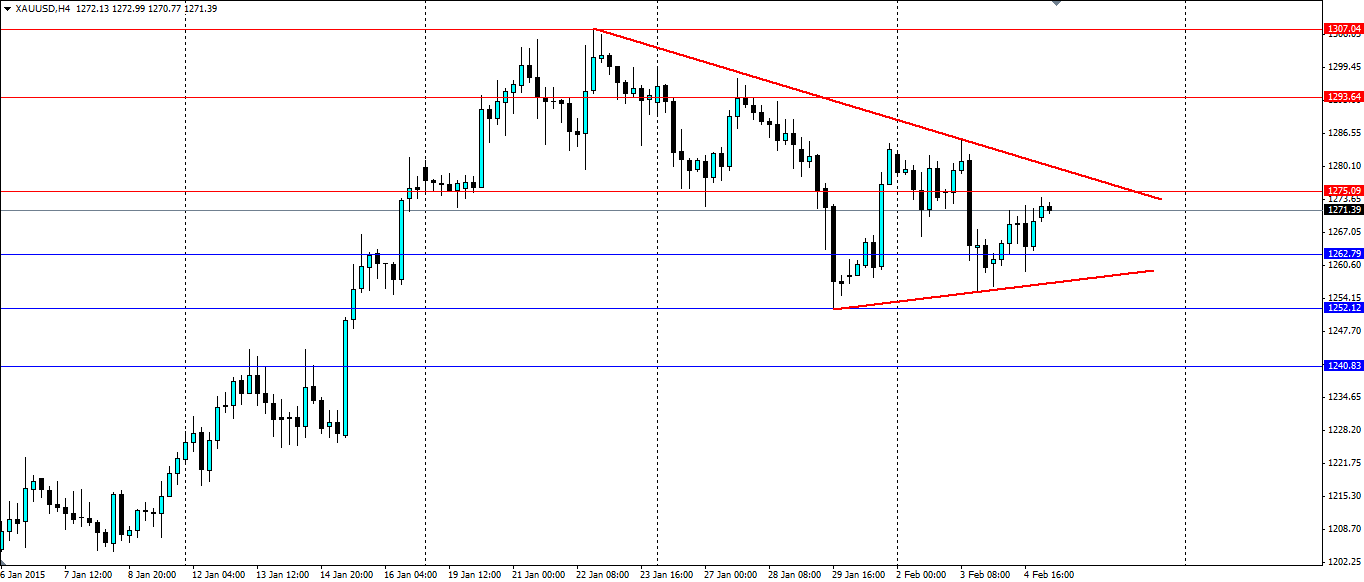

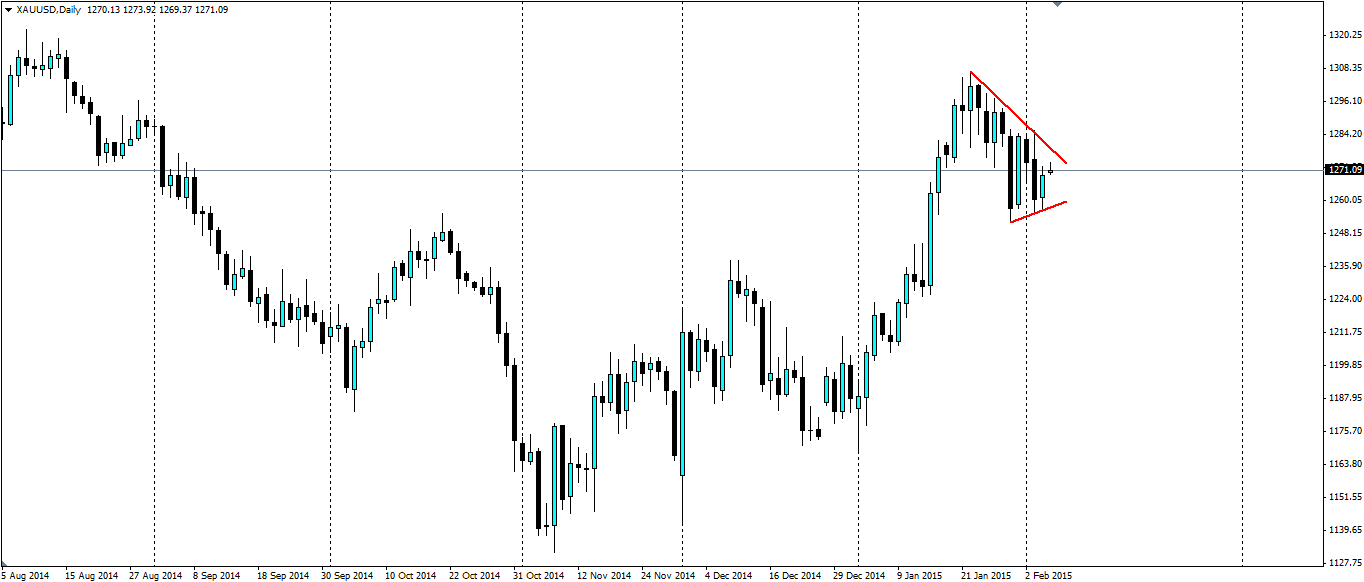

Gold traders may have noticed the highs getting lower on the charts while at the same time the lows are getting higher. This is leading to a squeeze in the price of gold that will likely result in a breakout and a strong move either way.

From the highs over $1,307 an ounce, gold has pulled back thanks to a bit more certainty surrounding the actions of various central banks around the world. The troubles in Greece could yet play another hand in pushing the gold markets higher, but for now things have cooled.

Watch for US Unemployment claims later today and of course US Nonfarm Payrolls on Friday. These both will give an indication into the strength of the US economy. Gold generally reacts quite a bit to US labor market news and any positive figures could push gold lower out of the pennant shape.

From here the likelihood of a breakout upwards or downwards is about even. We could see a continuation of the recent bullish trend in the form of a breakout to the upside. Otherwise we could see a continuation of the recent reversal trend downwards.

Traders can take advantage of either scenario regardless of a bias on the direction of the breakout. Setting a stop entry either side of the pennant shape will ensure the momentum is caught when the shape breaks down. Resistance will be found at 1275.09, 1293.64 and 1307.04 while support is found at 1262.79, 1252.12 and 1240.83.