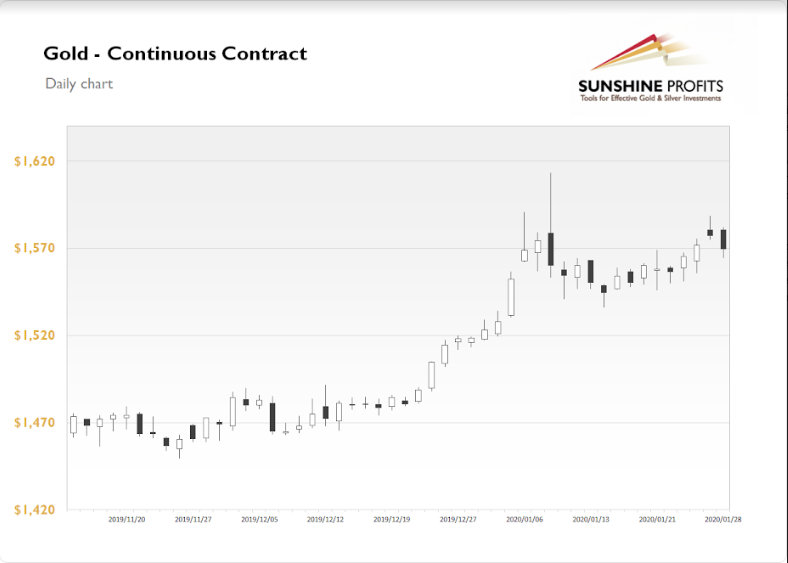

The gold futures lost 0.48% on Tuesday, as it retraced its Monday’s advance. The financial markets reacted to better-than-expected U.S. economic data releases (Durable Goods Orders, CB Consumer Confidence) and China virus fears somewhat eased yesterday. On last week’s Wednesday gold has bounced off $1,550 level, and since then it gained almost 2.5%. The market trades within a short-term uptrend as it is still retracing some of its move lower from the January 8 medium-term high.

The gold price is currently 0.3% higher, as it retraces some of yesterday’s decline. Overall, it remains within a consolidation following the recent advances. What about the other precious metals? The silver sold off yesterday, as it fell 3.31% and it got further away from the $18 mark. Silver is currently 0.3% higher. The platinum remained slightly below $1,000 mark yesterday, as it gained 0.33%. On the other hand, palladium gained 2.73%. However, that metal has retraced just some of its recent sell-off from new record highs.

The financial markets are focusing less on the mentioned China virus crisis and much more on today’s FOMC Monetary Policy Statement release at 2:00 p.m. There will likely be a big increase in volatility on the financial markets. Where would the price of gold go following the FOMC news?