- Gold prices are being supported by a shift in Chinese monetary policy, and geopolitical developments.

- China has resumed gold purchases after a six-month pause.

- From a technical perspective, gold is currently caught between support at $2650 and resistance at $2700. A break above $2700 could signal further upside potential.

Gold has started the week on the offensive as the stars have somewhat realigned for the precious metal. The regime change and geopolitical developments in Syria coupled with a Chinese monetary policy shift and a weaker US Dollar has reignited the appeal of the precious metal.

There was also the announcement by China that they would be starting a probe in AI leader Nvidia (NASDAQ:NVDA), over alleged anti-monopoly law. This could be seen as a sign of what is to come from a trade war moving forward between the US and China and has added to the haven demand narrative.

Together with Friday’s US jobs data, markets have also come to terms with another 25 bps rate cut by the Fed in December. This is also underpinning Gold prices and is likely to limit downside potential.

China Resumes Gold Purchases

China, who had been a major buyer of Gold this year but remained on the sidelines since May, has resumed Gold purchases. The People’s Bank of China said on Saturday that it bought 160,000 troy ounces of gold in November. This ends a six-month break in purchases.

What followed was the announcement yesterday regarding the loosening of monetary policy by the Politburo. This comes as Chinese inflation data remained weak, highlighting slow demand. Markets will no doubt be hoping that stimulus will lead to an uptick in demand and keep the Chinese Central Bank buying the precious metal.

US Dollar to Continue Poor December Performance?

The US Dollar has had a mixed December so far as it looks to buck its historic trend of poor performance in December. The index is advancing this week and this could also be down to its haven appeal.

It may be that the rate cut in December has largely been priced in and thus the US Dollar is experiencing a rally. I think the closer we get to the Christmas break is when the US Dollar will really be tested. As institutions begin to close shop for the festive break, many will look to reposition themselves and their portfolios ahead of 2025.

The US Dollar is primed to enjoy a positive 2025 but we may still see some volatility the closer we get to Christmas.

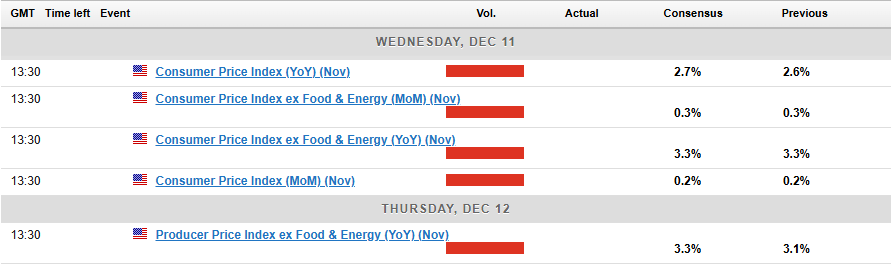

Looking ahead and the biggest impact on Gold this week from a data perspective is likely to come from US CPI numbers out on Wednesday.

The print is unlikely to alter the Fed decision on December 18, but it could stoke some short-term price swings and volatility.

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, Gold on a daily timeframe is trading above the range it held last week but below a key resistance area around the 2675 handle.

Immediate support from the range break rests at 2656-2660 which for now appears to be holding firm and thus supporting a bullish narrative.

I would say caution will be key as the precious metals may face a host of challenges gaining acceptance above the 2700 handle once more.

Immediate resistance rests at 2675 and 2685 before the 2700 handle grabs the attention.

Are we going to see more choppy price action like last week, or will the geopolitical risk drive the bullish rally beyond the 2700 handle?

Gold (XAU/USD) Daily Chart, December 10, 2024

Source: TradingView

Support

- 2656

- 2639

- 2624

Resistance

- 2675

- 2685

- 2700

Most Read: Markets Weekly Outlook – Central Bank Focus as US Inflation Looms