The gold markets have looked to turn rather bullish in recent days as the fallout from the Swiss bombshell saw massive demand for safe haven assets. Gold has now found itself sitting at some resistance that could see a reversal.

Source: Blackwell Trader

The turmoil in the forex markets came as the Swiss National Bank (SNB) dropped a bomb on the markets when it announced after three years that it would abandon the price floor that pegged the EUR/CHF rate at 1.2000. The markets were completely blindsided and for good reason; as late as December the SNB had reiterated its stance that it would “defend the price floor with unlimited reserves”.

The move sent the EUR/CHF down as much as 40% within minutes and the markets are still feeling the effects. Gold was a big winner from all of the volatility as traders looked for a safe place to park their money while the markets went crazy. Now that they have settled down somewhat, gold traders may now look back towards the fundamentals which could see gold look to turn back down.

Those fundamentals are largely based around the US economy and the US Federal Reserve. The US economy is ticking along well, certainly much better than the likes of the EU. The US labour market has been a standout with the unemployment rate dropping to 5.6% and the Nonfarm payroll consistently adding 200k+ jobs per month. The FED has maintained its intention of raising interest rates this year and many believe that will happen around June.

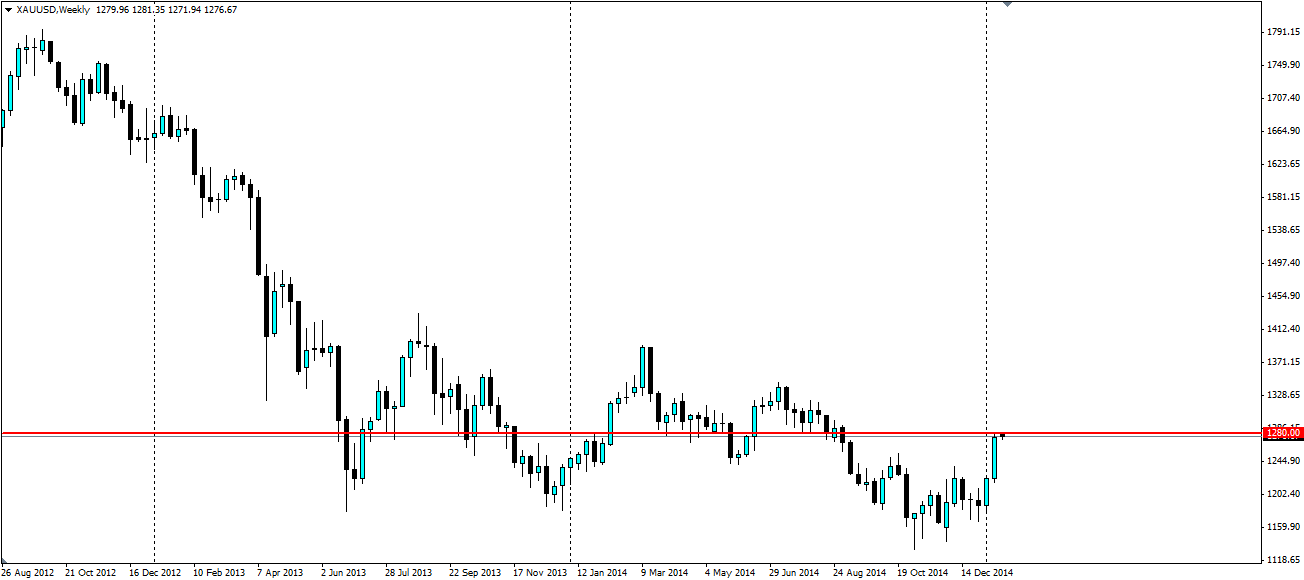

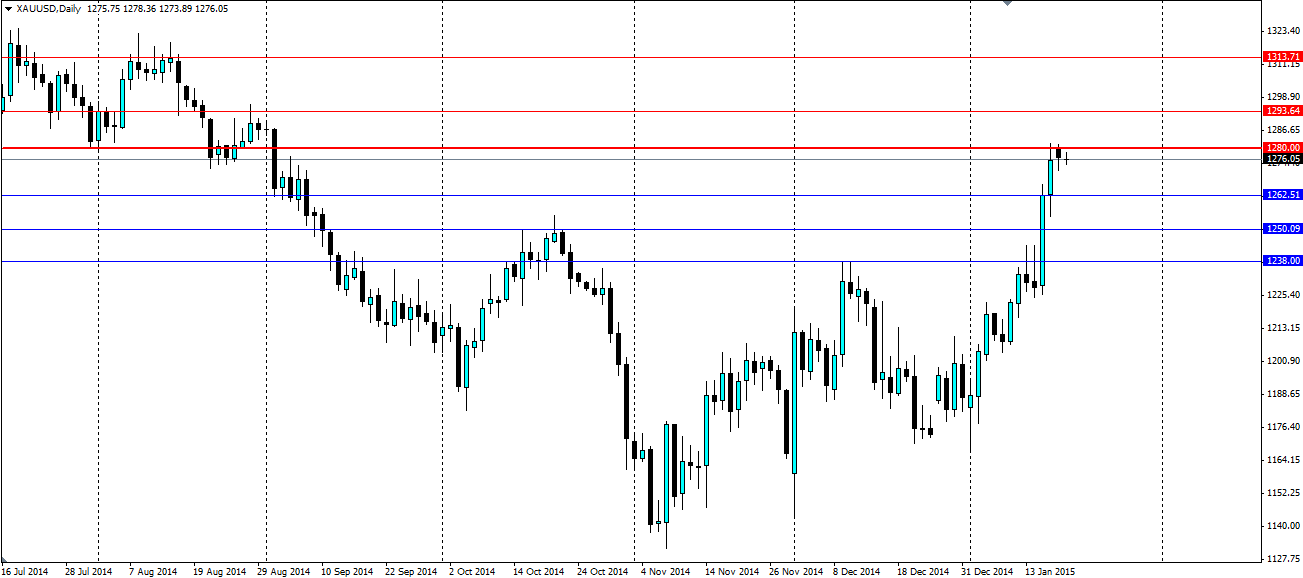

The $1,280.00 an ounce mark proved to be a level at which the price has been interested in on numerous occasions over the last year. The level has acted as both support and resistance as the price has hovered around it. So it’s no surprise to see the price once again hovering around this mark.

From here we could see gold consolidate around this area before it rejects off, or we could see a strong push through as the resistance fails. It would pay to watch the shorter time frames for either a double top which would signify a rejection, or a breakout-pullback which would signify a continuation of the bullish move. The market will look for resistance at 1280.00 as mentioned above, 1293.64 and 1313.71. If we see a rejection, the market will find support at 1262.51, 1250.09 and 1238.00.

Gold has seen a big move from investors demanding safe haven assets and is now sitting on resistance as $1,280.00. Either way the gold is likely to see some slight consolidation at the current levels before making a move.