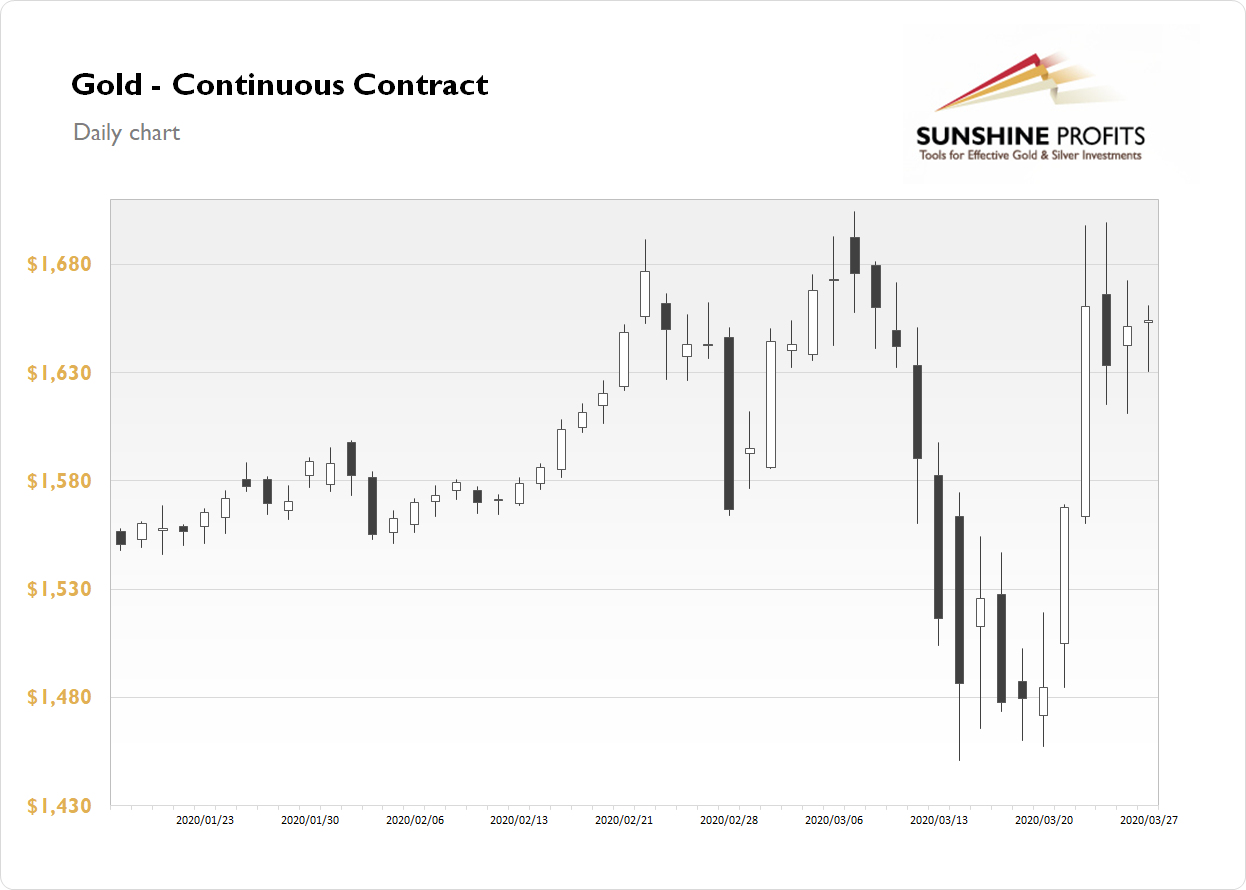

The gold futures contract gained 0.18% last Friday, as it extended a short-term consolidation following the rally last Monday into Tuesday. The market reacted to the previous Sunday's Fed unlimited Quantitative Easing announcement. The yellow metal has retraced all of the previous sell-off, as it got back close to March 9 medium-term high of $1,704.30. Since then, gold trades within the mentioned short-term consolidation.

Gold was down 0.3% this morning, as it continued to fluctuate following last week's rally.

What about the other precious metals?

Silver lost 0.97% last Friday, while today it is trading 3% lower. Platinum gained 0.61% last Friday and today it is 2.2% lower. Palladium lost 1.32% last Friday, while today it is 1.6% lower. So precious metals extend their short-term fluctuations following the recent advances.

Investors will wait for the PMI numbers releases from China at 9 p.m. today. They will likely show virus crisis' impact on the economy.

Last week's record-breaking weekly U.S. jobless numbers have been quite shocking. And we may see more bad economic data releases in the near future, as they will be revealing coronavirus damage to the economy.