-

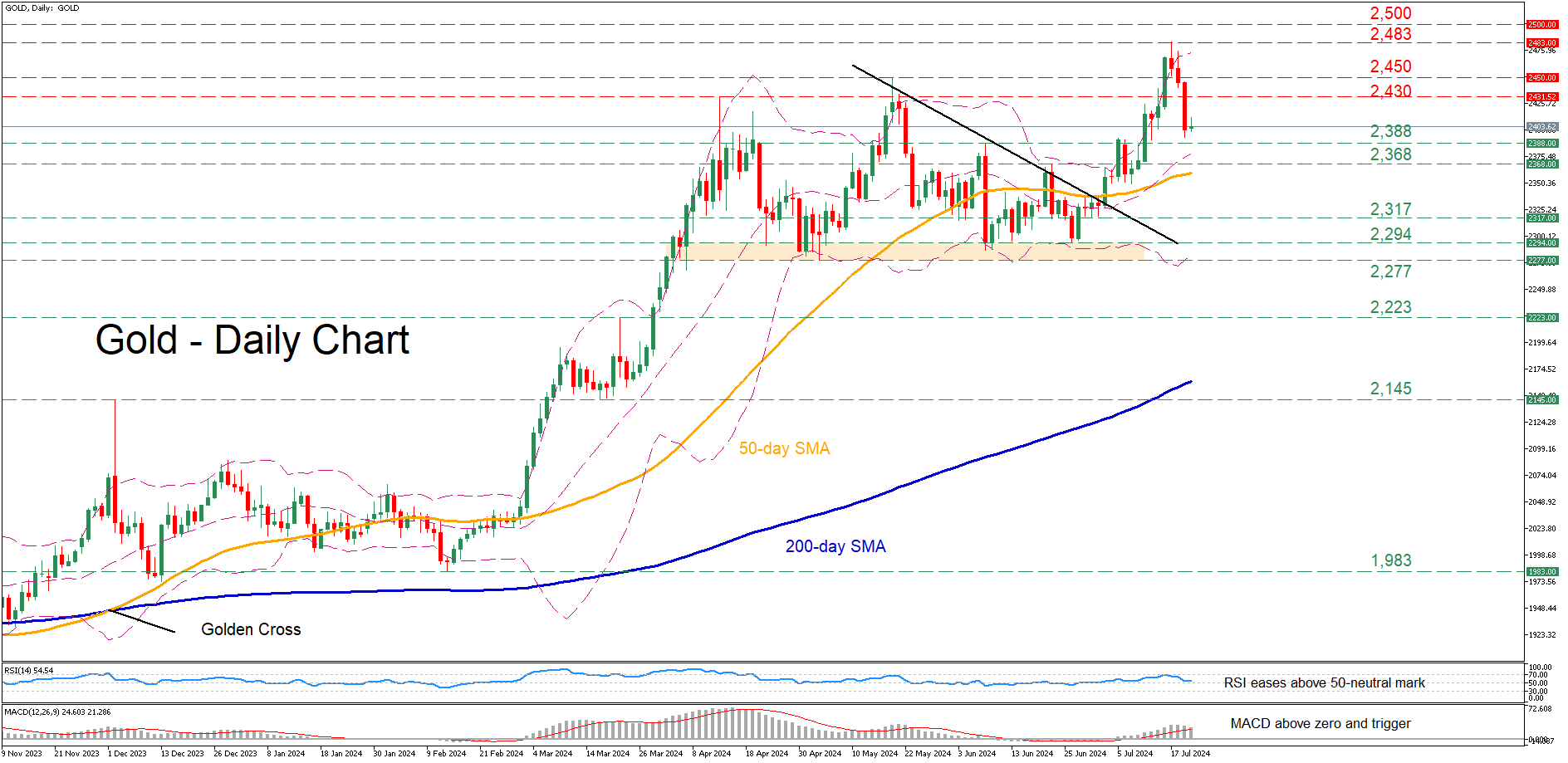

Gold jumped to its highest level ever on July 17

-

But reversed lower due to reaching overbought conditions

-

Despite latest weakness, oscillators remain positively tilted

Gold had been in a steady uptrend since late May, which led to a fresh all-time high of 2,483 last week. However, the pair quickly corrected lower as the momentum indicators warned of an overstretched advance.

Should the pullback extend, the price could inch lower towards two previous resistance zones of 2,388 and 2,368, which could now serve as support. Further declines could then stall at 2,317, a region that held its ground both in June and July. Even lower, bullion might face the 2,294-2,277 range, defined by the May and June lows.

On the flipside, if the bulls attempt to strike back, immediate resistance could be found at the April high of 2,430. Surpassing that hurdle, gold might attempt to revisit its May high of 2,450. A violation of that zone could set the stage for the recent record peak of 2,483.

In brief, gold has been undergoing a pullback after its trip to all-time highs came to an end. Should the bears keep the pedal to the metal, the 50-day simple moving average (SMA) might quickly come under scrutiny.