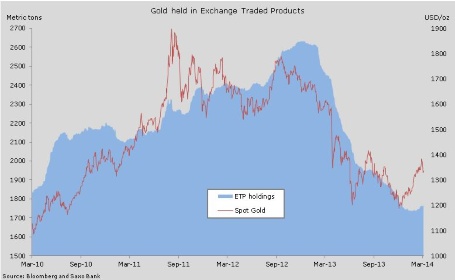

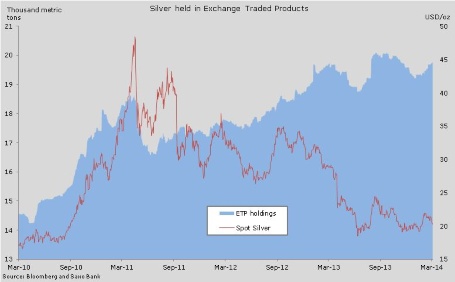

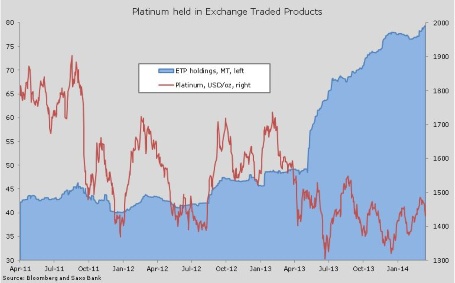

Gold suffered a 3.5 percent setback last week as profit taking outweighed geopolitical concerns. As a result we saw the first reduction in four weeks of holdings in exchange traded products backed by physical gold. Silver holdings increased during the sell-off while Platinum holdings rose to a new record.

Gold holdings only suffered a small reduction during the set-back last week. Those who currently have a bullish view are prepared to take more pain in terms of correction than what we have witnessed so far. For this week the 200-day moving average at USD 1,297/oz continues to hold the key.

In silver we have once again seen holdings rise during a sell-off which could indicate that some consider this renewed weakness as temporary.

Platinum holdings rose to a new record despite seeing the price suffering a second week of losses. This correspond with the behaviour from tactical traders in the futures market where speculators are now the most bullish in more than a year.

Ole Hansen is head of Commodity Strategy at Saxo Bank.