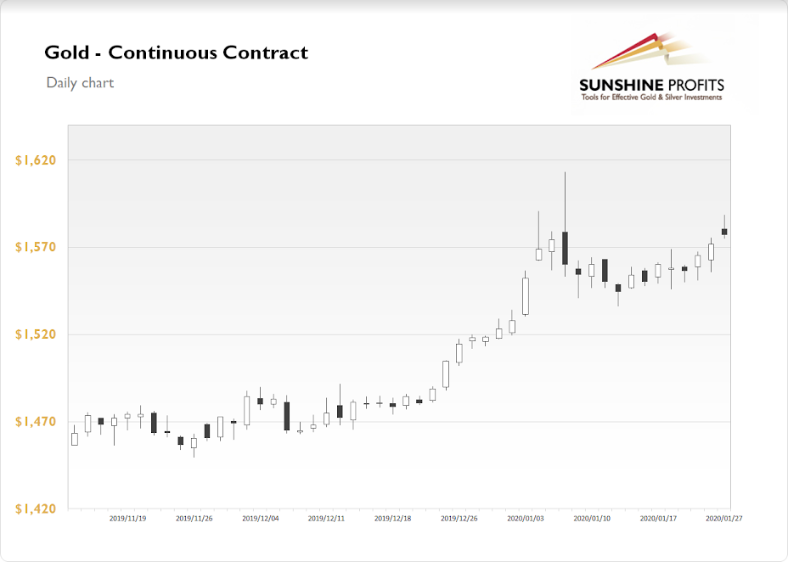

The Gold Futures gained 0.35% on Monday, as it extended its short-term uptrend. However, the market has retraced most of its yesterday’s intraday rally from the daily local high of $1,588.40. Gold continued to gain following China virus fears, among other factors. On Wednesday gold has bounced off $1,550 level, and since then it gained almost 2.5%. The market trades within a short-term uptrend as it is still retracing some of its move lower from the January 8 medium-term high.

The gold price is currently 0.2% lower, as the market fluctuates following yesterday’s intraday downward reversal. What about the other precious metals? The silver retraced some of its recent advance, but it continues to trade above $18 mark. It is currently 0.4% lower. The platinum got back below $1,000 mark on Friday, as it fell more than 1%. It is currently trading 0.4% up. The palladium regains some of its strength, as it trades 1.6% higher this morning.

The financial markets continue to focuse on the mentioned China virus crisis. But investors will wait for the important U.S. Consumer Confidence number release today at 10:00 a.m. There will also be the Durable Goods Orders release at 8:30 a.m. But all the attention is being focused tomorrow’s FOMC Monetary Policy Statement. Where would the price of gold go following the FOMC day? Take a look at our Monday’s Market News Report to find some clue.