The week ahead is likely to be volatile for gold but the question remains as to what extent a potential US rate hike has already been priced in.

Gold came under pressure early in the week as FOMC member Bullard’s speech further fuelled the case for a rate hike. In addition, US Core Retail Sales and PPI were also buoyant at 0.4% and 0.3% m/m respectively. Subsequently, gold was sold off strongly as capital fled the metal for other safe havens. However, the slide was arrested by a weaker than expected US Unemployment Claims result at 282k (270k exp) and the metal managed to finish the week at $1074.44 an ounce.

Looking ahead, gold is facing a volatile week as the US Federal Reserve is set to ponder the state of the Federal Funds Rate on Wednesday. The central bank has been largely tipped to raise the benchmark rate by 25bps which would see the metal under significant pressure. Subsequently, expect to see plenty of sharp swings in the lead up to the news release.

In addition, most participants within the market agree that the risk of a 25bps rate rise has already been priced in and that subsequently there shouldn’t be a large rout following the release. However, that would largely rely upon gold remaining in stable equilibrium which is debateable considering some of the capital flows and swings of the past few days. Subsequently, expect to see the metal experience some sharp volatility before recommencing its long term bear trend.

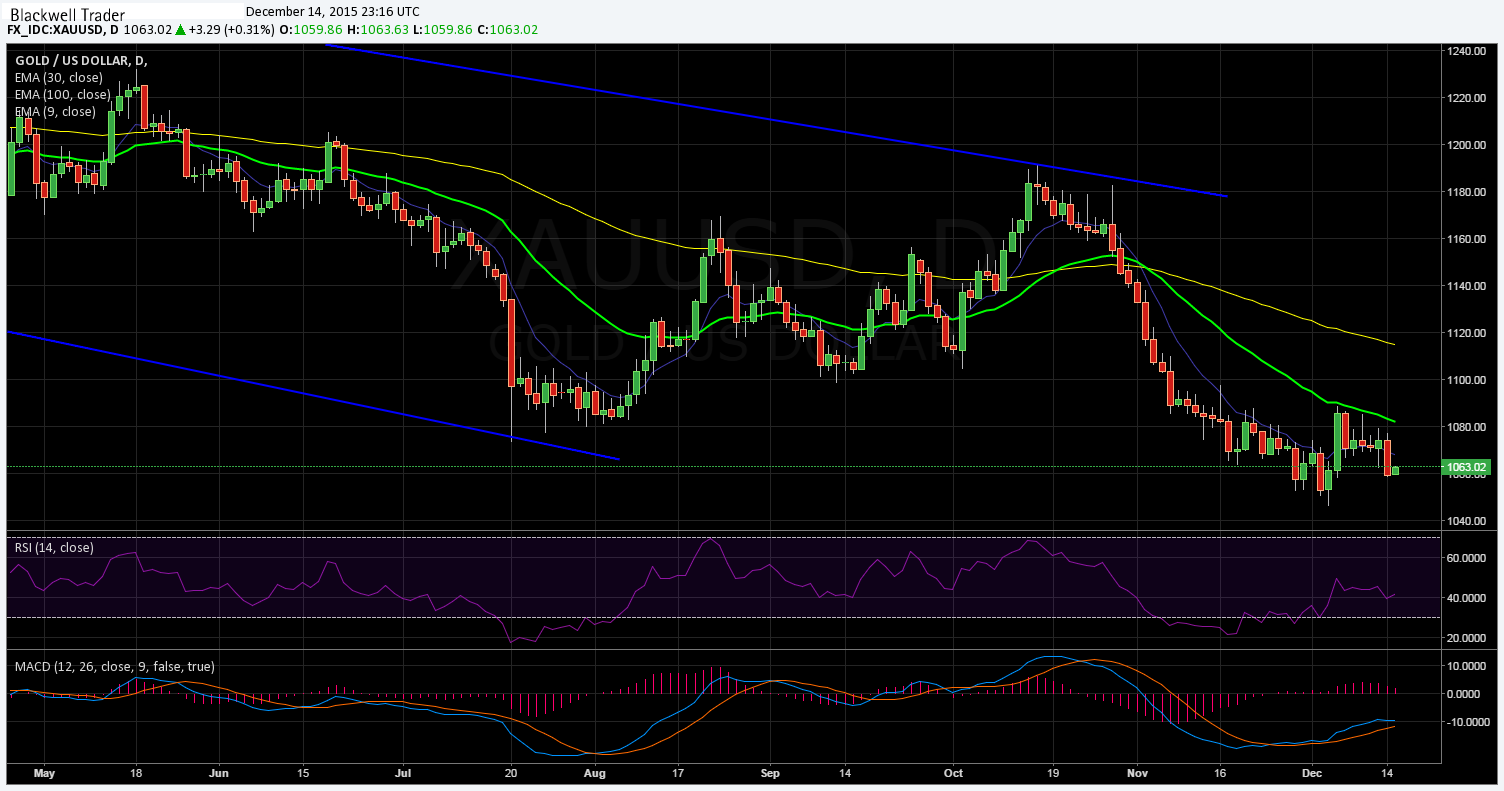

From a technical perspective, gold remains trapped within a bearish channel that has been capping the price action. The metal also remains depressed and well below the 100 and 30 EMA’s whilst RSI remains flat within neutral territory. Given the strong volatility expected around the FOMC decision, and the difficulty in managing that downside risk, our bias remains neutral. Support is currently in place for the pair at $1072.11, $1045.96, and $1035.55. Resistance exists on the upside at $1097.63, $1191.38, and $1233.71.