One potential ETF trade entry on our radar screen this week is SPDR Gold Trust (GLD), a commodity ETF that tracks the price of spot gold futures. We have not discussed trading this Gold ETF for a long time because it has been in correction mode, retracing from its all-time high, for nearly a year. It has also been rather flat for the past several months.

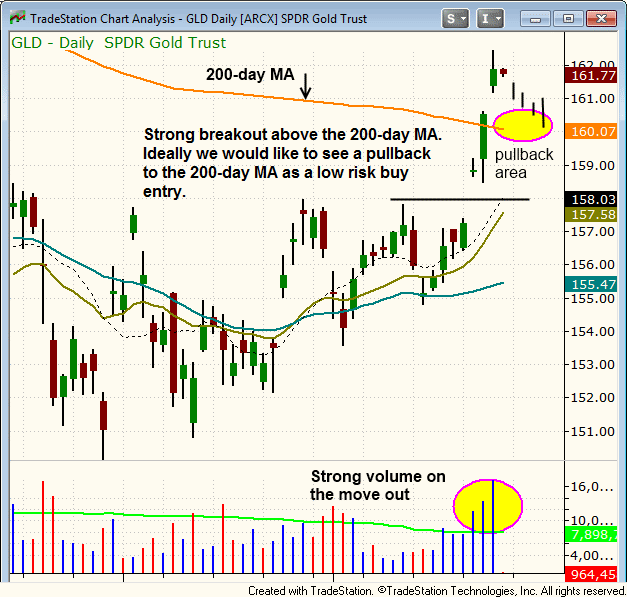

However, upon closer examination of the big picture, we see that momentum of GLD may now be reversing, which could provide for a solid swing trading opportunity on the long side. To begin with, notice the breakout above the 200-day moving average that occurred just last week:

As you can see, GLD rallied to close above major resistance of its 200-day moving average (on August 22) for the first time since March of this year. Increasing volume, which rose above its 50-day average level, helped to confirm the move. In the subsequent two days that followed the breakout above its 200-day MA, GLD traded in a tight, sideways range. However, although such price action is bullish, the daily chart pattern presently does not yet provide us with a clearly defined buy entry point and level for setting a stop price.

For that, we would need to see at least a one or two-day pullback that ideally forms a reversal candle. If that occurs, the levels for setting our buy trigger and stop prices would be much more clearly defined. As annotated in the chart above, we would ideally like to see a quick pullback to near new support of its 200-day MA (the orange line), presently just above the $160 level.

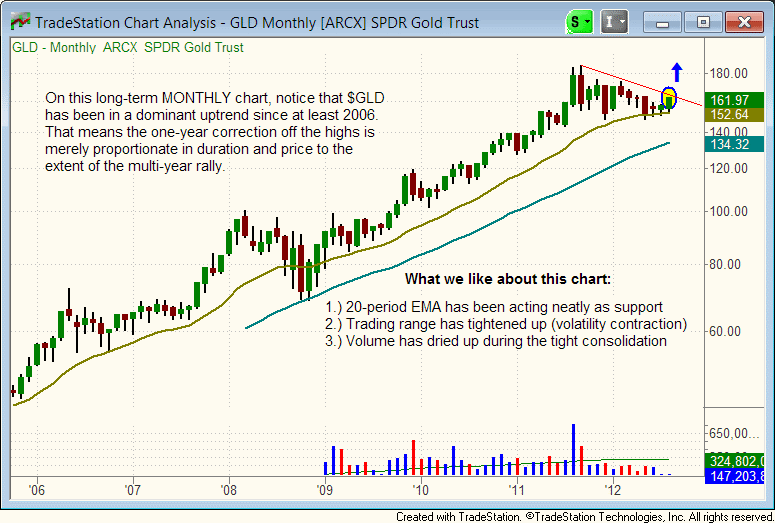

This would form a bull flag chart pattern. Another reason we would first like to see a minor price retracement from current levels before buying is that the long-term monthly chart interval shows us that GLD is actually running into resistance of its downtrend line from its September 2011 high:

If GLD is bumping into resistance of a downtrend line that has been in place for nearly one full year, one may be wondering why we would be considering trading this ETF on a pullback before it actually breaks out above resistance of that downtrend line. There are several reasons. Perhaps most importantly, one must remember the basic tenet of technical analysis that states a longer-term trend always holds more weight than a shorter-term trend.

Therefore, even though GLD is kissing resistance of a downtrend line that is nearly 12 months old, notice more importantly that this Gold ETF has clearly been in a dominant uptrend since at least 2006. As such, technical analysis dictates that the odds favor an eventual resumption of that multi-year uptrend. Although the current one-year pullback off the high has been rather lengthy, it was merely proportionate (in the big picture) to the duration and extent of the uptrend for the past 6 years.

In addition to the long-term uptrend being more powerful than the shorter-term downtrend, notice how the price action of GLD has perfectly held support of the 20-period exponential moving average (the beige line) for the past three months. While doing so, price action also tightened up dramatically, creating a volatility contraction that should soon lead to a significant volatility contraction. Checking the volume pattern, we also notice that volume declined dramatically during the consolidation of the past several months.

This tells us the sellers have been drying up, thereby making it easier for GLD to eventually break out and attempt to resume its dominant upward trend. Finally, because GLD is a commodity ETF, it has very low correlation with the direction of the main stock market indexes. That’s why we do not view this trade as having relative weakness to the broad market.

Overall, we like the technical setup for a momentum-based swing trade buy entry into GLD, but we will patiently wait for a proper entry point first. When the ETF trade setup meets our criteria for potential buy entry, our exact buy trigger, stop, and target prices will be listed in the ETF Trading Watchlist for subscribers to the full version of The Wagner Daily newsletter. Until then, we will continue to closely monitor the price and volume action of $GLD.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold ETF Starting To Shine Again. Is Now The Time To Buy?

Published 08/28/2012, 05:49 AM

Updated 07/09/2023, 06:31 AM

Gold ETF Starting To Shine Again. Is Now The Time To Buy?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.