Talking Points

- Gold & Silver Remain At Risk As The US Dollar Bulls Return In NFP Aftermath

- Crude Oil May Face Further Pressure As Supply Glut Concerns Linger

- Gold Remains Vulnerable To US Dollar Index Strength Over Q4 – Quarterly Forecast

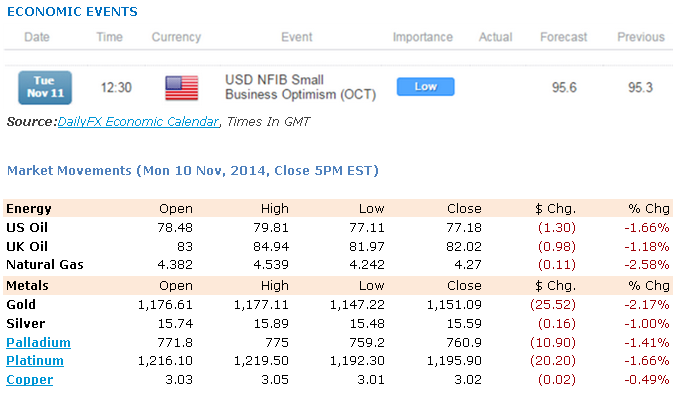

Crude oil resumed its descent on Monday with newswires suggesting speculation over ample global supplies as the likely driver. Over the session ahead such concerns could continue to keep pressure on the commodity, with a light US docket unlikely to offer positive demand-side cues.

Also in the energy space; natural gas suffered a sharp retreat of over 2 percent in recent trade. Media sources cited anticipation of milder US weather conditions as a catalyst behind the fall from its multi-month high. As noted in recent reports the sustainability of natural gas’ ascent was questionable in the face of above-average storage builds.

Finally, the precious metals saw renewed downside momentum at the outset of the week as the US Dollar bulls returned. Traders have had some time to digest Friday’s disappointing headline NFPs print, and have likely recognized that it does not materially alter the prospect of Fed policy normalization. This in turn is USD positive and could keep gold and silvertrading heavy in the near-term.

CRUDE OIL TECHNICAL ANALYSIS

Crude continues to whipsaw within the 77 to 80 trading band. While the proximity to the floor could see some profit-taking, the scope for a recovery may be limited by nearby selling pressure at the 80.00 handle. Further, trend indicators continue to point downward (descending trendline, 20 SMA, ROC). This leaves a close below 77 desired to open a descent to the next definitive level near the 2011 low (74.70).

Crude Oil: Awaits Break Below 77.00 to Open 2011 Low

GOLD TECHNICAL ANALYSIS

Gold’s sharp retreat from the 1,180 barrier has left a Morning Star formation lacking confirmation. Amid a sustained presence of a short-term downtrend as indicated by the 20 SMAand ROC downside risks remain. This leaves the spotlight on the mid-April ’10 low near 1,123.5.

Gold: 1,123.5 In Focus As Sell-Off Resumes

SILVER TECHNICAL ANALYSIS

Silver’s sell-off has resumed, which in turn has negated a Morning Star formation on the daily. With signs of a short-term downtrend remain intact (20 SMA, ROC) the focus remains on the 2010 low near 14.65.

Silver: Short-Term Downtrend Remains Intact

COPPER TECHNICAL ANALYSIS

Copper continues to gyrate erratically around the 3.00 handle with the latest upswing finding selling pressure at the 23.6% Fib. While this may limit the extent of further gains, caution is suggested when adopting fresh positioning given the commodity’s tendency towards volatility over recent months.

Copper: Awaiting Clearer Guidance As Wild Whipsaws Endure

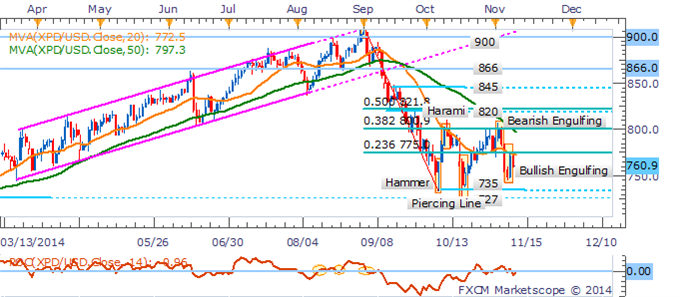

PALLADIUM TECHNICAL ANALYSIS

Palladium’s Bullish Engulfing pattern has been left lacking confirmation after a pullback from the 23.6% Fib. Negative cues remain for the commodity including signs of a downtrend from the 20 and 50 SMAs. This suggests a potential retreat towards the 2014 low near 735 may be on the cards.

Palladium: Encounters Sellers At Key Fib. Level

PLATINUM TECHNICAL ANALYSIS

Platinum is pressing against the critical 1,187 barrier after a key reversal pattern failed to find confirmation. With trend indicators pointing lower (20 SMA, descending trendline) a breakout could pave the way for a push towards the July ’09 low near 1,101.

Platinum: At A Critical Juncture Near Technical Floor