Gold has been bid up off the recent six year lows, which comes as a bit of a surprise given the market’s expectation of a forthcoming rate rise. The support gold found in recent trading has come from the FOMC meeting minutes, despite them suggesting December is still a live meeting.

Gold has been heavily sold off in recent weeks as some in the market are expecting the Fed to signal a forthcoming rate rise. In particular, many were looking towards the FOMC’s October meeting minutes for a solid signal that an interest rate rise in December was imminent.

At that October meeting the FOMC said "In determining whether it will be appropriate to raise the target range at its next meeting". In the minutes Members wanted to convey that December liftoff may be appropriate which is not exactly saying a rate rise in December is definite. That is where the market realised that perhaps it had been a bit harsh on gold, and decided to cover some of the short positions.

The market still puts the chance of an interest rate rise at around 70%, and inflation figures from earlier this week support the case for a rate hike. Core CPI remained steady at 0.2% m/m and is now sitting at 1.9% y/y. The steadiness of Core inflation will please the Fed, as will the annual figure being close to their 2% target.

Earlier this month we saw employment figures hit their strongest level in five years which has certainly given the Fed confidence. The unemployment rate fell to 5.0%, down from 5.1% the previous month. The Nonfarm employment change figures were a big surprise as they lifted to 271k vs the market expectation of 183k. The NFP result scheduled for release on December 4th will be keenly watched by all and could very well prove to be a decisive indicator.

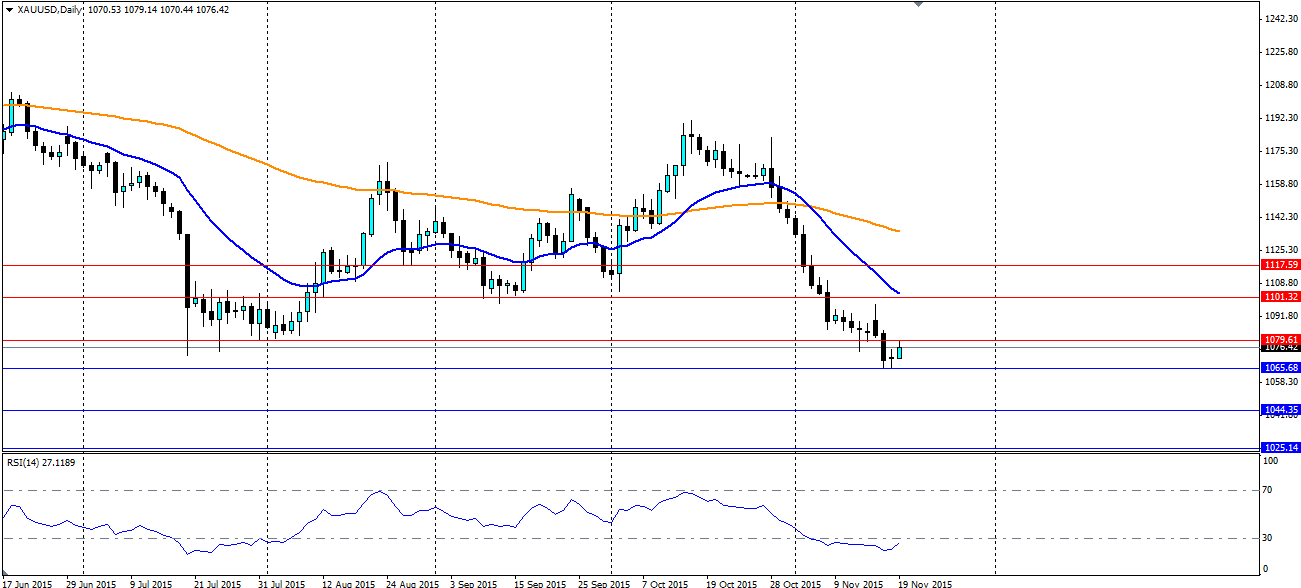

The slightly less hawkish minutes than the market was expecting has helped gold to lift from the six year low, however it has met resistance at $1,079.61. The oversold RSI may also help gold to strengthen over the coming days, and if so, the next levels of resistance will be met at $1101.32 and $1117.59. If the Fed signals a rate rise is coming, gold will continue to fall. Look for support at the recent low at $1,065.68, with further support at $1,044.35 and $1,025.14.