The gold market has been very active over the course of this month with it peaking yesterday after the FOMC meeting minutes were released. A double top pattern and a rejection off the moving average signalled a reversal of the recent uptrend and we could see the bottom of the channel targeted.

Source: Blackwell Trader

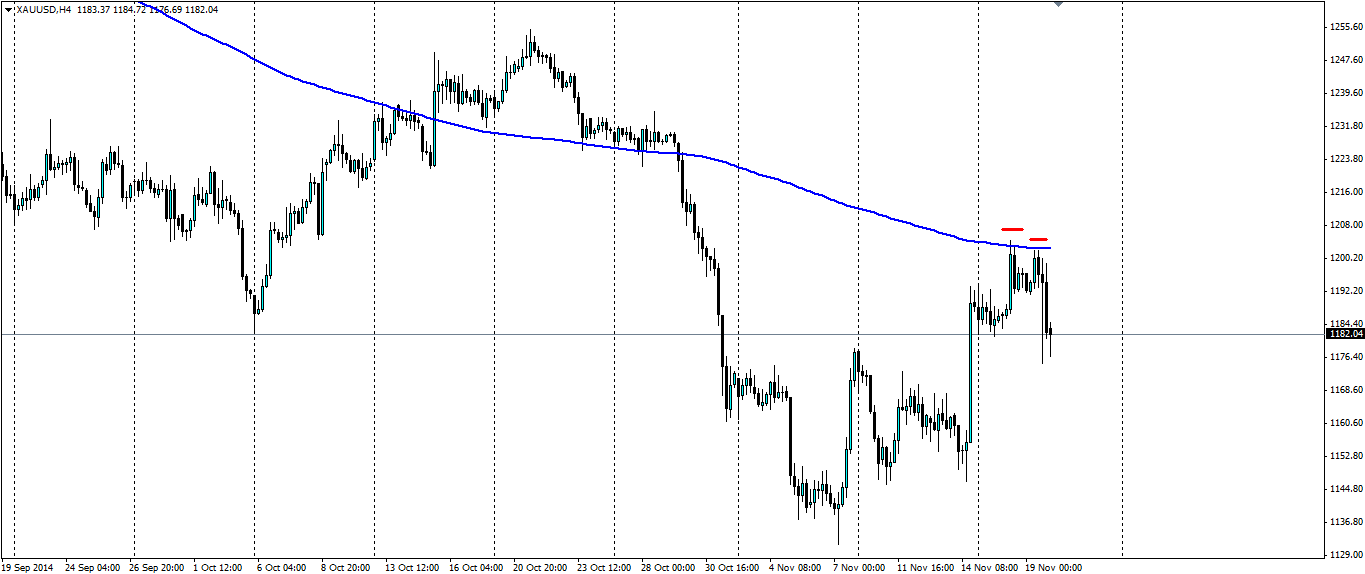

The gold markets love to play off technicals and the double top pattern on the 4 hour chart would have excited many. There was a fairly strong rejection off the resistance at $1,204.71 an ounce two days ago and the price went up to test it again yesterday ahead of the FOMC meeting minutes.

There was obviously strong selling pressure from the bears as the price didn’t make it as far as the previous high, instead falling short at $1,202.06. This could have been due to the 200 Simple Moving Average acting as solid resistance just below the previous high. Either way the level held, the double top formed and the price rejected off.

The FOMC meeting minutes were bullish for the dollar and therefore bearish for gold. The market focused on the more hawkish elements such as the debate on whether the Fed should remove the phrase: ‘considerable time’, when speaking about interest rate rises. The Fed also noted the need to remain attentive to lower inflation expectations in the long term, again adding bearish pressure to the gold markets.

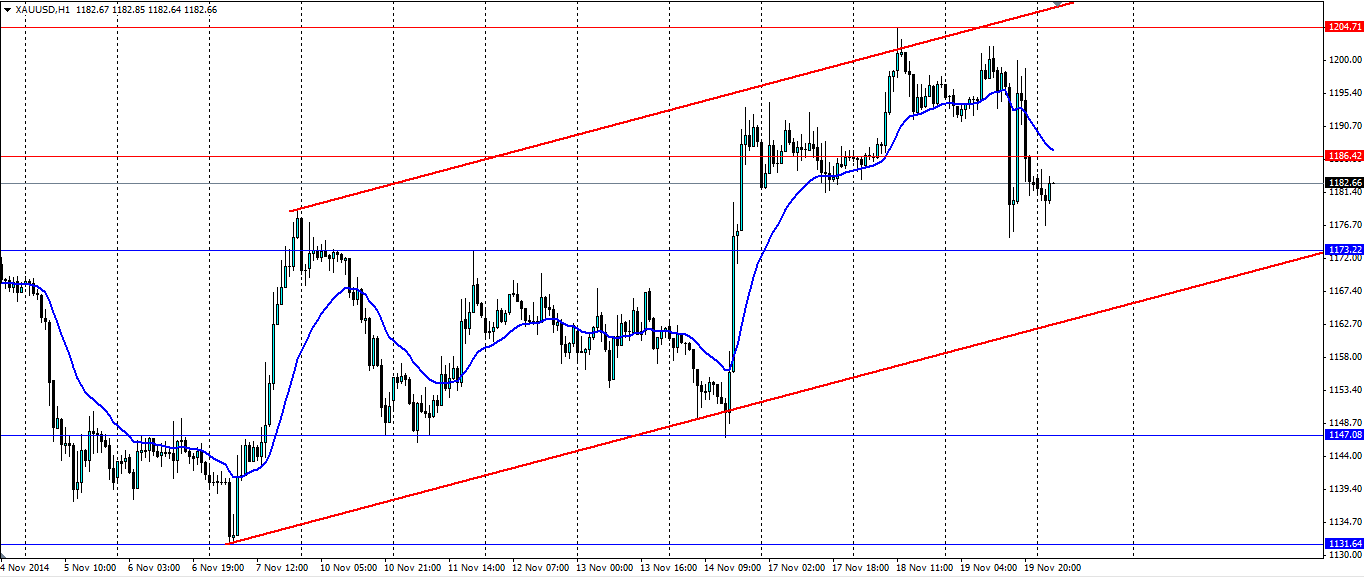

At present gold is in an upward sloping channel and the bearish movements look to take it down to the bottom. Gold will likely find support at 1173.22 and the price may be held up for some time. But the selling pressure looks enough to target the dynamic support along the bottom of the channel. Further support will be found at 1147.08 and 1131.64.

Source: Blackwell Trader

Resistance for a movement higher is likely to be found at 1186.42, 1204.71 and 1222.17 although the latter will only be targeted in an upside breakout of the channel which is unlikely any time soon. It would also pay to keep an eye on the 20EMA on the H1 chart as this has been acting as dynamic support/resistance and is likely to carry the price down.

Gold has formed a double top which signals a reversal of the recent intraday uptrend. A rejection off the 200 MA and hawkish comments from the US Federal Reserve also added to the selling pressure which could see the bottom of the channel tested.