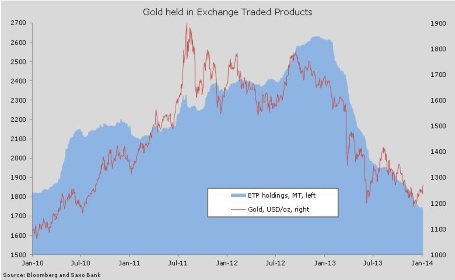

The current gold rally has now lasted four weeks to become the longest in 16 months, yet so far has failed to trigger any excitement among investors in Exchange Traded Products. During the past four weeks, holdings have dropped by 28.1 metric tons and flows has been negative in three out of those weeks, including last week when the price made a renewed attempt to the upside.

While money managers have increased their net exposure to gold during January by 27 percent, investors in ETP holdings have continued the run of reductions which has been ongoing for the past year. It highlights how physical demand more than paper demand, has been the main driver so far this year as many investors, despite the recent risk off, still focus on the adverse impact from rising rates.

The four biggest providers of gold ETPs are SPDR (45 percent), ETF Securities (14 percent), ZKB (10 percent) and iShares (9.3 percent)

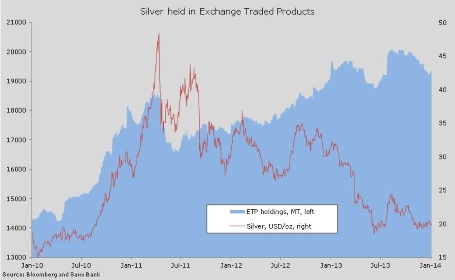

Silver, which continues to underperform gold, saw the biggest weekly increase in holdings since September. Total holdings rose by 122.6 tons after four consecutive weeks of reduction.

The four biggest providers of Silver ETPs are iShares (52 percent), ZKB (13.5 percent), Central Fund (12.3 percent) and ETF Securities (9.2 percent)