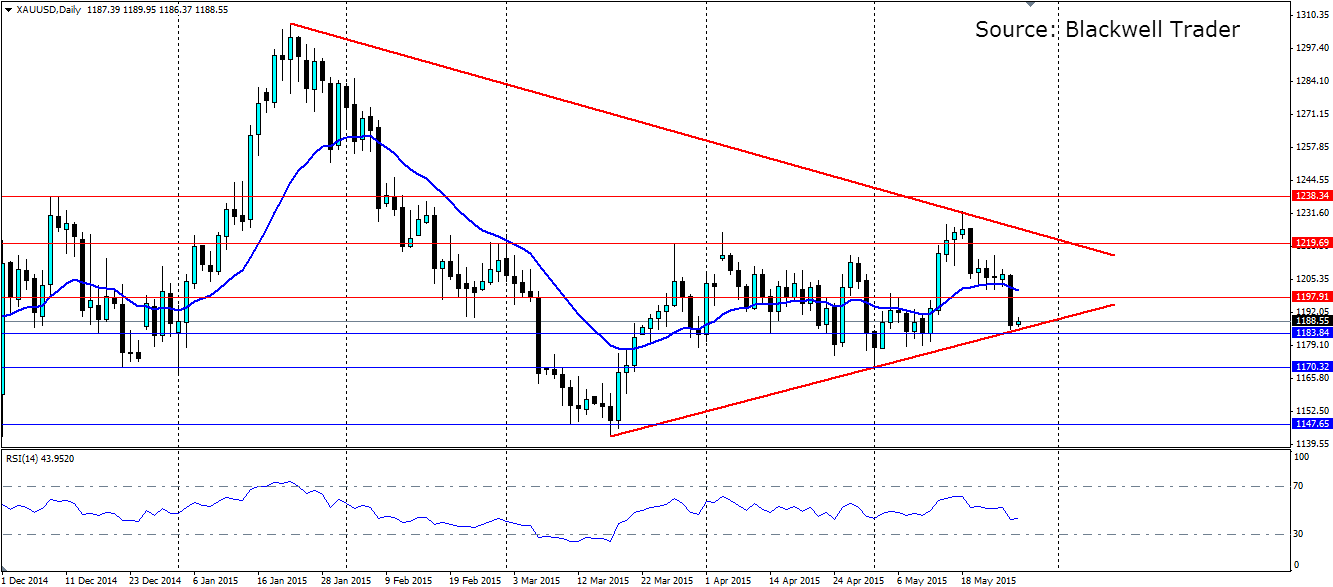

Gold was sold off heavily yesterday, pushing the metal back below the $1200 an ounce mark as India announced a ‘Monetisation Programme’. Gold now sits along the bullish trend line at the bottom of a consolidation shape that will provide dynamic support and could see the metal retrace higher.

India announced a plan to unlock the wealth stored in some 20,000 tons ($767 billion worth) of gold that is currently lying idle in Indian households. The plan is to encourage banks to take deposits of gold in the form of bullion and jewellery that will pay interest to the owner. This gold would then be sold on the open market to try and satisfy local demand. Currently India imports 1,000 tons of gold per year and this is putting a huge drain on foreign reserves.

This plan could go some way to reduce those imports with locally sourced gold. Depositors will not receive back the specific gold they deposit, which will put off a lot of people from depositing jewellery. But for holders of bullion it will be a good way to receive a return on their investment. Whether it is successful and reduces imports remains to be seen.

Gold traders responded by selling off the precious metal from $1,206.72 an ounce, down to $1,188.51. The rampant US dollar certainly would have helped by adding to the bearish pressure. The bullish trend line that has been in play since the lows hit in mid-March has once again been brought back into the picture.

Gold has fallen back into a liquidity zone that has seen plenty of raging and reversing, so it’s likely we will see this act, along with the dynamic support along the trend line, to reverse gold once again and see it push higher towards the recent highs, or at least the bearish trend line that forms the top of the pennant shape that gold is currently consolidating within.

Either way look for a rejection and a bounce off the bullish trend in the short term. Resistance will be found at 1197.91, 1219.69 and 1238.34 with the bearish trend line acting as dynamic resistance. If we see the bullish trend line fail, look for support at 1183.84, 1170.32 and 1147.65.