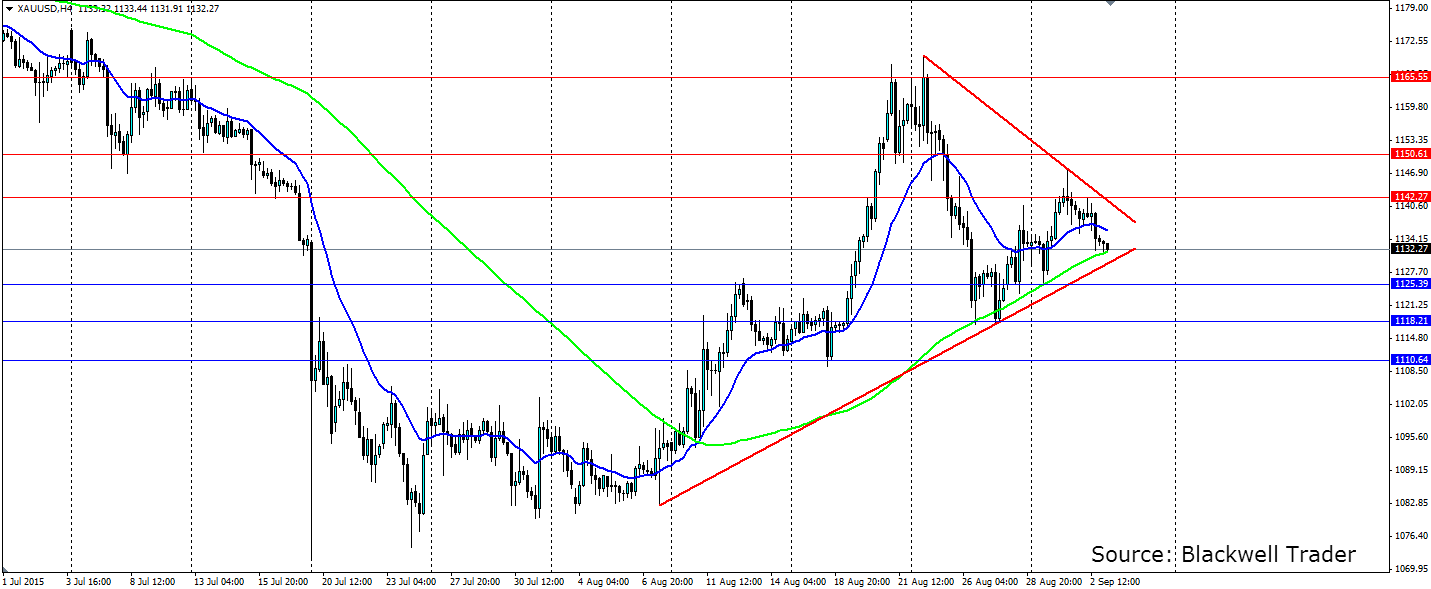

It’s a pattern that has repeated itself time and time again in the gold market. The precious metal has consolidated into a large pennant structure over the past few weeks as indecision and uncertainty take hold. A big end to the week could see gold forced out of the shape.

The tug-o-war between factors in the gold market is causing the consolidation. One of the main drivers is the uncertainty in US Interest rates, specifically if the Fed will begin raising interest rates when they meet later this month. The US Nonfarm Payrolls later this week, the last before the Fed meets on 17th September, will be keenly watch by the market and could go some way in swaying the Fed.

The Beige Book report released yesterday showed “modest to moderate” growth in all districts which will certainly be looked upon positively by the Fed. The labour market is rather robust at the moment in the US, however inflation has remained persistently low. This will make a rate rise a tough sell, and the market has responded by more or less giving a 0% chance of a rate rise.

The uncertainty in China is playing havoc with the gold market. On the one hand, gold is sought out as a safety bet and has benefited from the flight of capital from the turmoil in the Chinese stock market. On the other hand, there is speculation that the PBOC is selling up large holdings of reserves, including gold, to stabilise their financial markets.

All of this has left gold at the pointy end of a pennant shape and the breakout is likely to be determined by the US Nonfarm Payrolls later this week. Watch for resistance to be found at 1142,27, 1150.61 and 1165.55 if the breakout favours the bulls. If the bears take charge, watch for a breakout lower that will look for support at 1125.39, 1118.21 and 1110.64.