Investing.com’s stocks of the week

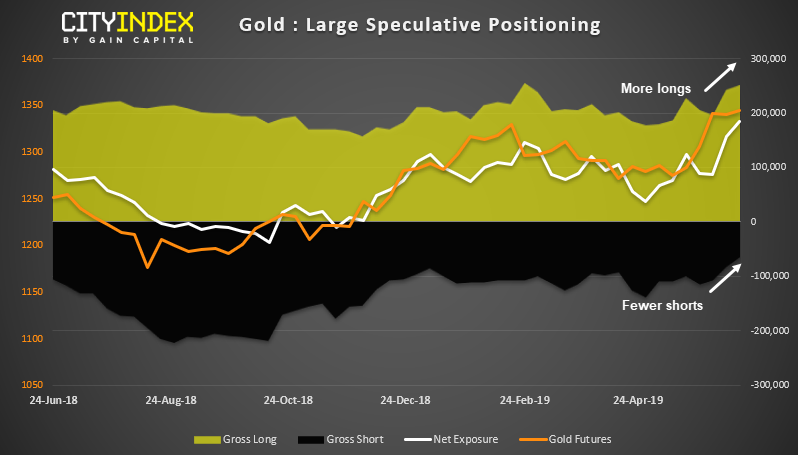

Following yesterday’s FOMC meeting, gold prices exploded and stopped just shy of $1400, as the world digested the increasing ‘easiness’ of central banks policies.

The Fed had confirmed their dovish stance nearer the end of the U.S. session, with nearly half of the voting FOMC members expect two cuts this year. Shortly after, RBA’s Philip Lowe hit the wires to hammer home their dovish views and all but confirm another cut is on the horizon. And, let’s not forget that RBA teased the notion of QE in June’s minutes, adding that “Lower interest rates were not the only policy option available to assist in lowering the rate of unemployment”.

Not wanting to miss out, BOJ reiterated their ultra-easy policy and expect to keep ‘extremely low rates at least through spring 2020’. Given the backdrop of trade wars and deteriorating economic data, the pressure if building for BOJ to stimulate the economy further. And, of course this is after Draghi shot down the Euro with potential for ECB to ease further, earlier this week.

With an increasingly bullish trend structure on the monthly charts, we remain bullish after prices have had a chance to pause for breath.