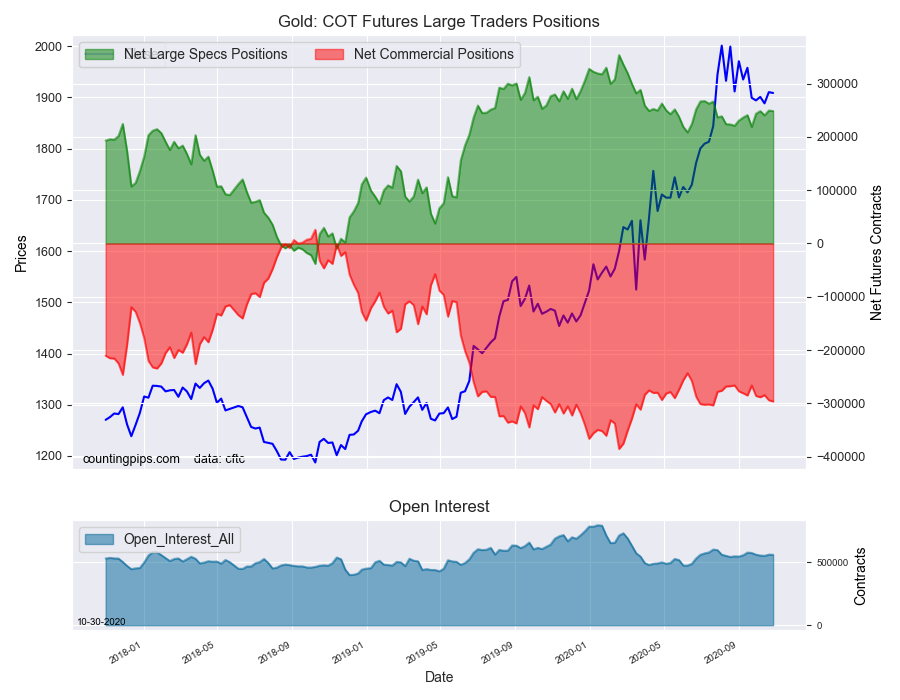

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1908.80 which was a decline of $-1.60 from the previous close of $1910.40, according to unofficial market data.