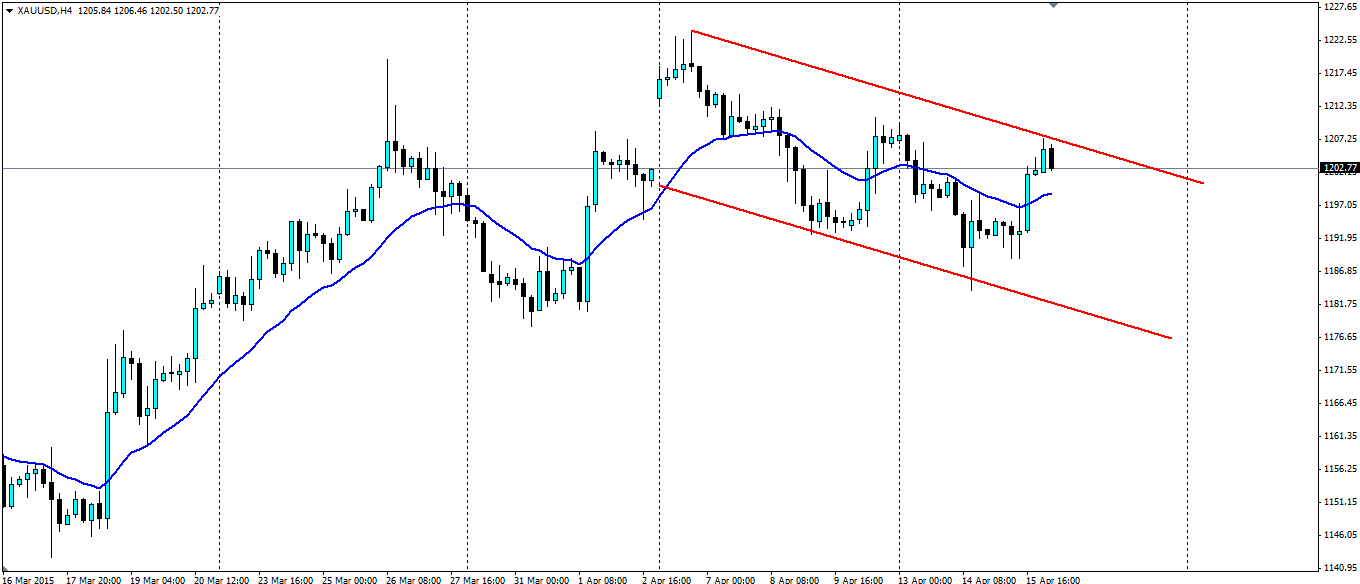

Gold has been trending lower over the last week with lower highs and lower lows forming. It is yet to make a solid extension lower, but that could be on the way with this technical set up.

The Gold markets have been choppy recently with fear driving it. There is plenty of fear that tensions in Yemen will lead to a wider conflict, also fear that the Greek situation will not be resolved and will lead to a full crisis. There is fear that the US will grind to a halt with the data coming out of the US becoming increasingly mixed. Data such as Industrial production at -0.6% m/m and core retail sales at 0.4% vs 0.7% expected.

The fear driving the bearish movements in the US at the moment is that the US Federal Reserve will push ahead with interest rate rises in June despite the data not being robust enough. This makes the CPI figures at the end of the week all the more important. Or not, depending on whether the Fed will act regardless of low inflation.

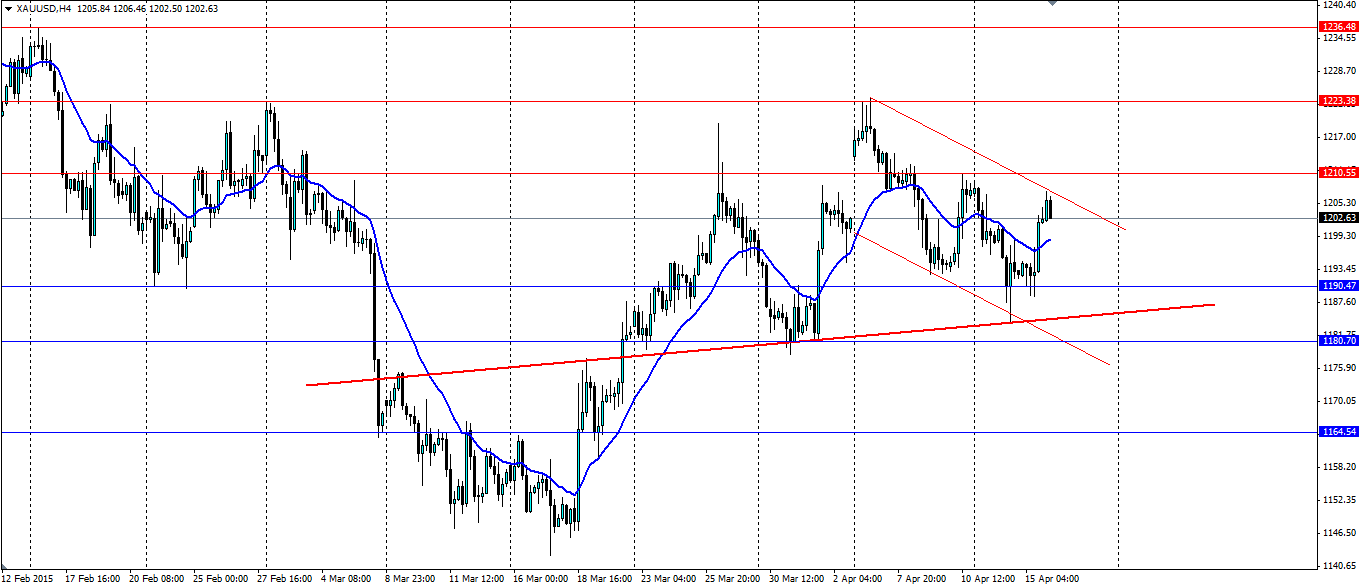

Either way the choppiness has been with a bearish bias as the highs get lower. One interesting feature on the below H4 chart is the dynamic support/resistance line that price seems to have respected on several occasions. If this line breaks down we could very well see a run towards the recent lows at the support of 1146.93 an ounce.

In any case the short term bearish channel is one to watch and could provide useful for anyone trading at the moment. Look for resistance to be found at 1210.55, 1223.38 and 1236.48. Support is found at 1190.47, 1180.70 and 1164.54.