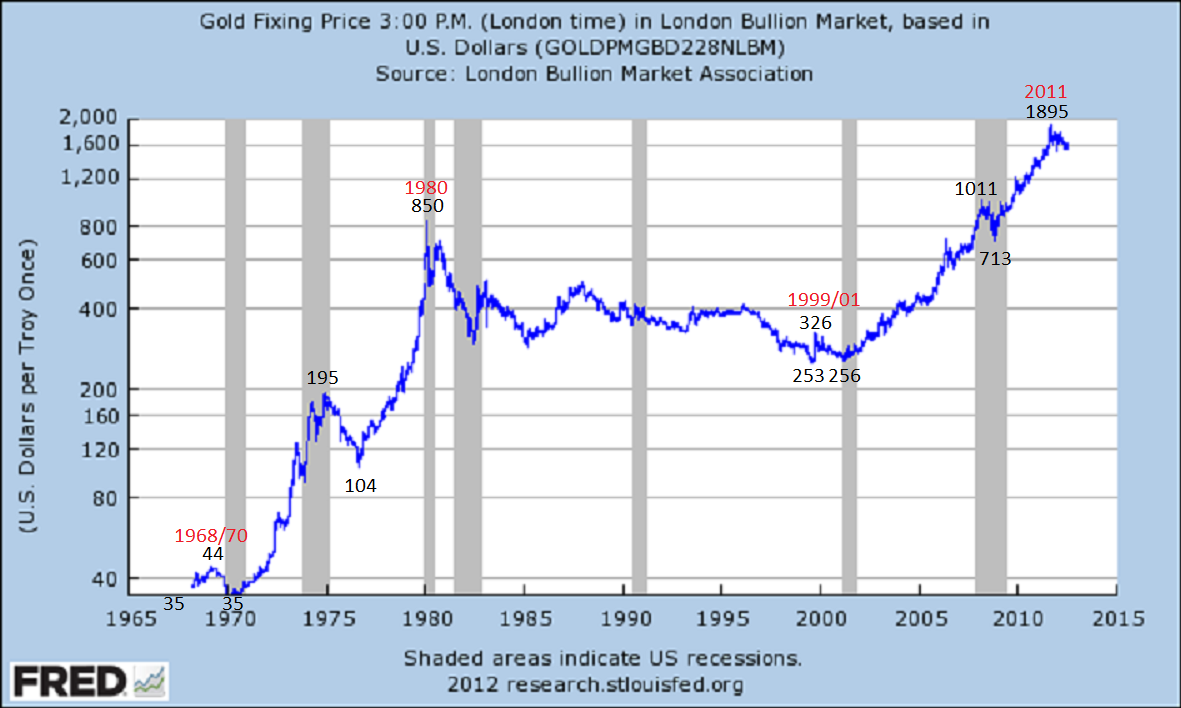

Thanks to the FED’s recent addition of the London PM fix data, April 1968 to date, we have uncovered an unmistakeable repetitive pattern in gold. The chart below displays the price data for the entire period.

First a little history. After World War II the Brenton Woods system was established whereby all currencies were valued in terms of USDs, which at the time, was on a gold standard priced at $35/oz. This made all currencies indirectly linked to the gold standard. Heading into 1968 the USA started to have a difficult time maintaining the price of Gold at $35/oz. In March 1968, the USA abandoned its gold intervention policy and allowed it to trade freely in the secondary market. The data in the above chart begins the following month.

1969 -- 1980

The initial reaction to this two-tier gold pricing system was a rally to $44 by 1969. Then gold declined back down to $35 by 1970. In January, 1970 the gold price began to rise again. By August, 1971 the price of gold had risen to $44, and the USA abandoned the standard altogether. This launched the 1970-1980 bull market. Notice the 1968-1970 double bottom, then the 10-year 1970-1980 bull market.

After the January, 1980 blowoff top in gold, a 19-year bear market followed. In 1999 the price of gold hit its low at $253. Then after a rally to $326 it retested that low again in 2001. What followed, as we have all observed, was a 10-year bull market into the 2011 high. Notice this bull-market pattern, in time, is identical to the previous bull market -- a two-year double bottom followed by a 10-year bull market.

'Price' Separated Bull Markets

The major difference between the two bull markets is obviously price. During the 12-year (1968-1980) bull market cycle, the price of gold rose from $35 to $850 using the London PM fix data. Prior to this bull market, there were decades of pent up demand. In fact, U.S. citizens were not allowed to directly own gold until late 1974. The 1970′s was also a period of high inflation, directly devaluing the purchasing power of all currencies. Gold, considered a safe haven against currency devaluation and now legal to own, soared. The last stage of the bull market was quite spectacular.

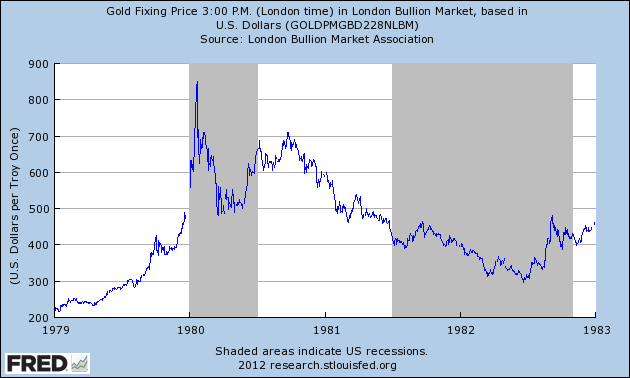

Notice during the last year of that bull market gold soared from just above $200 to $850. Also notice the nearly $100 gap-up over the holidays in late 1979 into the blowoff top in January, 1980. Gold had gone parabolic to end that bull market. When parabolic tops end, as we all remember from the dot-com bubble, the collapse in percentage terms is just as sudden. But putting that aside, look at the decline in actual USD’s.

The initial drop from $850, about $350, retraced about 50% of the bull market’s last year advance. Then a failed rally attempt to reestablish the bull market, about $200, retraced about 2/3′s of that decline. After that, the bear market took hold and prices gradually declined to around $300 by 1982. Now let’s review the current price activity in the gold market.

Secular Cycles Drive Markets

During this bull market we at first had a demand driven commodity boom, 2001-2008, as emerging-market countries grew putting a strain on supply. Gold rose to just over $1000 during this phase. When the commodity boom ended, all commodity prices collapsed, as the deflationary impact of this secular cycle took hold. Keep in mind, gold only experiences real bull markets during secular cycles.

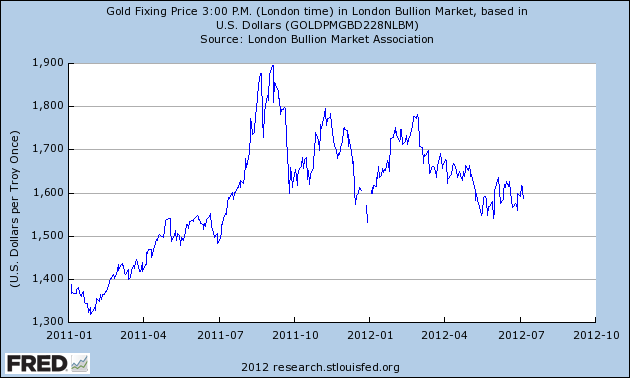

During the collapse in late 2008, central banks started what is termed Quantitative Easing programs. They essentially were increasing the money supply at a rapid rate to offset the deflationary pressures. Gold, considered a safe haven against currency devaluation, rallied. The second QE program in the US, QE 2, ended in June, 2011. Gold corrected, then rallied again, on speculation of a QE 3 program. When the Fed announced Operation Twist in mid-September 2011, gold had topped and was already correcting.

Notice the initial drop from $1895, about $350, retraced about 50% of the 2011 advance. Then a rally attempt to reestablish the bull market, about $250, retraced about 2/3′s of that decline. Now gold has been gradually declining toward those lows again. Just like it did in 1981, the year after the 1980 bull-market high.

One would have to admit the similiarities between both bull markets are quite striking. Despite the difference between the inflationary pressures of the 1970′s and the deflationary pressures of the 2000′s. Now, even the decline after their respective peaks are also looking similar when one takes into account that most of the commodities peaked in price during the 2008-2011 time period. And they now appear to be in ongoing bears markets. We will have to consider that gold is currently in a bear market, unless it can exceed its 2011 high to extend it.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Deja Vous?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.